It’s Friday, I’m in Love

I don’t care if Monday’s blue, Tuesday’s grey, and Wednesday too…It’s Friday, I’m in love!

The stock market started the week with a dip on Monday, a bounce on Tuesday, and renewed selling on Wednesday, only to bounce strongly on Thursday after the PCE data came in as expected. But, by Friday afternoon, all I could do was stare at the screens and wonder why everyone was so in love with stocks. But the market, much like love, is complicated.

Really difficult to craft a narrative around last week.

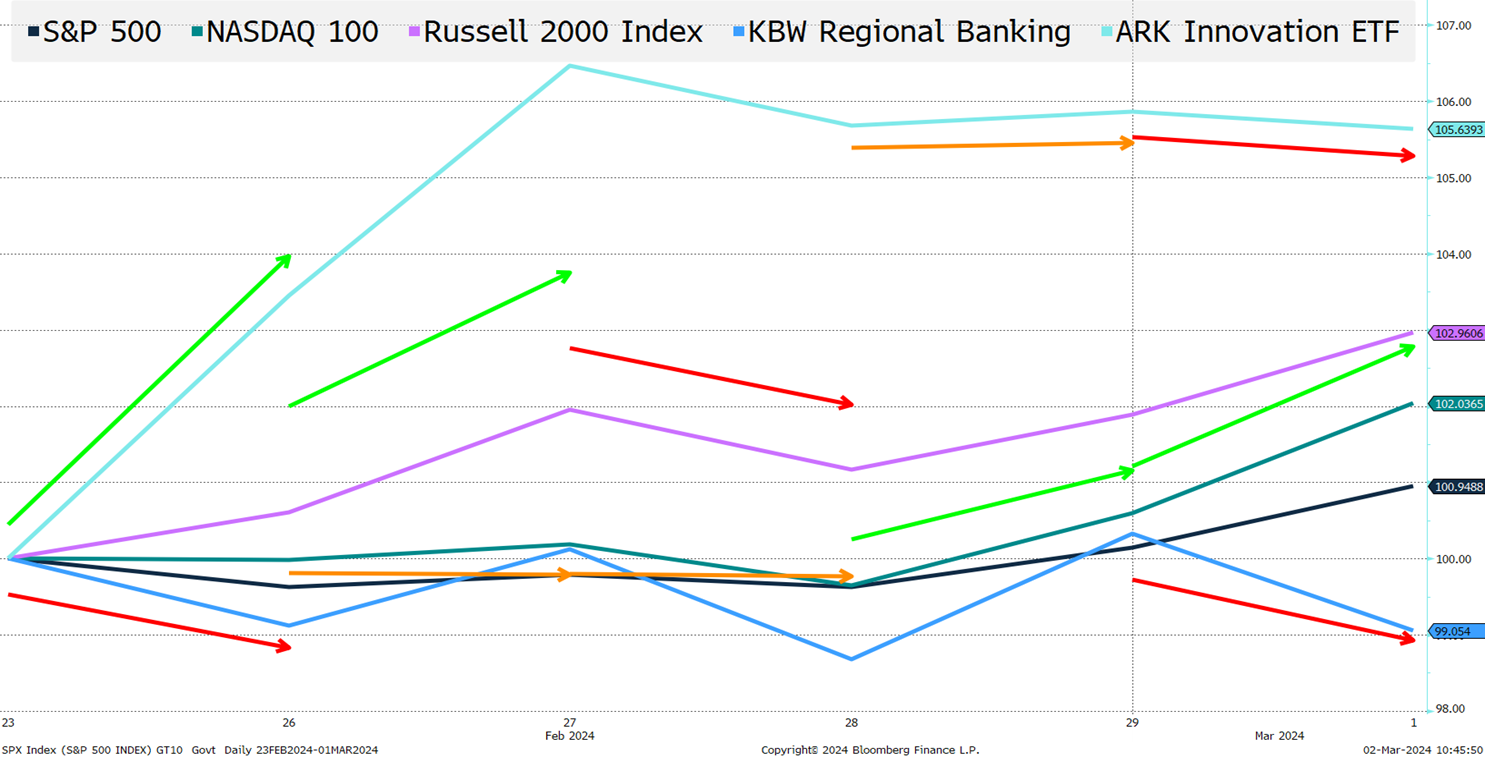

I looked at a few of my “favorite” indices and ETF proxies. Monday, while a slightly weak day for the S&P, was quite strong for small caps and “innovation.” Tuesday showed some strength for those same sectors but was kind of dull overall. Wednesday is when we saw most indices break down, except the S&P, which was flat. While Thursday started the rebound, “innovation” didn’t do much, and Friday, which had strength across the broad indices, had some weakness in “innovation” and regional banks (the latter closed lower on the week).

I resisted adding Bitcoin to the chart, since it defied gravity and rallied over 20% on the week as inflows into the recently launched ETFs continued. More importantly (at least from an adoption standpoint), Bitcoin got put on more and more platforms, making it easier for Registered Investment Advisors to add it to their portfolio allocation mix. The first time Bitcoin breached $60k was at “peak ZIRP,” which was around the time that ARKK (my proxy for “innovation”) closed at a high of $156 compared to Friday’s close of $51. So, whatever is going on with Bitcoin, it is not just some “everything” rally.

The “interesting” part is that this mishmash of returns, where correlations seemed surprisingly weak, could be an indication of “stock picking,” or just “short squeezes,” or the fact that I need to find an index that really picks up the “AI influence.” I’m not sure where to classify DELL for example, but that stock jumped from $81 the prior Wednesday to close this week above $124! Most of the move can be traced to their earnings, which (based on the reaction) were extremely strong, but also included an “AI element” in terms of which servers drove their returns.

What Role did Rates Play?

Since I’m having so much difficulty pulling together a narrative for last week’s price action (more on the correlations, or lack thereof, if anything), let’s look at the bond market as a catalyst.

The 10-year yield started the week at 4.25%, got as high as 4.3%, and finished the week at 4.18%, with Friday being its best day. This presumably helped markets along (though didn’t seem to help “innovation” or “regional banks,” which seems slightly odd). The 5-year yield tells a similar story, moving from 4.28% to 4.16%, with Friday being the best day. Weirdly, the 30-year, which should affect “long-duration stocks,” only moved from 4.37% to 4.33%. I’m not sure that the magnitude of the rates move should move stocks as much as it did, but it seemed to play a major role, at least on Friday.

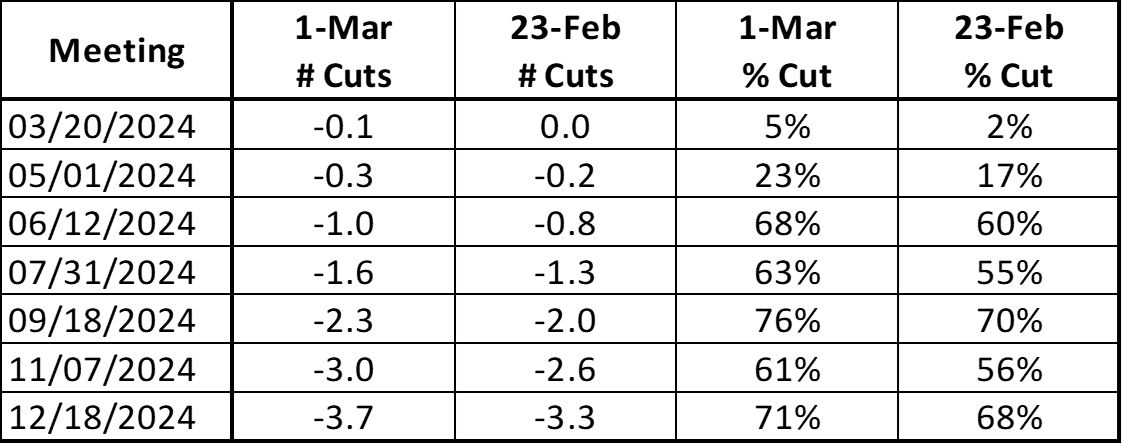

Since it seems a bit dubious that these rate moves should help propel the market higher, maybe I need to check out what the market is thinking about regarding the Fed, so we go to the handy dandy WIRP function in Bloomberg.

The timing barely budged, with June still being the odds-on favorite for the first cut (May did go to 23% from 17%, but that seems de minimis to me). Ditto for 3.7 cuts from 3.3 cuts, which is about 10 bps.

I continue to believe that the Fed will have difficulty cutting at the September or November meeting. The scenario where they cut rates, stocks skyrocket, and their decision takes on serious ramifications for the election could be very difficult for even the Fed to navigate. They might try, but I remain convinced that they either cut in the May/June/July timeframe, or they are on hold until after the election. May looks less and less likely, so my “best” case for risky assets is 2 cuts (in June and July) with the possibility that one or both are 50 bps, but even that seems less and less likely given the economic data and the easing that we continue to see in the financial conditions as the market prices in lower bond yields, tighter credit spreads, and higher stock prices.

The “relief” rally in rates, whether justified or not, seemed to do more for stocks than I would have thought, which again leads me to believe that something else is going on (with AI “deputization” and short squeezes bubbling to the top of my list). More on AI “deputization” later on in today’s report.

The PCE Nothingburger

Academy was quoted in the FT post-numbers and we stuck to our assessment that the market had gotten a little too afraid of a “hot” print, so the reaction was reasonable when “expectations” were met.

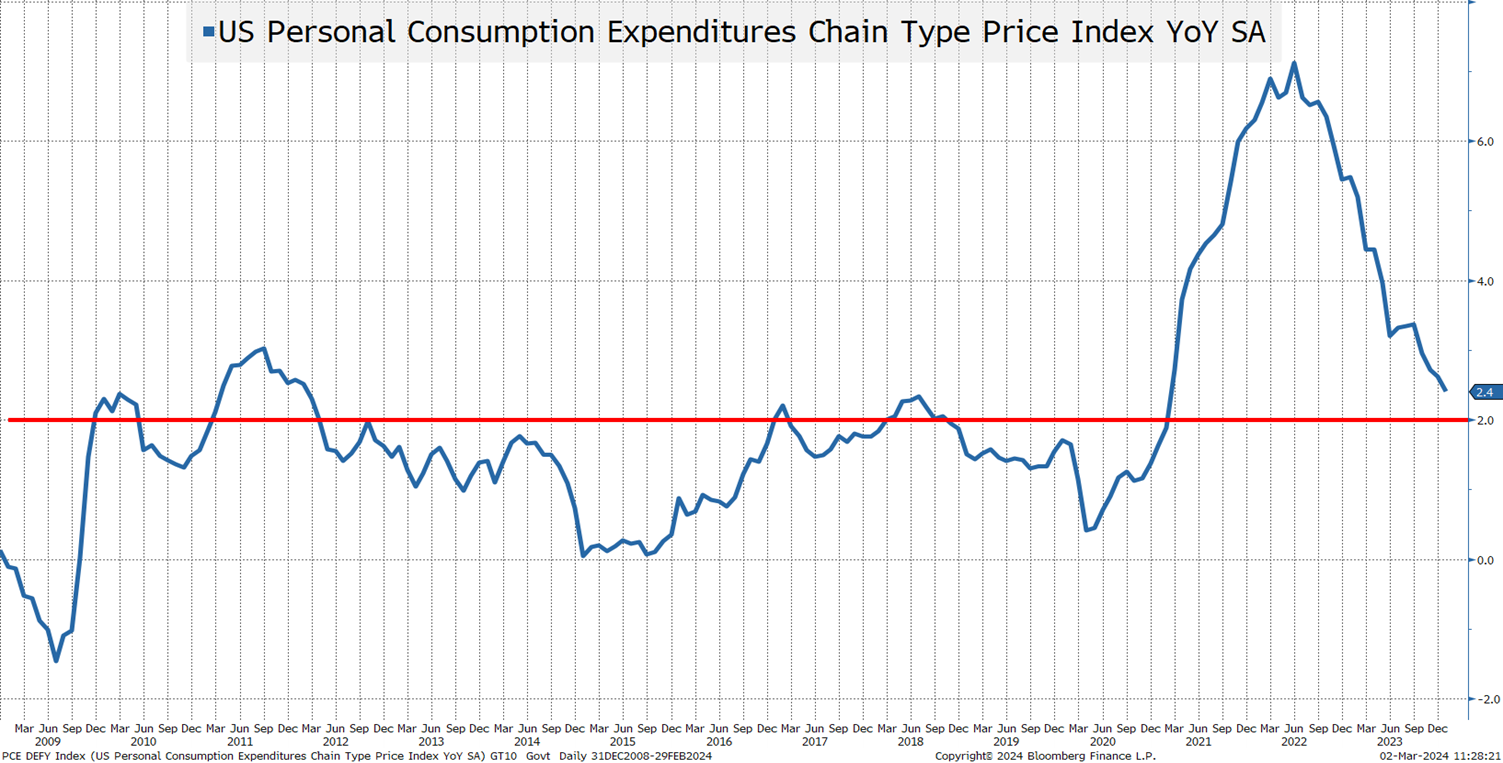

What I find most interesting about the CPE deflator is that people seem to forget that it spent much of its adult life below 2%.

The average since the end of 2008 is exactly 2.0% (one might view that as “successfully” navigating the longer-term average, though that would seem like a stretch).

If you take the 12 years, from the end of 2008 until the end of 2020 (when we got the COVID spike), the average was 1.3%.

I am acutely aware of this, as I spent a good part of that decade arguing that the Fed should have tighter monetary policy (rates, QE/QT, etc.). A big part of my argument had been that their “favorite” measure of inflation is designed in such a way to be lower than what most of us see as inflation.

So, it is not surprising that PCE is headed towards 2%, but:

- This month only “met” expectations, so the rally in yields was a touch overdone.

- Powell, more than other Fed Chairs, has indicated that he is looking at a variety of metrics for inflation, which makes sense to me, and I think that the broader measure will make it more difficult to get to their 2% target.

It is worth noting that the University of Michigan CONsumer CONfidence inflation expectation came in unchanged (holding on to the gains in the prior print). That takes us straight into Friday!

It’s Friday, I’m in Love

So, after all this, we are back to what happened on Friday and what it means going forward!

If anything, the ISM Manufacturing survey showed significant weakness in manufacturing. New orders dropped back below 50 and employment dropped to 45.9 keeping the 1-year average at 48 (which, given the jobs data overall, is a stark reminder that even with re-shoring, manufacturing is a small part of our economy).

The CONsumer CONfidence survey that we already mentioned had a big drop in sentiment, current conditions, and expectations for the economy. Maybe that helped markets? Are we back to the logic that we are slowing, so the Fed can cut, but not slowing so much that we don’t have to worry about a recession? I would hate to think that is what we rallied on, and fortunately I think it is only a small portion of what drove markets.

On Tuesday we published Time to Retire the Magnificent 7 Moniker! This report focused on:

- The Magnificent 7, as an “explanation” for markets, is no longer helpful as that is NOT what is occurring.

- A series of charts and data that points to some risks of significant downside. These include equity put/call ratios, large moves creating new highs, market correlation (it has been low, and that has been a warning sign in the past), margin debt, and some of my “favorite” leveraged ETFs (remember FANG and FNGU?).

I highly recommend glancing at this report, as those conditions remain in place. There are a few things the report did not dwell on that we need to spend more time on now.

- Stock buybacks. Anecdotally, the number of companies and types of companies announcing new or increased buybacks along with their earnings has seemed to increase. That is very good for the market and will help push stocks higher or cushion any fall. I cannot be bearish without acknowledging this trend, which is something I welcome, even if it doesn’t help my current market outlook.

- Short squeezes. I have access to a variety of the “most shorted” indices and they generally showed that the “most shorted” stocks outperformed the most owned stocks and the broad indices. That short squeeze can help push stocks higher, and I would argue that it seemed to have a big impact on Friday, because I saw the sentiment of “I give up on my shorts” permeate social media. Short interest is a cushion, and as they get squeezed, it may be difficult not to get squeezed along with it, but it would set up circumstances that would make any move to the downside that much greater.

- How helpful is AI? I’m spending more and more time trying to use some generative AI in my analysis and work. So far, I’m underwhelmed. On a recent piece, the AI produced names of ETNs that sounded real, along with a ticker which turned out not to exist. While it is helpful in many ways, I’m finding myself fact checking things, slowing the process, making it less efficient. Then (and this might just be personal) I’m finding it frustrating that since I didn’t do the work (or searches) myself I haven’t learned much in the process, and that increasingly I’d rather do the work myself. I’m probably looking at the wrong AI or not using it properly. That must be the case, I guess. So, I’m on the cusp of beginning the journey of 10,000 hours to become an AI coder. Malcolm Gladwell made the 10,000-hour connection between the time spent on an activity and becoming world class at that activity (or something like that). I have a degree in Computer Science and was once a software engineering intern at Microsoft, so I have some hours already put in. If you add some time spent gaming, I’m probably far closer to the 10,000 hours than I’d like to admit. I haven’t quite decided to make that commitment but:

- I’m somewhat disappointed in my use of “AI,” but since it is driving “everything,” it must be me, so I have to get better at it (not doubt it).

- If I can learn to code AI, then I have a fallback if this macro strategist thing doesn’t pan out. 😊

- AI “Deputization.” One thing that I’ve been looking for is more and more companies to benefit from AI. We are seeing some of this in the markets. In the Wild West, when the Sheriff pinned a badge on someone, it made them a deputy. We are seeing that occur now in AI. To some degree, I think that is what happened with DELL and a series of other companies. That “deputization” does a lot more to explain the stock market than some other narratives. That is good and is helping markets, but it is still not what I’m really looking/hoping for. What I’m still really waiting for is to see company after company beat earnings based on efficiencies gained from AI. When markets can price every company at a higher multiple because not only have efficiencies been achieved, but it is also highly likely that there are more to come! I’m a huge believer in technology, but I’m also a big believer in cost/benefit analysis. So, I can understand why company after company is embarking on projects to use AI (as am I), but I’m wondering how many are experiencing at least some disappointment (like me) on what can be achieved versus what it costs (in time, money, and understanding). It is probably a bit too early to tell whether the efficiencies are justified or not (they probably will be, but…). At the same time, it is 100% clear that being part of something that companies need to use while adopting AI is big for your stock. NTAP seems to have been another stock recently “deputized” into the AI community! That should increase competition, which should make AI implementation better and cheaper, but it may also cause some to question whether the playing field for AI is as cut-and-dried as many seem to have thought, or if there are still a lot of companies waiting to be “deputized” (and you can bet that certain analysts are looking for those)!

A lot to think about, but I do think AI is what we need to be thinking about.

Bottom Line

Despite last week’s rally, I’m still looking for the 10-year to get into a range of 4.4% to 4.6%.

On stocks, the story is all about AI, AI “deputization,” and overall efficiencies. I think that is overwhelming any economic data and (coupled with short squeezes) is helping the market, but I cannot help but think the market is far more fragile than it looks and would be buying short dated/significantly out of the money puts against long risk here.

The “laggards” should be the next to benefit, but we are not seeing moves like we saw in November of last year, and that does concern me.

Away from all of that, last weekend’s The Game of Chicken in markets and geopolitics is a fun and hopefully useful read.

And as someone who watched QQQ beat FXI last week and yields go lower, all I can do is think of yet another song by the Cure – “Boys Don’t Cry” (which is probably horribly politically incorrect, but it seems to fit)!

Strategists can rethink their views, but they don’t cry. I’m still bearish. I am nervous that the forces driving markets late last week have more room to run, but I am wondering if the market can fall out of love as easily as it fell into love on Friday?