Academy SITREP – Geopolitics of Rare Earth Elements

July 13, 2023

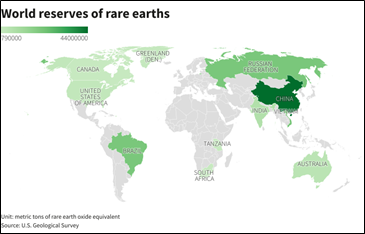

What has Happened: This SITREP is a follow-up to our 2021 report (Rare Earths – A National Security and Environmental Threat) and our semiconductor-focused piece from earlier this year (World War v3.1). Last week, China said that it would impose export restrictions on gallium and germanium products used in computer chips and other components. This move was likely in retaliation for U.S. curbs on sales of technologies to China and it raised the concern that at some point in the future, China could limit exports on other rare earths that it produces. China recently accounted for 70% of global mine ... Academy SITREP – Geopolitics of Rare Earth Elements