Know When to Fold ‘Em?

It is not often that a single title can apply to so many things.

Let’s start with Geopolitics, where:

- How long can the war in Ukraine continue?

- What is going to happen in the Middle East as it too seems to have reached a “stalemate” status?

- The issues surrounding China and Taiwan and China and the Philippines seem to be at opposite ends of the spectrum, as we are getting more and more questions around the potential for “starting” conflicts, rather than questions about how it all ends.

Academy’s Geopolitical Webinar from Wednesday covered these and many other relevant geopolitical questions. Geopolitics as a tail risk was also discussed on Fox Business as a Bank of America survey of investors listed geopolitics as the biggest tail risk to markets.

We could discuss “folding ‘em” in terms of politics, but we won’t go into detail.

- Former President Trump is no longer the “presumptive” nominee and is now the official nominee. J.D. Vance is his official running mate. While the Republican ticket has been finalized and the convention was widely viewed, it is too early to clearly identify what policies (that are being discussed) will have a real possibility of becoming laws after the election. While it is “fun” to play “what if games” in terms of policy (in the event of a Trump win), we will hold off on that for now. Figuring out what is a campaign promise, versus a real policy desire is difficult enough. Then, even if the Trump ticket wins, it will be important to see who wins the House and the Senate.

- President Biden remains the presumptive nominee, but there are daily questions about that. Once that is definitively decided, we will need to know the vice-presidential candidate. In any event, all the reasons why we are not overly interested in predicting “what the economy will look like” if so and so wins apply to the Democratic ticket as well.

- We will largely ignore “if this party wins” type of trades and market moves for now, with two exceptions:

- We continue to like energy. The commitment to growing both traditional and new energy sources is real and is increasingly important to supporting AI and data centers. Also, owning energy related stocks and commodities remains our favorite “geopolitical tail risk” hedge.

- We think yields, especially at the long end, will drift higher. Whatever the current takes are on various economic policies, we remain convinced that as the campaigns continue, it will become painfully obvious that no one cares about doing anything to stem the growth of the deficit. Yes, there will be all sorts of “offsets” for any spending plans or tax cuts to “keep the budget stable,” but they will be largely wishful thinking rather than anything that is likely to work in the real world.

We remain on heightened watch for a potential “surprise” or “wildcard” geopolitical event while the nation and the media is so focused on domestic issues.

Know When to Fold ‘Em – Markets

Let’s start with rates.

We continue to see 75 bps of cuts this year. The data is likely to support a cut by at least September, if not July. The data, in our view, already supports a July cut, but that is unlikely to occur.

One thing that is becoming extremely clear to everyone, and something that we’ve been pounding the table on for months, is that a rate cut ahead of the election will be portrayed as helping the incumbents by all those looking to oust the incumbents. The political backlash against a Fed cut, as undeserved as such backlash would be, could pose longer-term threats to how both America and monetary policy are viewed.

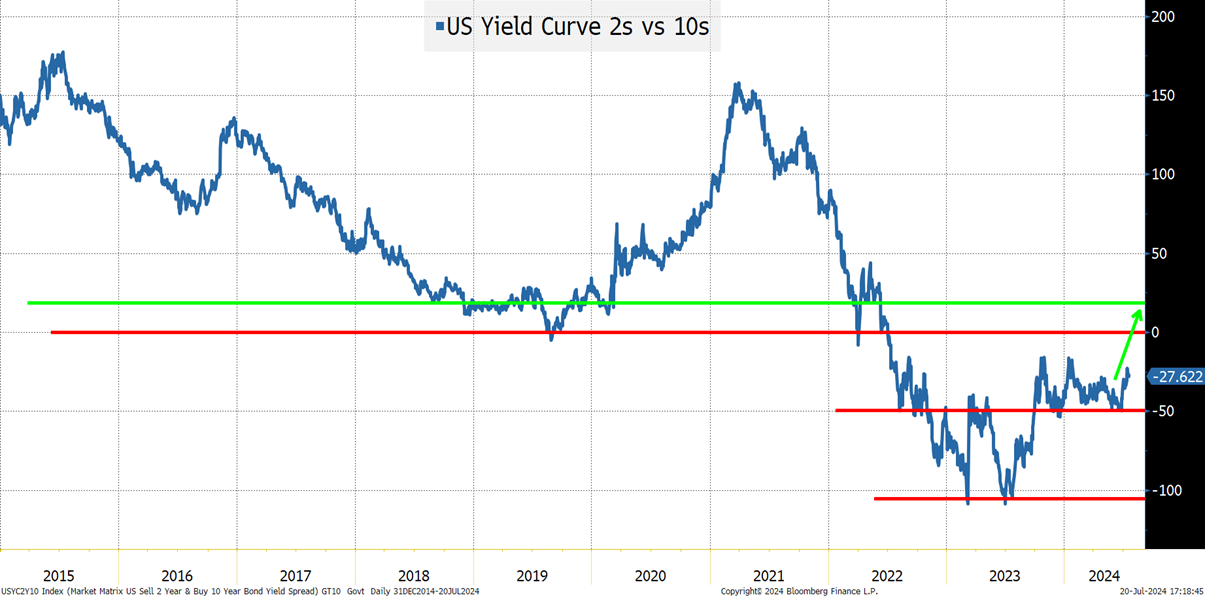

Having said that, the daily reminders that the deficit is heading higher are likely to take their toll on the long end of the yield curve. That rise in yields will be driven by a “normalization” of yield curves and a return to risk premium. First stop would be 0, then possibly as high as 20 bps between 2s and 10s. Also, I think that we can forever retire inverted yield curves as a very useful signal of an upcoming recession.

On the equity side we certainly saw “de-grossing” where hedge funds in particular scaled back both their longs and their shorts.

That helped contribute to a week where the S&P 500 lost 2%, the Nasdaq lost 3.7%, and the Russell 2000 gained 1.7%. This follows our writing and views in Chips and the Russell 2000 vs S&P 500 Ratio, which were also presented in more detail in last weekend’s July – Breadth and Liquidity which really focused on the S&P 500 versus the equal weighted version of the S&P 500. That index was “only” down 0.1% on the week, outperforming the S&P 500 again, and narrowing the biggest gap that we’ve seen in a long, long time between the two indices.

It is difficult to believe that this week started with questions about the assassination attempt (which haven’t been fully answered), concerns about more sanctions surrounding chips, and even chatter about an imminent attack on Taiwan (which we saw no evidence of) and with the help of the Geopolitical Intelligence Group, responded with the view that it was some very misleading and out of context headlines from a Japanese annual defense report on China’s military activities around Taiwan.

All of this impacted markets, and we are left knowing that we had “de-grossing,” but we are questioning whether we have had “de-risking.”

De-grossing is cutting longs and shorts. Often “simplifying” complex portfolios. It tends to be a hedge fund/quant fund/CTA strategy. It can feed into “risk parity” strategies (strategies that attempt to harness the correlations and volatility of stocks, bonds, and commodities to generate alpha).

De-risking is actual selling. Where fear starts driving decisions. Where assets are sold, not to buy other assets, but to reduce leverage or risk.

IWM, a Russell 2000 ETF, for example, had large inflows starting late last week. Consistent with de-grossing or rotation, not risk aversion (though it also started to have outflows later in the week). In a similar vein, RSP, an Equal Weighted S&P 500 ETF, experienced inflows and has the most shares outstanding since it was launched in 2003.

Rotation and de-grossing are not de-risking.

Which means that the investors (or “gamblers” using our theme of the day) are still holding ‘em.

Given:

- Summer “liquidity” or lack thereof may concern investors.

- More uncertainty and unprecedented events surrounding our election may not be an ideal backdrop for risk.

- Heightened concern about geopolitical risk and activity across the globe is a threat.

- There are indices with heavy concentrations of a few names, sitting near all-time highs, that have performed well year-to-date. The S&P is up 15% and the Nasdaq 100 is up 16% (seems low), which may promote profit taking. This would hit the “momentum” factor hard and produce more selling.

- While it is early in the earnings season, we are trying to figure out results, versus what was expected, versus what happened to the stocks, and whether it was earnings related or just market noise. We may well be entering a period where the hurdles are quite high for stocks to perform on the backs of earnings.

You should watch out for investors who might be looking to “fold ‘em.”

The Nasdaq 100 is down almost 6% from recent highs and nearing its 50-day moving average (19,522 close versus 19,321 50 DMA). We could see the 100 DMA come into play (18,627) which would be another 5% drop from here, taking us to our 10% downside target.

Expect derisking, hands to fold, and while “rotation” sectors will outperform, we should have better entry points later this summer!

Bottom Line

Don’t count your money while you are sitting at the table. My sense is that too many are doing this with both bonds and stocks, leading to more selling than buying in the coming days and weeks!

While there is some debate about whether “The Gambler” is a country song, a crossover song, or just selling out, there can be no debate that the National Anthem sang before the home run derby at the All-Star game was an abysmal performance!

In any case, be prepared for more volatility in an illiquid market, which will amplify moves in either direction beyond what the news flow would justify!