War, Inflation, and the Neutral Rate

The probability that we see oil production targeted as part of the escalating fighting in the Middle East has increased. Academy’s General (ret.) Robeson, Rachel Washburn, and Peter Tchir discuss this in a highly viewed webinar – Risk of Further Escalation in the Middle East. The webinar was very much driven by audience Q&A, which reflects the uncertainty managers are facing when dealing with the conflict. We highlight oil, as disruptions in oil supply or production would have the largest impact on the global economy.

Academy also published a number of SITREPs which can be found here. You may need to contact your Academy representative for access to all the reports. The most recent SITREP covers the Iranian Missile Attack. We also examine that incident and our outlook from a T-Report perspective in Fool Me Once, Shame on You, Fool me Twice, Shame on Me.

At its most simple level, there are two main reasons to expect further escalation, which could include targets connected to energy production and distribution.

- From a military standpoint, Israel has had a series of successes. The attacks using pagers and walkie-talkies seemed to do three things.

- Caused actual injuries and deaths attributed to those devices exploding.

- Forced more “in person” meetings to occur, which have in turn been attacked.

- While not only killing and injuring many with exploding pagers and walkie-talkies, the attacks also had a massive psychological effect. Enemies of Israel must wonder about how much information Israel has on them, and whether their whereabouts are known at any given time. What other ways has Israel potentially infiltrated their organizations? Are they at risk of further unconventional attacks? This fear is relatively new and is likely an important part of the calculus for Israel’s next steps.

- From a military standpoint, Iran did not seem to accomplish much with their ballistic missile attack. Yes, some got through and hit military targets, but the vast majority were intercepted or landed in areas causing minimal damage to either people or infrastructure.

- If the attack was meant to signal to Israel that they were unsafe and subject to retaliation and retribution, it is difficult to see this attack as having been very successful.

- If the attack was meant to reassure the proxies that their proxy leader is all-powerful and could easily protect them, that likely failed too.

The combination of those two factors is why escalation is likely, even in the face of pressure from many countries to de-escalate.

Add Inflation Back to the Fed’s Calculations

Friday’s job report was so strong that the Fed can no longer just look at jobs data (which has been their modus operandi for the past few meetings). As discussed in NFP – WOW!!, it was very important that we got the upward revisions we were expecting. However, another “beat” on the headline data (but with downward revisions) would be easy to ignore. If you, like us, believe that the BLS has corrected some of their model errors (primarily in the birth/death model), we should have more balanced revisions going forward. Speaking of that model, it actually came in at -100k jobs, which I think is encouraging. For too many months last year, the birth/death model was too great of a percentage of the entire number for my taste (I have a natural aversion to data where the “plugged numbers” dominate the overall number). I didn’t highlight this, but we saw a big increase in full-time jobs in the household part of the survey.

So, with the employment data so much stronger and with chatter about the Sahm “rule” dying down, the Fed is likely to be more cautious in terms of their next steps.

While I am not particularly worried about inflation, there are some things that we should be watching for:

- The risk of higher energy prices from any major disruption in the Middle East (with Russia and Ukraine also a potential risk on that front).

- Rising commodity prices across virtually every commodity. If you pull up GLCO on the Bloomberg terminal, and set the time frame to 1-month, all the commodities under energy, metals, and agriculture (which surprised me a bit) are up. The NYMEX Henry Hub natural gas futures contract is up a whopping 33% in one month. Copper (aka “Dr. Copper”) is up 11% along with aluminum and nickel. While rising commodity costs can take time to filter into prices paid by consumers, it is worth watching.

- China stimulus. Who knows what impact Chinese stimulus will have on domestic consumption, but if it does, that could put upward pressure on commodities and even finished goods. It is clear that some of the rise we’ve already seen in commodity prices is in anticipation of that stimulus, so the stimulus will really need to work well to continue to put upward pressure on prices, but my base case is that it will work.

- It will be very interesting to see how the Chinese stock market behaves when it reopens this week. It has been closed since September 30th to celebrate “Golden Week.” Since then, KWEB and FXI (two ETF proxies I track) are up 12.9% and 12.4%, respectively. So, we should see the Chinese market open very strongly, but expect some volatility as investors get a better “peek under the hood.” I find myself feeling the need to repeat one of my overriding premises on the current market. A reminder that we live in a world where true depth of liquidity is low, and market moves are amplified in BOTH directions.

My view is that the Fed has tilted to being 90% fixated on jobs and now they must increase the weighting on inflation risks, of which there are several.

Let’s not forget that expectations for CPI on the 10th are 2.3% for overall, and 3.2% ex-food and energy. While comforting (from an ivory tower standpoint) and moving in the right direction, they are still above 2% and are impacting consumers (voters) at levels higher than where those consumers are comfortable.

While the market has tempered Fed cut expectations (down to 4 cuts in the next 4 meetings from 6 cuts in the next 5 meetings), I think they will come down further.

Right now, and this is all data dependent, I think that we need to be thinking 25 bps in November. No chance right now of another 50 (unless inflation is really low or jobs drop again) and 0 is probably off the table, because optically it makes 50 seem like it was a mistake (which I don’t think it was) and sets the stage nicely for a pause. Then maybe one more in December, but I would think they start moving at alternating meetings, so the very front end, as much as it has sold off, probably has more room to move to higher yields.

The Neutral Rate

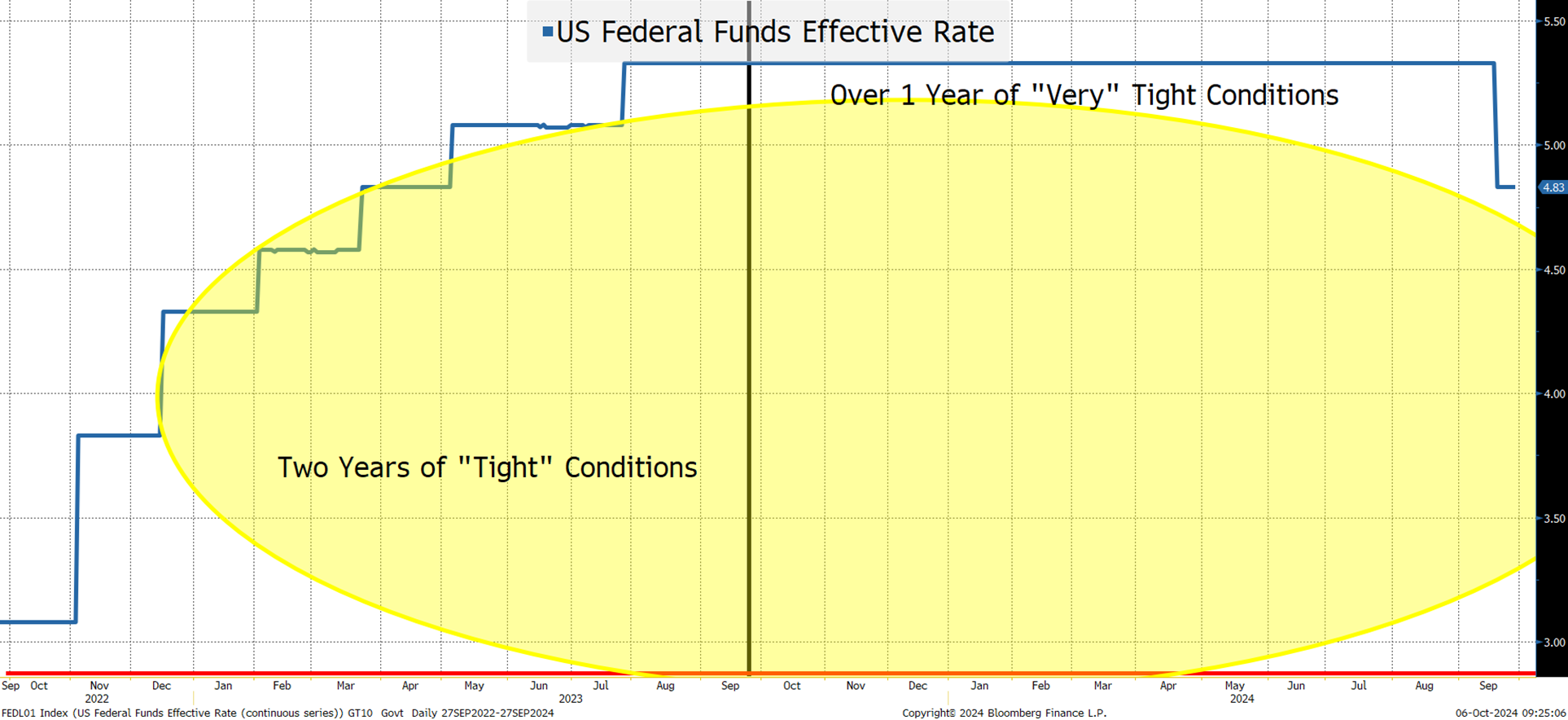

My simple view is that the “neutral rate” should be just that, a level that allows the economy to function “normally.” We cannot measure what this normal rate is, so we rely on all sorts of estimates. What rates are considered “tight” or “loose” from a monetary policy standpoint? It really is difficult to determine what it is, but we will try to do that in any case.

Since the Fed’s goal should be to have “neutral” monetary policy as their desired outcome, the terminal rate (or longer-term projection) in the dot plot should reflect what the Fed thinks about the neutral rate. Using that, we will run our little “thought experiment” on why we think the Fed will start talking about leaving longer-term rates higher than the market is currently pricing in.

At the last meeting, the terminal rate dots were:

- A median of 2.875%, but with a weighted average of 2.99% (my view is that while markets focus on the median, which might be correct for the next meeting or two, the weighted average provides more information on where the Fed is headed).

- There were 4 dots at 3.5% and higher for longer-term rates and 7 for 3.25% or higher.

At the meeting back in March, we saw a different picture:

- The median was 2.56% and the average was 2.81% (which I think supports my view that the weighted average helps understand direction).

- There were 3 dots at 3.25% or higher!

There are two reasons why I think this shift in neutral rate/terminal rate is occurring:

- As the Fed pivots to a new cycle, they can actually think more about the terminal rate. When stuck deciding between more hikes, or when to cut, the terminal rate probably doesn’t come up much in discussions, but as they now think about when it comes time to end, it does, so it is becoming a more thought about/discussed number.

- Does the economy feel like 2.875% is “neutral?”

The Atlanta GDPNow GDP forecast averaged 2.9% during this 2-year period, which is what actual GDP has averaged. From an intuition or “gut feel” standpoint, this economy is not acting like the Fed has been as restrictive as a 2.875% neutral rate would imply. You get me to 3.5% or higher (where some Fed dots are moving to), then you have a believer.

One of the biggest misses in all of this, is that every smart corporation and individual (who could) locked in long-term debt during the era of ZIRP.

So, while those stuck borrowing short-term have felt the increase in debt cost, for most companies and probably even more individuals, the rates haven’t done much. There is even an argument, which I subscribe to, that the move to higher yields was beneficial to many as it added to their income, particularly through record holdings in money market funds. Also, the full impact of rate cuts didn’t bleed into longer-term yields as 2s vs. 10s (for example) were at -50 bps on average for the past two years.

Lots of difficulty measuring the neutral rate. Historical analysis is only marginally useful as the starting conditions change (one of the important ones here is average duration of borrowing).

So we might not get a big change in this, but I’m betting that the next hiccup for the bond market is less about how quickly we get rate cuts (market still a touch too aggressive there), but on where the Fed finally gets to (and I think the market needs to be looking at 3.5% or higher).

Bottom Line

Moderately higher yields across the curve.

- The two year at 3.92% is probably getting close to reality, but I think closer to 4.1% is more realistic, given the pace I’m expecting based on how I see the data playing out in the next few months.

- With 2s vs. 10s back to positive and a target of 25 bps, I think we see 10s push towards 4.25%. We should see yields rise this week as investors set up for the auction, followed by a post-auction rebound, then we will see where the trend is really headed.

Equities.

- I do think the re-opening of China’s markets this week will impact U.S. markets (especially if it doesn’t hold on to big gains already priced in). I’m 100% convinced that the benefits of stimulus will accrue disproportionately to Chinese companies selling products domestically and commodity producers. Given the “need” for the CCP to ensure stability, expect them to add more and more stimulus until they achieve the desired effect. We will do a larger update on the Threat of Made By China later this week. Given that we view the market as “tradable, not investible” I like the idea of taking some profits ahead of the opening, given the parabolic move so far.

- I was surprised by how well stocks responded to the 10-year nearing 4% on Friday. Stocks threatened to fade several times, but decided to ignore the move in yields (good news was good) and to downplay the risk of escalation in the Middle East – which has not occurred as of Sunday afternoon). This week will be interesting, but I expect the risk is skewed to bigger downside moves, as many of the issues discussed here (war, inflation, and the neutral rate) get coverage and traction.

Credit. Boring!

- I continue to believe that the top of the rating range (already tight spreads) can go tighter as investors overweight credit versus government debt (more kicking the can on the debt ceiling doesn’t do much to shift the narrative that corporate governance is better than government governance).

- At the smaller, lower rated end of credit, private credit is still helping to drive credit spreads lower via competition not only with each other, but also with many big banks looking to expand their lending.

- Don’t forget to register here if you are in New York for Thursday’s Geopolitical and Credit Roundtable led by General (ret.) Spider Marks at Bobby Van’s GCT location. A brief overview will be given by Spider, but the primary goal is being able to mingle with Academy’s team of credit professionals. Attendees from sales and trading, capital markets, and syndicate will be there. Heavy appetizers will be served at this informal event (not table seating).

The Election.

- With just over a month to go, we are starting to focus on possible outcomes. So far, “gridlock” and an “uncontested” election are the base case. That seems right, and the market is reasonably priced in for that (though I still think deficits will grow more than expected even under gridlock). So the “shock” or “risk to the market” would be some side “sweeping” and being able to enact much more aggressive policy agendas, or real fears about the aftermath of the election growing. As we near the election expect volatility to increase moderately, just because nothing can be completely discounted at this stage, and the illiquid nature of our markets seems susceptible to noise on the election front, as the date draws near.

Good luck, and looking forward to seeing many of you in person at Academy’s events or at some of the conferences where we are speaking this month!