Geopolitical Risks – Perception versus Reality – June 2024

Academy published our inaugural “Perception vs Reality” piece last month.

Before jumping into this report, it is worth highlighting our recent SITREPS that focus on Putin in North Korea, Ukraine Using U.S. Weapons inside of Russia, and Russian Naval Exercises in the Caribbean.

You can also listen to our latest Around the World Podcast (from June 13th) where General (ret.) Walsh, Maria Donnelly, Bret Lowry, and Peter Tchir discuss a wide range of subjects, including Israeli Operations in Rafah, Iranian Elections, U.S. and China Defense Chiefs Meeting, and the macroeconomic impacts.

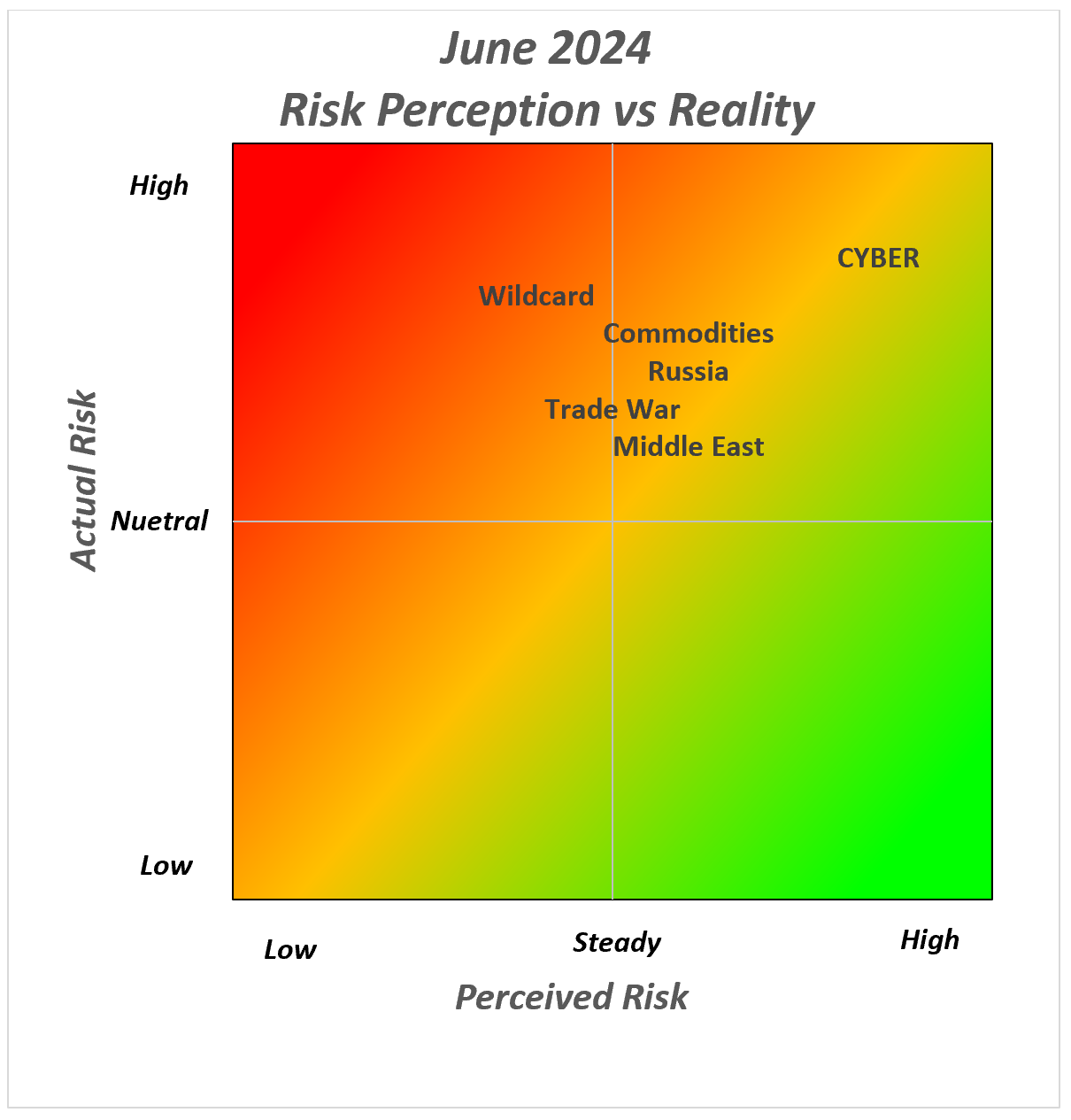

Geopolitical Risks – Perception versus Reality

We discussed the difficulties of incorporating Geopolitical Risk into “Actionable” Strategies (and the goals of this report) in last month’s edition, and have included it as an endnote.

The big mover was our “Wildcard” category, where overall risk perception increased, but not as rapidly as our assessment of actual risk increased. The risk of a trade war with China has de-escalated a little as they have been slow to respond, but it does not mean that we are out of the woods.

CYBER and the Middle East are “priced about right” as the perception and reality seem to match up well.

Russia

As you can see by the list of recent SITREPs (in addition to the Podcast), Russia has been top of mind. We have increased the risk, but the market has also increased its perception of the risk.

In a nutshell:

- Working with North Korea to receive more weapons allows Russia to continue to attack Ukraine. While most of the weaponry is unlikely to be sophisticated, we have all seen the damage that artillery shells can cause. Clearly a direct response to the U.S. (and NATO) sending more weapons to Ukraine. Also, possibly an indication that Iran is keeping more of their weapons for their own use (or their proxies), so Russia needs even more from sources like North Korea. So far, no indication of China overtly or directly selling weapons, but that could be a risk as this conflict continues.

- Some of our generals have pointed out one obvious error by Putin. The weapons being sent to Ukraine arrive mostly by land and mostly via Poland. So far, there is no indication that there have been any significant attempts to stop these weapons deliveries. Even the writers of Hogan’s Heroes understood the importance of this and had the characters trying to disrupt some weapons shipments in many of their episodes. It seems bizarre that Russia has done little/nothing about this. Since we don’t understand why this isn’t being attacked, it is difficult to assess what would make Russia change their strategy, but something to think about.

- Ukraine has attacked Russia on Russian territory. It has been a limited effort so far, but it is a change in tactics for Ukraine. The Geopolitical Intelligence Group largely agrees that it is an important step in Ukraine’s defense. By allowing Russian troops to amass at the border, they gave Russia an advantage. Russian troops could pull back to the border, reorganize and resupply, and then attack again. This new capability that is being allowed will make that more difficult for Russia. Making them set up their depots further away complicates the logistics of their attacks (and logistics, from everything we can see, has not been a strong point for the Russian military). One fear is that Russia responds by attacking some weapons (presumably supplied by NATO) that are being repaired, stored, or for some other reason are in a NATO country, but destined for use by Ukraine. Since the Russians haven’t really attempted to stop shipments as they enter Ukraine, this would be a big step, but something we are starting to talk about. Would that trigger an Article 5 response? Is this an area where Russia would test the resolve of NATO? We think we would first need to see attacks on shipments within the borders of Ukraine before we need to worry about this, but it is something to keep an eye on.

- While the exercises in the Caribbean (in and around Cuba) are not uncommon, they bear watching. One risk, which we still perceive as being highly unlikely, is some sort of interference with oil operations in Guyana (on “behalf” of Venezuela). If any world leader seems to favor Trump over Biden (due to stated intentions on support of Ukraine), it would be Putin, which means we continue to see a risk (moderate, but real) that he does something to affect the supply and prices of commodities. Inflation is clearly an Achilles heel for incumbents.

Wildcard

This is a “placeholder” for much of what is going on across the globe. Last month we highlighted North Korea, Venezuela, North Africa, and terrorism.

We continue to see setbacks in North Africa (primarily on the political/diplomatic front). Whether the trip by Putin elevates the risk that North Korea does something remains to be seen (warnings shots were fired yesterday by the South at North Korean troops that crossed the border, but that crossing appears to have been unintentional).

Having said that, we escalated the risk (the perception of risk a bit, and the actual risk a bit more) of the wildcard, primarily for two reasons:

- Election and political risk across the globe, especially in Europe. Neither the Indian election nor the Mexican election seemed to help markets, at least not in the immediate aftermath. But things seemed to have stabilized there. It is Europe that is attracting more of our attention. We discussed this in detail in Same, But Different on Sunday, so we won’t repeat ourselves here, but the simple version is:

- The “extremes” seem to be winning at the expense of the center.

- Nationalism is growing, and some (maybe all) of the issues that led to Brexit remain and seem to be causing discontent elsewhere (with immigration high on the list).

- While not expecting a “wave of exits” we may have to brace for headlines (and market reactions) along those lines.

- The Philippines. The intensity of activity around the Second Thomas Shoal has increased. We have been discussing China’s attempts to disrupt supplies to the Second Thomas Shoal as part of their territorial dispute with the Philippines (see May’s Around the World piece). That has recently escalated to accusations by China that one of their ships was rammed. In addition, there were reports yesterday that Chinese forces seized two small Philippine boats that were engaged in re-supply operations. When Academy’s Geopolitical team mentions China, the first question on the military side is always related to Taiwan. That is increasingly followed by questions about the size of their navy, their aspirations, and any potential risks to global trade. The Philippines, until more recently, had not come up as frequently. The U.S. has made commitments to the Philippines, which it reiterated on the heels of these two incidents, but what would we really do if the tension escalated to the point where lives were lost over the Second Thomas Shoal? It is a reef, where a Philippine naval vessel was grounded to enforce the territorial claim of the Philippines. Yes, there is a mutual defense treaty, but how aggressively would the U.S. intervene? How aggressively could we intervene? Getting involved in a third front, against the second largest economy in the world over a reef seems to be a political hot potato. Yet if there were fatalities, not acting would show weakness and could sow distrust amongst our allies. I think we can all hope that China does not escalate tensions further here, but if you go back to our Geopolitical Chicken, it would seem like a risk that is rising and would not help global markets (or the global economy).

While the wildcard risk is difficult to identify (and from our perspective, the European election risks have come out of nowhere), there is a real sense of global unease, a lot of opportunities for troublemaking, and fewer reasons for the “bad actors” not to behave badly.

Markets, in our assessment, are underpricing these risks.

Trade Wars

So far China has been very quiet on retaliatory measures with the U.S. For that reason, we are backing off on our estimate of actual risk. Maybe China wants to wait until after the election before deciding what they want to do? Maybe their economic bounce is so fragile that they don’t want to add yet another potential problem?

Our perception of the risk remains higher than that of the market, but it has de-escalated from a “red zone” danger risk to something more cautionary (yellow).

Commodity Shock

This remains a risk.

Growth in India, increased prosperity, and infrastructure building may turn out to be highly inflationary on the commodity front. It would be great for India, but would put pressure on commodities across the board.

Oil prices have been recovering from a post-OPEC slump. Brent crude is back to almost $85 from the high $70s and WTI is back above $81 from the low $70s. Some of this may be related to the “summer driving” phenomenon, but I continue to believe that we are susceptible to higher oil prices if we get even a relatively minor decrease in supply (or ability to ship that supply).

One interesting thing that has come up in recent conversations has been about the Saudi’s efforts to become the Data Center of the World. We have seen domestic utility stocks do very well on the back of expected demand from AI and data centers. Data center builders are focused on getting access to reasonably priced and reliable energy sources (the reliability seems as important as the price).

What the Saudis seem to be working toward is arguing that it is much more efficient to transport data than oil or gas. So why not build out data centers and become their own biggest consumer of energy (which provides them protection as countries become less dependent on fossil fuels). They are well positioned for solar during the day. The cost of cooling data centers might be high, but the abundance of energy (solar and traditional) could make it an interesting proposition. Trusting your data there might (and probably should be) a concern, but it is another twist in the rapidly evolving AI story, which is helping feed demand for energy (the build out of sustainable energy infrastructure requires significant up front energy costs in many cases, and vast amounts of raw materials). All factors that should prop up commodity prices.

With everything going on around the world, it seems to be safer to keep some commodity long positions on, and it continues to seem more contrarian than not.

The Middle East

Iran looks like they have backed down, which is good.

Peace seems unlikely, as Israel remains committed to eradicating Hamas as a fighting force capable of attacking Israel. Hamas is demanding a permanent ceasefire, which would allow them to potentially re-entrench themselves.

Speaking of “failures,” the “aid pier” was a failure. For all the technology and resources the U.S. has, it too can make mistakes. Hopefully “we” learn from them, but it is impossible to look at the situation in the region and not point this out. It also highlights the ongoing need to not just get supplies into Gaza, but to also get them distributed (which has been a stumbling block).

In the end, the status quo seems to be in place for now. It isn’t a good status quo, but markets and the global economy have adapted to it, even if the people in the region haven’t – sad, but true.

Bottom Line

Hopefully this format is helpful in framing how we are viewing the Geopolitical landscape and translating that into corporate and trading strategies.

As we enjoy the Juneteenth Holiday it is a good time to remember how much this country has overcome in the past, and it gives us confidence that despite headlines and social media, we can overcome difficult situations again and again!

Endnote – From the inaugural report.

Difficulties with Incorporating Geopolitical Risk into “Actionable” Strategies

The biggest thing most people face when analyzing geopolitical risk for investment purposes is that it is “surprisingly” stable.

North Korea has been a “bad actor” since before I joined Academy Securities. Occasionally they fire a ballistic missile or two. They have nukes, though so far haven’t demonstrated that they can marry their ballistic missile capabilities with their nukes, but it is probable that they will (if they haven’t already). They are supplying munitions to Russia, and they do pose a real threat to South Korea. In many cases there are “tactical opportunities” when North Korea does something “alarming” and Academy’s Geopolitical Intelligence Group (“GIG”) is able to assess the situation and help us create trading opportunities when their assessment is different (and usually correct) than the initial market reaction.

Long periods of stability with periodic “binary” events are difficult to manage risk around.

- If we knew the day that China was going to invade Taiwan, how useful would it be? If the date was in the next few weeks, that would be great for everyone. Companies could quickly reduce their exposure to the region, shipping could be diverted, and excess inventory could be built up, etc. Investors could “easily” position their portfolios for such an invasion. On the other hand, if we “knew” it was going to occur on May 8, 2027, would that help? Our corporate clients would have plenty of time to position their businesses accordingly. It takes time to change dependencies in any case, so they would need to start reacting now to minimize the risk to their businesses. Presumably some efforts would be made to change the future as well, creating some doubt around the “certainty” of the attack date. For most asset managers, 3 years is almost a lifetime. Maybe you can do some things around the margin, but “knowing” that event is coming likely does little to change your current portfolio.

- When “binary” events are not that binary. I’m probably misusing the term here. Binary, by definition, means it occurs or doesn’t occur. But for me, at least in terms of markets, binary has an implication of “being a big deal.” The October 7th invasion/attack/war that was launched by Hamas against Israel was a “binary” event. It had been an ongoing risk, and one that Israel attempted to dissuade or prevent from happening, but it did. As horrible as the war has been, even as the debate has raged globally about how the war should or shouldn’t be prosecuted, the impact on the global economy and markets (away from a few specific markets) hasn’t been incredibly noticeable. U.S. stock indices are at all-time highs after all. We can examine Russia and Ukraine, regrettably, through a similar lens.

That, I think, is the difficult part of thinking about managing geopolitical risk.

Our Goal

Having gone through the reality check above and understanding the limitations and pitfalls of translating geopolitical risk into actionable strategies, we will attempt to do the following:

- Look for highly significant changes in either the actual level of risk or the perception of risk.

- Attempt to identify whether the risk is “near-term” (within months) or longer-term (unlikely in the next few months).

- Focus on what asset classes are most likely to be materially impacted if an event occurs.

Basically, timing and severity are meant to be key focuses.

Geopolitical Risks – Perception versus Reality – Chart Explanation

On the Y axis is actual risk.

- It is based on the “consensus” view of the GIG.

- It attempts to incorporate an element of timing into the level of risk (where things may be risky, but don’t have an obvious timeframe, are downplayed).

- Some estimate of “severity” or potential impact is incorporated into the assessment.

On the X axis is our perception of how the risk is perceived by the market and our clients.

- This is largely subjective. While it will incorporate hard data such as Google Trends, AI, etc., it is also a function of how we see the issue portrayed more broadly.

The color scheme.

- We’ve adapted this chart from our macro Hopium vs Doomium™ charts and retained the color scheme. What we are trying to do is identify “outliers.” Those where the market perception deviates significantly from Academy’s view of the risk. The opportunities and risks occur when there is a large gap between the two.

Bottom Line

Hopefully this was helpful in framing how we are viewing the geopolitical landscape and translating that into corporate and trading strategies.