Jobs Data Revisions, Fed Minutes, and Jackson Hole

I am not sure what to say about the expectations that we could see Establishment Jobs reduced by as much as 1,000,000 over the past year. Actually, I think I know what I want to say about that:

- We’ve written in the past that it seemed statistically impossible for Establishment Jobs to come in above the HIGHEST estimate of economists in several months. Not just at the high end, but higher than the highest estimate. These are economists with a lot of data, models, and analysts, and it seemed unlikely that they would all be so wrong. I am sure there is some economist now, after the “normal” revisions, and after these additional revisions, who will have been deadly accurate – but it sadly didn’t make a difference since the market “must” respond to the data presented.

- We’ve argued that the survey response rate has been low, making the data more reliant on “plugs” and “extrapolations” than in the past.

- We’ve been harping on the disproportionate importance of the birth/death model and the reasons why it is likely overstating “entrepreneurship” – see Willingness to Believe in Bad Data.

- Finally, the Household Survey is pretty much maligned by “serious” economists, to the extent that we could ignore consistent underperformance (instead of periods of underperformance followed by catch-up periods of outperformance). It turns out that the Establishment data, post-revisions, comes a lot closer to the Household data. Kind of funny, in a not so funny way, for those having to make decisions.

One other thing we’ve being saying has been about seasonality, where we think the winter data is getting overstated, but that gets taken away in the summer months and has been more of a zero-sum game, just shifting us into a world where we start the year over-stating the economy.

The Unemployment Rate Doesn’t Change

This is the “tricky” part. While it will be clear that we created fewer jobs than previously thought, the unemployment rate isn’t affected. That is completely based on the Household survey, which isn’t getting revised.

What does this mean for the Fed and for Markets?

The Fed can state that the labor market wasn’t as strong as we thought. Though that is an admission that we make policy based on bad data (probably something they can be comfortable admitting, since they cannot control the data).

But can they jump to being so weak that we need to get in front of it?

That is really tricky! The unemployment rate will not have changed. The Household survey didn’t alarm them at the time it came out (I’ve been told by many to ignore the massive switch from full-time to part-time jobs in that survey) so can they react now?

I can see bonds doing better and stocks going higher when the revisions hit the tape. A weaker economy should mean faster rate cuts, but I don’t think that will last long. If the unemployment rate was going to spike, then sure, but that key piece of data will be left alone, so can the Fed really change their tune by much? Again, why we all pay attention to the headline number, with the Establishment data and the unemployment rate (which is Household), still seems weird to me, but it is what it is.

If you are at all intrigued by the time you have gotten here, please read the above “willingness to believe” piece on the so-called ongoing inflation concerns, and What Type of Landing for our assessment on the consumer.

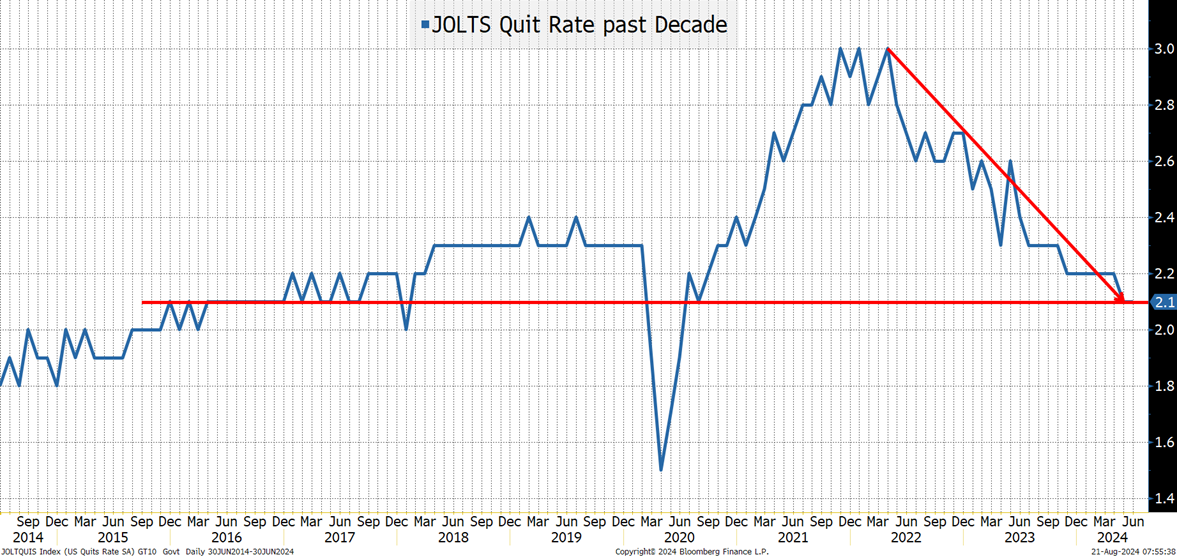

Is the JOLTS QUIT Rate the Most Important Piece of Data?

This is something we’ve been discussing more and more in terms of “crowdsourcing.”

What is the one piece of data we get that tells you what employees are thinking about the job market?

Increasingly, the case can be made for the QUIT rate. Presumably, workers are well aware of their skills, what type of work they do, and how easy it is for them to get a better job (or to take some time off and get rehired). This piece of data has the collective wisdom of employees. Probably skewed to lower paying jobs, but still relevant.

It will be interesting to see this piece of data on September 4th. It will also be curious to see how markets respond to payroll data on the 6th, after this revision.

Fed Minutes

The Fed had to have been close to cutting at this recent meeting. That will be reflected in the minutes, but since the market is pricing in 1.3 cuts in September and 4 by the end of the year, the minutes might not be dovish enough. The market is starting to price in cuts that will require more serious signs of economic weakness that we haven’t seen yet.

Jackson Hole

Policy transmission is not working great. With every individual (who could) locking in low mortgages, and companies issuing lots of long-term debt during ZIRP, the impact of rate hikes (and cuts) is limited. Then toss in the balance sheet management, which I believe has a more immediate impact than moving Fed fund targets around, and it is all “tricky” (sorry for being stuck on that word today, but it keeps coming up).

Do not expect a dovish Powell (nor a hawkish Powell). He has set the stage for a cut in September, likely 25 bps, which the data certainly supports, so why lock himself into anything until we get the jobs data for August?

Good luck, and hopefully you are finding it slightly difficult to wrap your head around the fact that jobs will clearly have been significantly overstated while the unemployment rate will be unaffected, because it means that I am not alone in that camp. 😊