One Trick Pony?

This weekend we pointed out some of the difficulties and mixed signals that arise from a Narrowly Focused Market. Monday fit that description as AI led the way down, and then that completely reversed on Tuesday as AI helped the market regain Monday’s losses in the Nasdaq 100. Apparently, Tuesday was one of the worst breadth days for the S&P 500 in decades (the index gained 0.4% with just over 100 stocks trading higher on the day).

The Nasdaq 100 gained about 0.5% in the last half hour or so of trading yesterday, presumably ahead of some semiconductor earnings. Those earnings, after the close, seem to have disappointed, but as we’ve learned lately, sentiment and direction seem very fickle.

To a large degree, this volatility makes sense:

- If companies continue spending aggressively on AI.

- If the leaders continue to lead.

- If pricing remains in the control of the suppliers.

- AI and AI related stocks are incredibly undervalued.

- If pricing remains in the control of the suppliers.

- If the leaders continue to lead.

But that is a lot of “ifs.” No wonder we get this volatility as hopes and dreams are affirmed, reaffirmed, and sometimes brought into doubt.

As discussed on Bloomberg TV from London (starting at 15:15), I think that we see the indices roll over and test the 50-day moving average (which clearly looked bad Tuesday afternoon). I continue to think more and more about the question of what is AI versus simple programming, or even just a lack of effort?

- Assuming at some point, every time you set a calendar invite on your computer, it sets an alarm on your phone (something many people do themselves), is that AI? Or is it just coordinating between a few apps and devices in a fairly simple way?

- I’m not sure about you, but sometimes my watch asks, “it looks like you are on the move, would you like to record an outdoor walk?” It often does that late into a walk, and maybe AI can make it better. But how about something as simple as when I use the map on my phone or tablet, and choose “walking” directions (which often show up on my watch), will it presume that I am on an outdoor walk? Do I need “AI power” to do something that is likely doable with coding available from the ‘90s?

There has been a race to launch AI projects. Shortages and investor interest have heightened that race. But it leaves us with the same “nested if” statement from above. A lot, but not all, of the “ifs” have been priced in – leaving us facing this volatility.

Geopolitical Risk

Speaking of volatility and the TV interview earlier, we must bring up Geopolitics. In the interview, we spend some time trying to address how investors and corporations can think about geopolitical risk and what strategies they can implement to address those risks and concerns (a theme also explained in Hedging the Unhedgeable and Perception vs Reality). My favorite “hedge” right now remains owning commodities and commodity-related stocks, skewed towards energy over industrials.

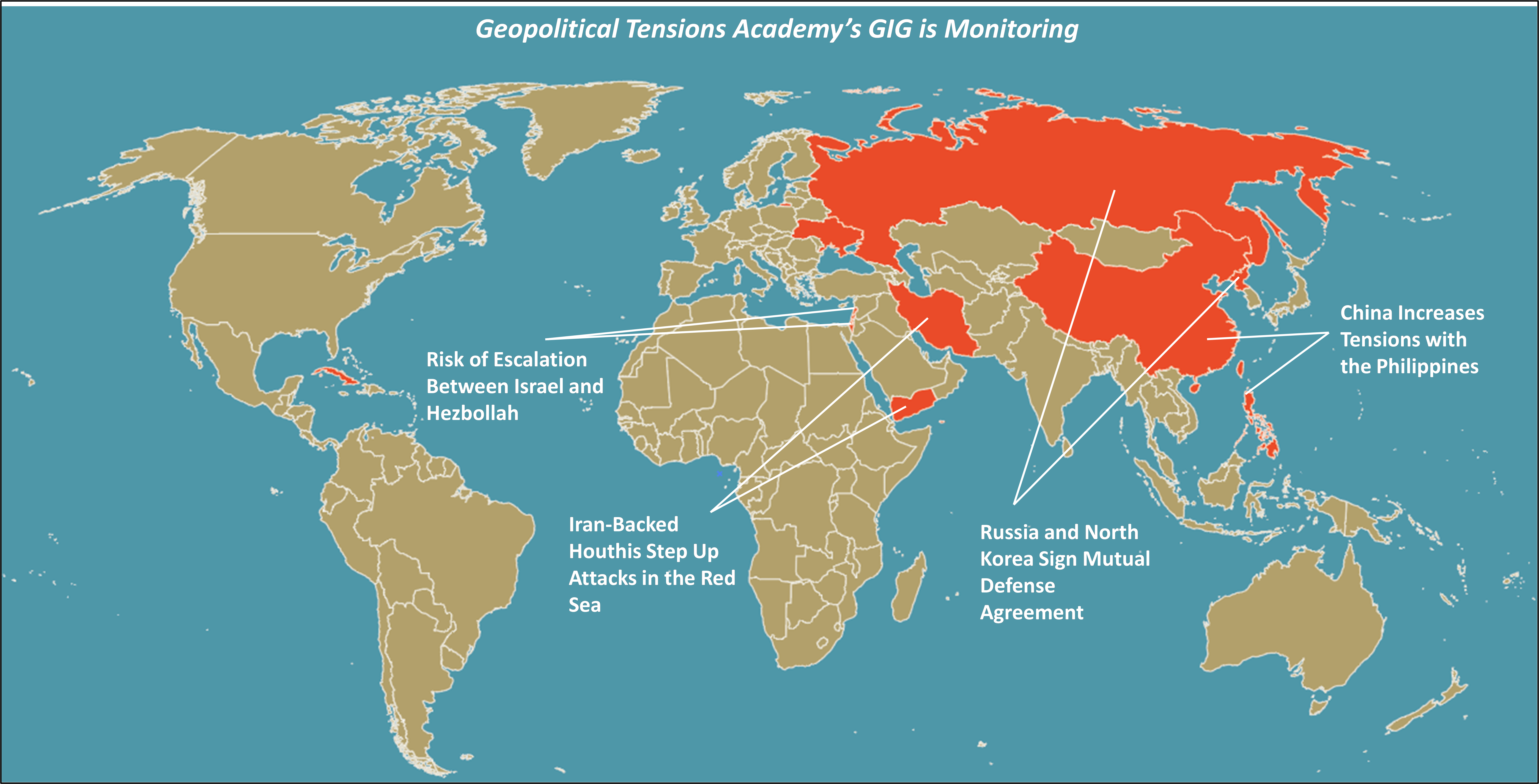

The conversations on geopolitics at Academy have registered increased urgency. Collectively, with around 1,000 years of service, the Geopolitical Intelligence Group is highlighting that this is one of the most difficult and tense times that the U.S. (and the world) has faced. The risk of “escalation and expansion” is everywhere. From Europe, to the Middle East, to Africa, to the South China Sea, to North Korea, the world is fraught with fighting and the risk of fighting.

Academy’s latest Around the World gives several hot takes and a great current summary of many of the issues that could catch markets off guard (the situation in the Philippines deserves some special attention).

Closer to Home

Tonight’s debate could be anything from dull, to interesting, to chaotic. Difficult to guess how it will play out given the rules. One thing that remains a risk to markets is that the debate seems likely to reignite deficit concerns. We are back to the low end of our 4.3% to 4.5% range on 10s and expect yields to go higher (another hurdle for stocks already so far above their moving averages, with many technical indicators hinting at overbought rather than oversold).

Good luck navigating markets, the AI story, tonight’s debate, and everything that is going on globally!