Geopolitical Risks – Perception vs Reality

As Academy expands our efforts across business lines and works on generating more usable content for our clients, we are revisiting our efforts to capture Geopolitical Risk. The goal here is to highlight where Academy, with its cadre of Generals and Admirals (ret.), believes the actual risk is (as well as the perception of that risk).

Before getting into that, let’s walk through some of the difficulties of not just evaluating geopolitical risk, but also attempting to turn it into something you can use. Our podcast from May 15th is very useful for background and covers many of these topics with interesting takes from a geopolitical, public policy, and macro framework.

Difficulties with Incorporating Geopolitical Risk into “Actionable” Strategies

The biggest thing most people face when analyzing geopolitical risk for investment purposes is that it is “surprisingly” stable.

North Korea has been a “bad actor” since before I joined Academy Securities. Occasionally they fire a ballistic missile or two. They have nukes, though so far haven’t demonstrated that they can marry their ballistic missile capabilities with their nukes, but it is probable that they will (if they haven’t already). They are supplying munitions to Russia, and they do pose a real threat to South Korea. In many cases there are “tactical opportunities” when North Korea does something “alarming” and Academy’s Geopolitical Intelligence Group (“GIG”) is able to assess the situation and help us create trading opportunities when their assessment is different (and usually correct) than the initial market reaction.

Long periods of stability with periodic “binary” events are difficult to manage risk around.

- If we knew the day that China was going to invade Taiwan, how useful would it be? If the date was in the next few weeks, that would be great for everyone. Companies could quickly reduce their exposure to the region, shipping could be diverted, and excess inventory could be built up, etc. Investors could “easily” position their portfolios for such an invasion. On the other hand, if we “knew” it was going to occur on May 8, 2027, would that help? Our corporate clients would have plenty of time to position their businesses accordingly. It takes time to change dependencies in any case, so they would need to start reacting now to minimize the risk to their businesses. Presumably some efforts would be made to change the future as well, creating some doubt around the “certainty” of the attack date. For most asset managers, 3 years is almost a lifetime. Maybe you can do some things around the margin, but “knowing” that event is coming likely does little to change your current portfolio.

- When “binary” events are not that binary. I’m probably misusing the term here. Binary, by definition, means it occurs or doesn’t occur. But for me, at least in terms of markets, binary has an implication of “being a big deal.” The October 7th invasion/attack/war that was launched by Hamas against Israel was a “binary” event. It had been an ongoing risk, and one that Israel attempted to dissuade or prevent from happening, but it did. As horrible as the war has been, even as the debate has raged globally about how the war should or shouldn’t be prosecuted, the impact on the global economy and markets (away from a few specific markets) hasn’t been incredibly noticeable. U.S. stock indices are at all-time highs after all. We can examine Russia and Ukraine, regrettably, through a similar lens.

That, I think, is the difficult part of thinking about managing geopolitical risk.

Our Goal

Having gone through the reality check above and understanding the limitations and pitfalls of translating geopolitical risk into actionable strategies, we will attempt to do the following:

- Look for highly significant changes in either the actual level of risk or the perception of risk.

- Attempt to identify whether the risk is “near-term” (within months) or longer-term (unlikely in the next few months).

- Focus on what asset classes are most likely to be materially impacted if an event occurs.

Basically, timing and severity are meant to be key focuses.

Geopolitical Risks – Perception vs Reality

Here are the areas that we are currently evaluating.

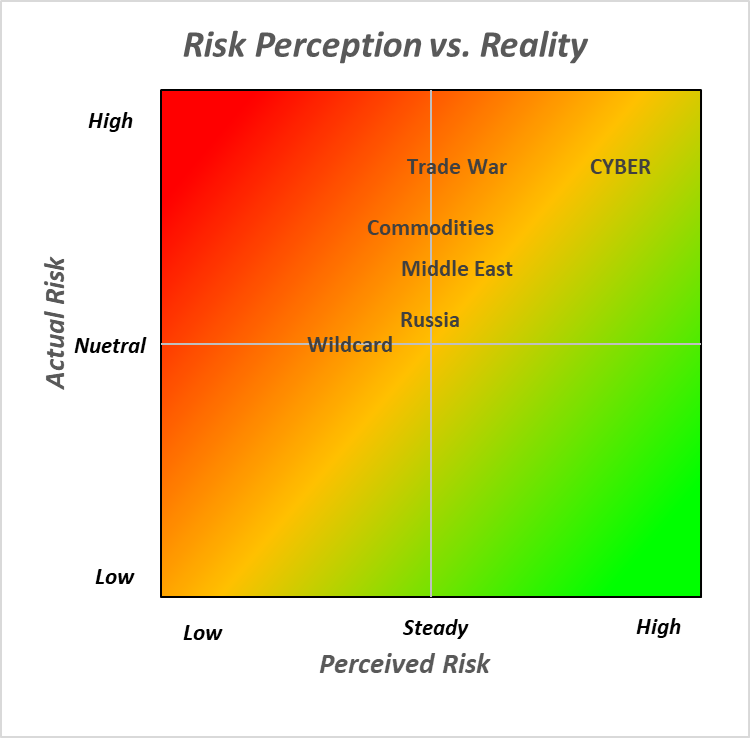

First, let’s explain the chart.

On the Y axis is actual risk.

- It is based on the “consensus” view of the GIG.

- It attempts to incorporate an element of timing into the level of risk (where things may be risky, but don’t have an obvious timeframe, are downplayed).

- Some estimate of “severity” or potential impact is incorporated into the assessment.

On the X axis is our perception of how the risk is perceived by the market and our clients.

- This is largely subjective. While it will incorporate hard data such as Google Trends, AI, etc., it is also a function of how we see the issue portrayed more broadly.

The color scheme.

- We’ve adapted this chart from our macro Hopium vs Doomium™ charts and retained the color scheme. What we are trying to do is identify “outliers.” Those where the market perception deviates significantly from Academy’s view of the risk. The opportunities and risks occur when there is a large gap between the two.

Let’s analyze these one by one.

CYBER

Let’s get this “trickly” one out of the way.

- If we had a previous chart to compare it to, we would have increased the CYBER risk. There have been more published warnings about CYBER attacks of late. While Volt Typhoon has been identified, we cannot be sure it has been eradicated. The “Living Off the Land” cyber threat is real and remains difficult to ascertain. In any case, the “chatter” about CYBER has been increasing (especially amongst the GIG) and it seems likely that the upcoming elections in the U.S. could spur activity.

- Offsetting this is how seriously corporations and governments are taking the CYBER threat. Almost nothing can be said on the CYBER front that “shocks” anyone. Everyone knows about the risks and are taking major steps to alleviate the risks. I’m not sure if it falls into the “shock” category, but the conversations around the size of the ransomware market and the ongoing use of crypto to pay for ransomware at least raise some eyebrows.

- The risks of a major CYBER attack are going to be impactful. But will they affect a company or two (specific hacks) or have a macro effect (shutting down utilities, limiting usability of ports, etc.)? If it is the former, then we are likely well prepared to deal with it. If it is the latter, all bets are off, but that risk seems too remote to play a central role in any investment or corporate strategy. We rarely hear about the cyber defense successes, but “the good side” wins most of the time and that is encouraging!

Basically, the risk is high and may be posing a more immediate threat, but spending and attention on defense have been rising commensurate with the threat. That leaves us with some probability of an all-encompassing attack, which, unfortunately, might be the status quo.

Middle East

We (and the market) have this one “about” right. The risk of major upheaval remains low in the coming months. Iran, after their feeble attack was thwarted, is unlikely to launch another major direct attack on Israel. While there is a push for some form of “truce” or “ceasefire,” we continue to believe that Israel will attack Rafah and continue to try to eradicate pockets of Hamas as they “re-emerge” in areas already cleared.

It seems roughly 50/50 that we see some “escalation and expansion” again, versus some sort of meaningful progress towards a longer-term solution that works for the region.

Oil will be the main way to manage this risk. Brent at $83 a barrel is potentially underpricing the risk, but not by much. Hence this issue sits more or less on the “yellow” or “neutral” line.

Russia

Once again, more or less appropriately priced by the market.

Russia is attempting another offensive because:

- They would like to capture and hold as much land as possible before the U.S. elections.

- They would like to capture and hold as much land as possible before the new/additional U.S. weaponry can be put to use by the Ukrainians. The one thing this war has demonstrated is that in this day and age, “well-fortified defenders” can still defend effectively against assaults even without overwhelming force, air superiority, and complex coordination.

Ukraine, as General (ret.) Marks points out, “does not have as long as it takes.” Weapons help, but just the overwhelming number of potential Russian soldiers versus Ukrainian soldiers takes it toll over time. Not only that, as the conflict grinds on, how many Ukrainians (who have been displaced) will choose to return? It wasn’t like Ukraine didn’t have issues before this conflict (corruption, for example) and now they have to deal with infrastructure issues as they settle into new lives.

China seems to be pushing for some form of “resolution” in conjunction with Russia. While that is interesting, it isn’t likely to be viewed as a win for Ukraine.

Our current assumption (and that of the market) is basically the same – stalemate and more of the same.

We do think that as we near the election, one side or the other might feel compelled to “up the ante.” We are not there yet, but several factors seem to be at play ahead of the election:

- China is pushing for some sort of an end.

- Russia may be realizing that they are unlikely to truly “win.”

- Ukraine may need to accept that the support for their efforts, especially as it pertains to regions closest to Russia, is dwindling.

By “up the ante,” we could see something where Russia tries to damage Ukrainian production facilities that they won’t “keep” in any peace.

We could also see Ukrainians try to damage Russia’s energy industry to hurt their war effort.

Not today’s risk, but it has the potential to impact commodities (not just oil, but potash, nickel, etc.) and maybe even agriculture has the potential to develop as a risk that we should concentrate on.

Trade Wars

This is another one that we have increased the risk on since the last time we reported. Xi has been to Europe. Putin is in China. President Biden added or increased tariffs on a variety of Chinese products. On the tariff front, we highlighted domestic response now vs 2018. One argument for why the market is taking this round of tariffs so calmly is a view (largely correct) that while the tariffs sound bad, they don’t impact much of what the U.S. is actually buying from China. It is further hinted that with Treasury Secretary Yellen having been to China, a path was smoothed so that these tariffs could be published to show that this administration is “tough on China” without repercussions.

The flipside of that, is so far China has refrained from obviously selling weapons to Russia. Is that something that could change? Will Xi, who is facing a difficult time in his own economy, risk his people hearing this news and not want to save face?

While on the Russian front, it seems very likely that Putin would prefer Trump versus Biden. This is presumably because Trump would likely stop the flow of weapons, but that might depend on if Putin thinks he can keep fighting if Biden wins, versus possibly being forced into a deal by Trump and Xi. On the China front, it is very unclear who China would want in power. So maybe they want Biden and may play nice? Maybe, China likes drama in the U.S., so maybe they step up their efforts regardless of who they want in power?

All difficult to ascertain ahead of the election, but overall, our view of the risk of more trade problems with China is much higher than the current market perception.

Maybe our theme of Made By China 2025 is influencing Academy’s perception, but there does seem to be a disconnect between markets and Academy on the trade war risks with China.

A year or two ago, one might have argued that Treasuries would be affected by a trade war, and maybe they already have been as China’s holdings of U.S. Treasuries have declined to a level last seen in early 2009. I suspect that when we get the April data, it will show further declines. Neither side can use Treasuries as a weapon against each other, like they might have been able to do in 2018, when China held almost $450 billion more in Treasuries than it does now. China is likely reducing their holdings to access money to stimulate their economy. That is “normal.” But it also gives them more flexibility to play tough with us. Now I wouldn’t expect Treasuries to do much as a slowing U.S. economy (good for Treasuries) would be offset by higher deficits and a further reduction of holdings by China.

Ultimately, increased competition with Chinese brands will hit the valuations of U.S. companies. With so many other things apparently favoring the U.S. stock market (like AI, better jobs here, etc.) that is a difficult way to play it (though now at all-time highs, with virtually no reaction to our tariffs, I think you should be underweight).

The best way to trade this (and it has been for months) is to own Chinese stocks, as their companies will now by and large benefit as they compete with the U.S., and China’s next steps would be to boost the value of “China Inc.” That, along with spending to prop up the economy, keeps me overweight Chinese stocks (we almost get the “trade war” for free). This is a trade, not a long-term commitment to owning Chinese equities.

Finally, for corporations, this is just yet another reason to restrict investments to the bare minimum in China.

Wildcard

This is a “placeholder” for much of what is going on across the globe. North Korea. Venezuela. North Africa, terrorism, etc. None of it is particularly encouraging (or encouraging at all). But none has risen to a near-term risk, with actionable ideas.

North Korea potentially selling more munitions to Russia. Possibly providing equipment to Iran.

Venezuela’s own oil production, and their views on oil in Guyana, could become an issue.

We are being asked to leave, or are choosing to leave countries in Africa. To the extent that “Business Follows the Flag,” this is not a good development.

The market is almost dismissive of this risk, but while we would have increased the perception of risk, it seems manageable in the near-term.

Nothing seems to be jumping out at us as imminent (though the October 7th attack was a surprise).

One commonality, at least in regard to Venezuela and Africa, is that they are commodity rich.

Our theme, for the past few years, is that China’s ongoing courtship of autocratic resource-rich nations persists.

We are keeping an eye on commodities and the flow of weaponry.

Commodity Shock

We’ve made it this far and have not mentioned India. I am not sure how to define India in a geopolitical sense (there is probably the biggest opportunity for the U.S. here), but I do think they pose the potential to create a commodity Shock, or Bubble like we saw when the Chinese economy took off two decades ago!

Copper is hitting an all-time high. We wrote about that in the most recent T-Report.

Interspersed throughout this entire report is the risk to commodity supplies. Add to that the specific demand due to AI/technology and the growth (and associated increase in wealth and desire to consume) in India, and we should not be so complacent about commodity inflation.

While not my base case, it is increasingly concerning.

If the U.S. “enemies” or even just “competitors” have come to understand that Inflation is the Achilles Heel of the U.S., could actual nefarious acts be used to create such a commodity shock?

Yes, the U.S. has plenty of untapped resources, but how quickly can they be tapped? And the processing of these resources is an even bigger concern. Reminds me of the report we published back in February 2021 – Rare Earths – A National Security Threat.

Being overweight commodities and associated stocks seems like a good trade, even if you think the U.S. economy is slowing. The overwhelming number of low probability, but still possible near-term events that would have a significant impact on the space is too difficult to ignore.

Bottom Line

Hopefully this was helpful in framing how we are viewing the geopolitical landscape and translating that into corporate and trading strategies.