Same, But Different

A few topics that we have touched on over the past few months continue to be relevant. What is interesting is that a few of those topics now seem to have garnered far more attention than in the past.

- Discrepancies and “weirdness” in the jobs report. Best of Times, Worst of Times picked up on many of these, and not only have they been topics of discussion, but the Fed Chair was also specifically asked about them. I still think that the extremely high percentage of jobs “created” by the birth/death model and the shocking number of part-time vs. full-time jobs need to be better addressed (Who Needs Enemies?). At the very least, everyone finally seems to be trying to figure out the “real” state of the job market, and not just cherry picking the data that suits their needs.

- Is 10% the new normal? While it took Apple 2 days to achieve a roughly 10% move, other large- cap companies are also jumping 10% or more in a single day. However, some others are losing that much in a day. As discussed in Is 10% the New 1% that is likely a sign that the market is more controlled by options, day traders, and “machines” rather than “traditional” investors. Probably a sign that liquidity has very little depth. This topic came up a LOT last week. Not sure what caused the spike in this topic, but even some “believers” in some stocks seemed to question what the heck is going on. I don’t think I’ve once said or written about stocks being in a bubble, and I am not doing that today, but for the first time, there seems to be a sense of “incredulousness” around what is going on in the markets. That could mean that we have another big leg higher as everyone gets “sucked in” to the market, but the discussions felt more disturbing than healthy.

- How Tight Can Credit Spreads Go? Last weekend’s report generated a lot of back and forth on the subjects that we delved into. The “private credit” and “return of bank lending” probably generated the widest range of comments, though I did find out several people still have their IG 200 hats from 2008! If you missed this one, I think it is worth a read, even though credit spreads weakened a touch on the week.

- “Extreme” Politics and Elections. It has been impossible not to notice how “polarized” so many things have become on the political front. While we are still at the “presumptive” nominee stage in the U.S., it feels like we are in the heart of the campaign already. But that we already knew. What I have to admit is that I didn’t realize this is apparently a global phenomenon. Markets were actually impacted by elections in France.

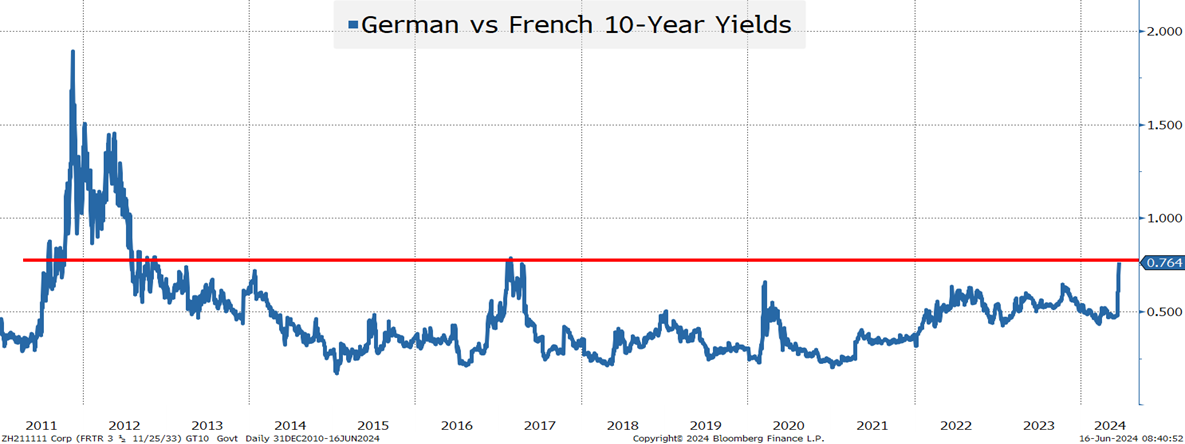

I, for one, did not have European Debt Crisis on my bingo card, and we are a far away from that, but maybe I should have? At first, the move was attributed to the fact that the right wing in France had done well. That those pushing a more “domestic” focused agenda had won. A trend that we have been seeing across the globe. It goes hand in hand with deglobalization. I am not particularly knowledgeable about French politics, so I went to those who are. What I found interesting is the real concern that the far left AND far right will do very well in upcoming elections. That would leave a “centrist” like Macron potentially short of support. I had not been thinking in terms of a bipolar world with respect to European elections. Now, maybe we have to? Will that be disruptive? Will it turn out that Brexit was merely the beginning of a trend towards countries “re-thinking” the EU? Probably far too early to say anything like that, but this issue, which was below my radar screen, has suddenly popped up and needs to be thought about more. This of course already comes on the heels of some interesting elections in Taiwan (pro-independence), India (Modi losing his grip?), and Mexico (a change in leadership as the border has become a vital part of the U.S. election). I’ve been so focused on U.S. politics and thinking about how the election is likely to play out here that I paid short shrift to Europe and that has to change.

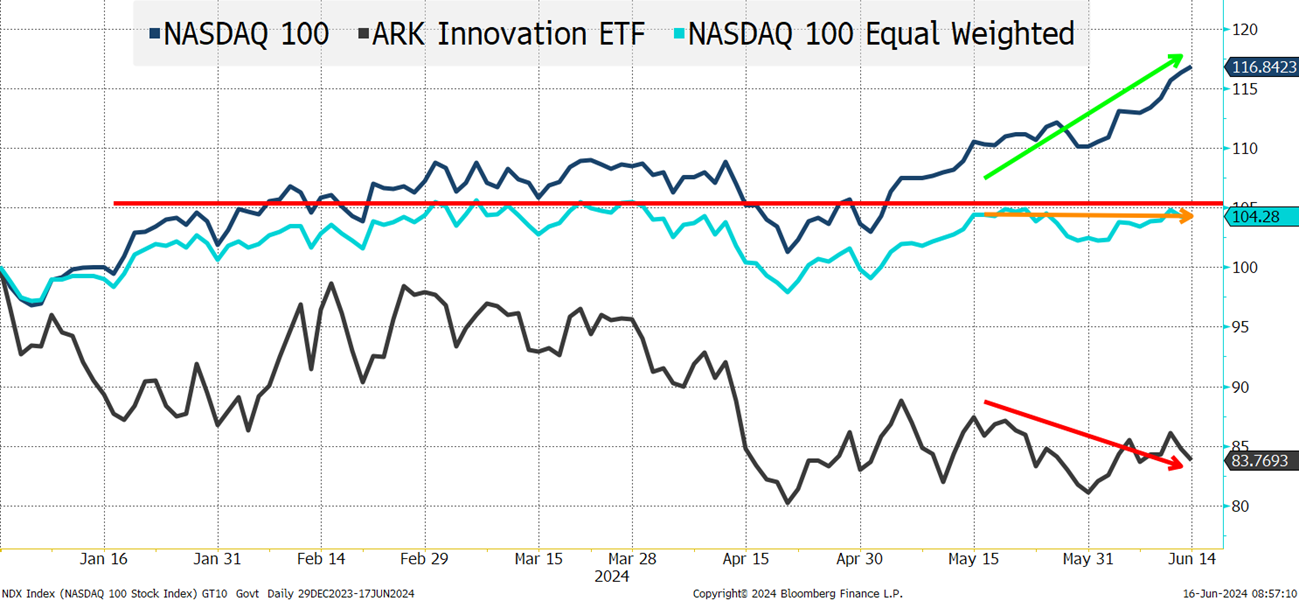

- Breadth.

Every day I read some new reports highlighting how few stocks are at their 52-week highs, while the index is setting records, or some other “anomaly.” I chose the Nasdaq 100, but the chart isn’t too dissimilar if you go with the S&P 500 vs the equal weighted S&P 500. The fact that the equal weight index isn’t at its highs and has barely budged in the past few weeks as the market cap weighted index soared tells you just how narrow this rally has been. It has been extremely AI driven and continues to be AI driven. That is the main reason I included ARKK. It is my proxy for “innovation” and continues to meander, while the Nasdaq 100 soars! So much of the return is being generated by a handful of large companies with great stories. But that leaves me (and I think a lot of others) wondering how long this bifurcated market can last? I am not sure, and the answer to that question might be “longer than we think” as many investors are staring nervously at Europe, given the political backdrop and tricky economic situation (the ECB cut, but raised their inflation expectation, while overall growth seems to remain behind that of the U.S.). Presumably, money coming from Europe to the U.S. will go into index funds, creating more demand for the most heavily weighted stocks. Personally, I had much more “fun” late last year when I was pounding the table for the “laggards” to outperform (and even more “fun” when that proceeded to occur). But, right now, I’m not sure that outperformance will play out, unless it is in a down market. The “catch-up” scenario would make a lot of sense if the economy was firing on all cylinders, but that isn’t my outlook for the coming months. In the meantime, we can watch VIX drop, and wait for it to cross 10, like it did back in early 2018/late 2017.

We will continue to focus on these issues, and it is interesting that they seem to be bubbling to the top (though off-hand, I’m not sure if that is good or bad for markets). The fact that the 10-year Treasury traded as high as 4.48% (the high end of our 4.3% to 4.5% range) and traded as low as 4.19% on the week (below the low end of our range) doesn’t give me a lot of comfort about the depth of liquidity. The CPI data and the Fed data helped, but the real boost seemed to come from concerns about Europe.

Hopefully, you can enjoy Father’s Day with family and friends and brace yourself for what is likely to be another round of corporate bond issuance as borrowers benefit from the reprieve in yields.