Heads I’m Smart, Tails I’m Stupid

That is how this week felt on many levels. Maybe it was because I was travelling, so I wasn’t staring at my screens every minute of the day, but I think it was more than that.

There was no shortage of opportunities to feel smart or stupid as the days went by (unless you are on Twitter selling your trading signals, in which case you apparently nailed every move).

While we discussed Catalysts and Landings last weekend, this market had some peculiar takes on the headlines, and often flip-flopped on the assessment.

What Did We Really Learn?

For me, there are two key takeaways:

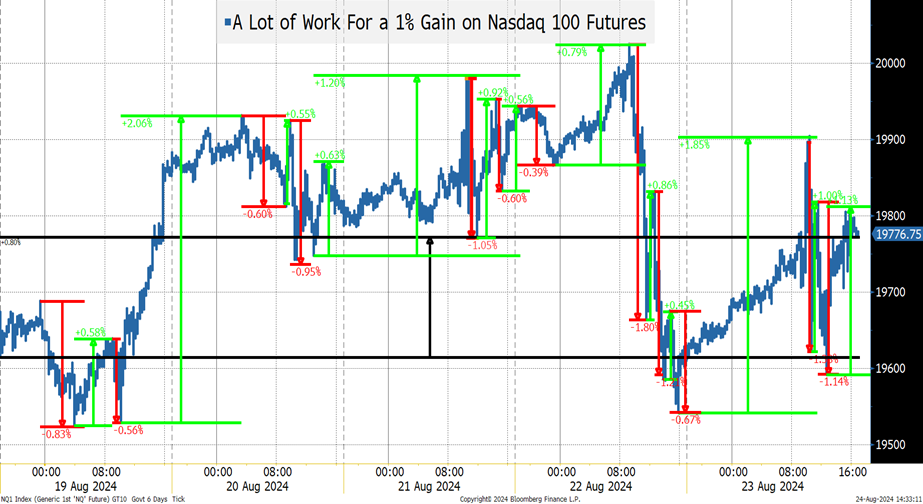

- Liquidity is abysmal. While the news flow was interesting, it didn’t seem to justify so many moves of 0.5% or greater! Especially some of the large reversals that happened within an hour. Every reasonably large flow (program trade) seemed to be able to move the market disproportionately more than one should expect. Add to that, the fact that “the rebalancing of leveraged ETFs” has become a common discussion as traders try to push markets creating larger “sell at the close” orders on down days, or “buy at the close” orders on up days. Since I wasn’t paying minute by minute attention to the screens, I cannot be certain, but I’d bet that 0 day to expiration options were a “weapon of choice” when trying to push markets into the close. For those not overly familiar with leveraged ETFs, those that say deliver 2X the daily return of some index (or increasingly, of some individual stock), they need to buy more shares on the close of up days and sell shares on the close of down days to deliver 2X the next day (assuming no inflows or outflows). This adds to volatility and creates a “path dependent” drag on these types of ETFs.

- We can now talk about the terminal rate on Fed Funds and the path to getting there. While we argued that the Fed should have cut rates in July, it seems inevitable that the Fed will cut in September. The only “question” around September is whether it will be 25 or 50. The market is pricing in a 35% chance of 50 bps. Since my preferred path was 25 or even 50 in July with a pause in September, I should probably lean towards 50 bps. But I cannot. I did hear someone suggest 50, with a dissent (someone who would have only done 25), which seems like an interesting path. However, with inflation still well above 2% (the lowering of this number is an election issue), and lots of griping (largely legitimate) that for many items official inflation figures are well below experienced inflation for the past couple of years, 50 would require very weak jobs data across the board.

- We now have cuts priced in for the next 8 meetings. The first time we have “doubt” about the potential for a cut is regarding the 50% chance of whether or not we get it next September. The market is pricing in 8 cuts, or 200 bps, over the next 8 meetings (it is almost doing it in 7 meetings). Will the data be so steady that the Fed can proceed without pauses, or even doing one or two of 50? That seems too “optimistic” for markets to be pricing in (or too pessimistic on the economy). Though, somewhat surprisingly, given Powell gave the go-ahead, the probabilities didn’t move that much from last Friday.

What Else Did We Learn?

The two things above (abysmal liquidity and that the conversation can now move to the time to reach terminal value) were the two most important things. But we’ve learned some other things as well:

- The earnings season is longer than ever. Earnings season used to get boring once the vast majority of companies (and many of the bellwether companies) had posted earnings. I am not sure if NVDA is the last company, but it is certainly not the least. NVDA comes out after the close on Wednesday. Those earnings seem highly likely to be a major catalyst for this market. We are hearing more from companies attributing some of their success to their use of AI, which is really encouraging. However, that might be more important for lifting the valuations of users than providers, given the run-up of stocks for companies involved in the AI provider space – anything from chips, to cloud, to data centers, to utilities.

- As a side note, I have to admit (once again) that I never would have thought you could generate a $50 million a year run-rate by just launching an ETF leveraged to a single stock, which NVDL has accomplished. Which likely explains the launch of MSTX (a MSTR leveraged ETF) that has already accumulated AUM of $127 million at a 1.29% expense ratio). I swore to myself that I wasn’t going to reference any songs today, but I cannot get the Dire Straits song “Money for Nothing” out of my head. I really fail to understand the need (or really, the appeal) of ETFs leveraged to a single stock, but clearly I’m just wrong on the demand!

- Data Disbelief. After the much larger-than-normal annual revision to the NFP Establishment Data (beyond the already large monthly downward revisions), will anyone ever trust this job report? The discrepancies and lack of consistency in data have been long-running themes in the T-Report. The concept of Garbage In, Garbage Out is why we spend so much time examining the data. No matter how good your model is at taking data and correctly predicting outcomes, it requires good data. We will continue to examine data as we always have, but we think that we will have more people doing it alongside us, as many of us (including, apparently the Fed Chair – see Revisions & Jackson Hole) are now struggling to articulate the “labor is strong” narrative. Again, I feel sorry for the economists who missed the original numbers by 100,000 or more. After monthly revisions and the annual revision, they probably turned out to be pretty darn close! And it does seem that we should all pay more attention to ADP.

- Rapid Oscillation. The AAII Investment Sentiment Survey is just below the July 17th reading (which I think was the highest this year). The bearish side is almost as low as it has been. Those are typically contrarian signals. While the size is not what it was in its heyday, the inverse ETPs like SVIX and SVXY saw massive inflows (close to tripling their shares outstanding). It is far from clear that the “pain trade” is lower equity prices.

- No one cares about the big bad Japanese yen carry trade. The yen closed Friday at 144.37, just above the low of 144.18 on August 5th, when people still cared about that trade! While we thought it was overdone and would be shocked if anyone reloaded on that trade, it seems like we should pay some attention because the Bank of Japan cannot tie their monetary policy (which points to needing to be restricted) to the Fed’s (which is clearly heading in the other direction).

- We can start buying the beneficiaries of lower rates. The Russell 2000 did very well this week (up 3.6%), but the KBW Regional Bank Index was up even more (5%). Commercial real estate should be stable and could once again be a big opportunity for investors. The last “bounce in small caps and value stocks” felt like a massive unwind of QQQ vs IWM (Nasdaq 100 versus Russell 2000) but this seemed more calm, orderly, and rational.

- Markets agree with us that it is too early to price in election “results.” While we continue to hear some chatter about the “Trump” trade or the “Harris” trade, it seems like the markets are not consistently pricing in anything. I know this because:

- We have another 10 weeks of this stuff, and a lot can change.

- It is too early to even tell what campaign promises the candidates are serious about (we are still in the pandering and trial balloon stage) let alone what might have a remote chance of turning into legislation.

Bottom Line

Good luck and expect more volatility.

If I’m an issuer of debt, I’m selling what I can, because despite my inbox starting to get flooded with warnings about the deficit, the 10-year yield is at 3.8% and spreads are still attractive.

The Fed can do a lot, and likely will, but I still expect the Fed to Plod Along, meaning that they will be slow to react to changing economic conditions (when they point to more easing). Additionally, both stocks and bonds got ahead of themselves, because they are pricing in a Fed put to occur sooner (or more easily) than it is likely to occur (when and if needed).

If this is what we are getting during the slow summer, I can hardly wait to see what September and October look like!