Chips, The Russell 2000 Getting “Ratioed,” and Academy’s Geopolitical Webinar

Three quick things to think about today.

Chips

Markets are reacting to concerns that the U.S. may adopt harsher restrictions on Chinese trade and the semiconductor industry.

We have been arguing that semiconductors are firmly entrenched in the national security mindset. The development and production of chips are major concerns at the national security level. While much of the focus has been on high tech and future tech, the concern has been expanding. “Dual Use” chips and technology are increasingly in the crosshairs of the national security community. Technology that may have mundane uses is also showing up in less mundane things – from targeting systems to drones.

Expect two things:

- The national security focus on chips and technology will continue.

- The national security issues will “remain above the fray” or “transcend” politics. Each party and politician will have their own views on what is necessary for security or not. But, and this is an important but, many (who haven’t benefitted from the latest briefings) will be saying things during the campaign that highlight how crucial these policies might be to national security.

Expect a choppy ride, and don’t expect much to change after the election.

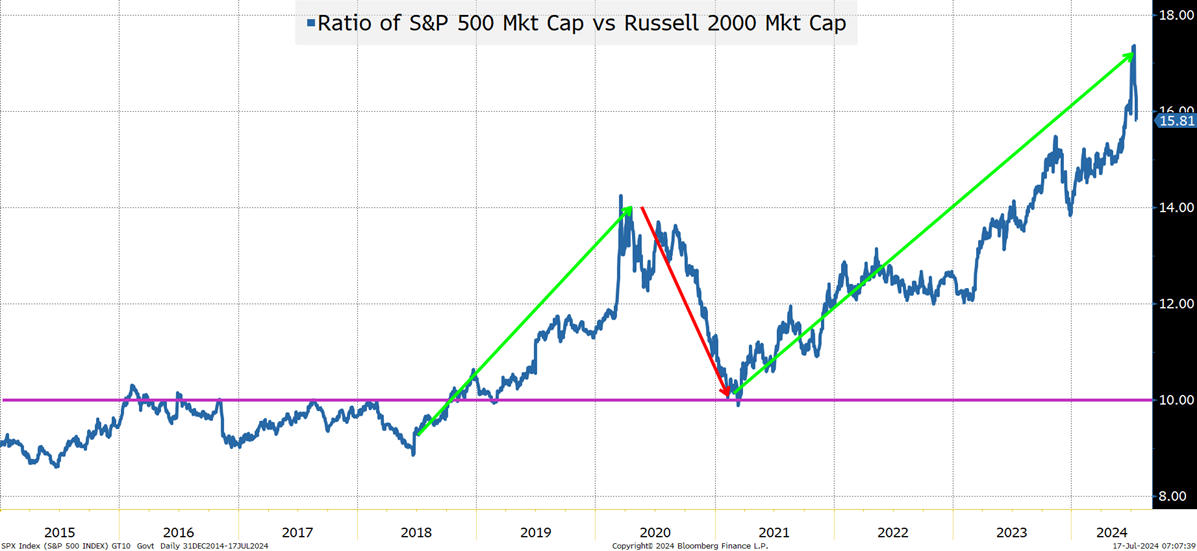

The Russell 2000 Has Been “Ratioed”

There are many ways to look at stock market indices. We focused on equal weight indices and concentration in Breadth & Liquidity. Rarely do we think of indices in terms of market capitalization. Individual companies, yes, but indices, no? What struck me as “odd” or “interesting” is that as of last Friday, the market cap of the Russell 2000 was less than $3 trillion. Yes, the S&P 500 is meant to pick up at least 80% of the market cap of U.S. stocks, but it has grown closer to 90%. Yes, there is a “survivorship” bias in the Russell 2000 that keeps the market cap smaller (companies that grow eventually get “promoted” out of the index). So, there are many reasons not to think about market cap, but it also seems odd that you can pick up 2000 or so companies, for the price of just a few (or even one). Since getting “ratioed” on Twitter (now X) is a bad thing, maybe it is being reflected in markets as well?

This is not a chart we’ve ever looked at before, and not sure how useful it is (given what the indices are meant to represent), but it reminds me of a “roulette” table. How many people bet all their money on one or two numbers? People usually spread their bets, they bet “red or black,” or make other low payout bets.

From a simple “liquidity” standpoint, it doesn’t take much to move any individual stock in the Russell 2000 (they are small). Factor in the view that many of these stocks are under-owned, and it really doesn’t take much of a flow to move the needle.

Maybe it is silly to say that for the better part of the past 10 years, you could get 10 Russell 2000s (now it is 16) for every one S&P 500 company. But this is a country that loves sales, so maybe it isn’t?

The combination of underperformance, low liquidity (especially in the summer), and underinvestment could be a powerful combination for small cap outperformance! As of this weekend’s report, the smallest 250 companies in the S&P 500 had an average year-to-date return of 0%!

Geopolitical Webinar at 11am ET Today!

Academy will be hosting a webinar titled Navigating Geopolitical Risk in the Middle East, Aisa, and Eastern Europe today at 11am ET. Rachel Washburn will be leading a discussion with Generals (ret.) Marks and Robeson, along with our Macro Strategist (Registration Link). No shortage of topics and the Q&A could get very interesting.