Academy Sustainable Finance Report

2024: It’s Looking Interesting

We’re almost through the first quarter of 2024, and it’s looking interesting. Despite a rout in sustainable, social, and green bond issuance in 2022 and 2023, this year has seen a resurgence. So far almost $8bn in U.S. corporate investment grade green bonds have priced, including new entrants like Dow Chemical (where Academy served as a Co-Manager), which came to market with its $1.25bn inaugural green bond. This is part of a broader theme that we’ve been tracking of increasingly more industrial names coming to market. The trend also confirms a recent survey showing further spending on “green” related projects.

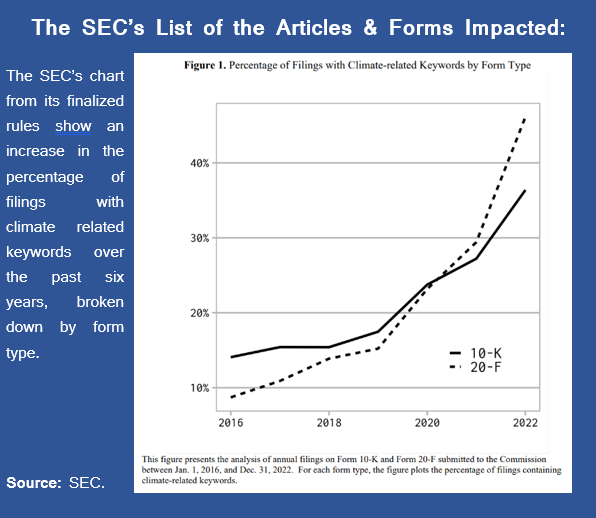

In addition to elevated green U.S. corporate issuance, we also saw the SEC finalize its Climate Related Reporting-Disclosures rules. This comes on the heels of California’s recent climate reporting laws and the SEC’s Cyber Disclosure rules, which is why in this month’s report we dive into the newly finalized climate rules and assess what they mean for registrants, the reaction, and possible knock-on effects.

A Close Decision

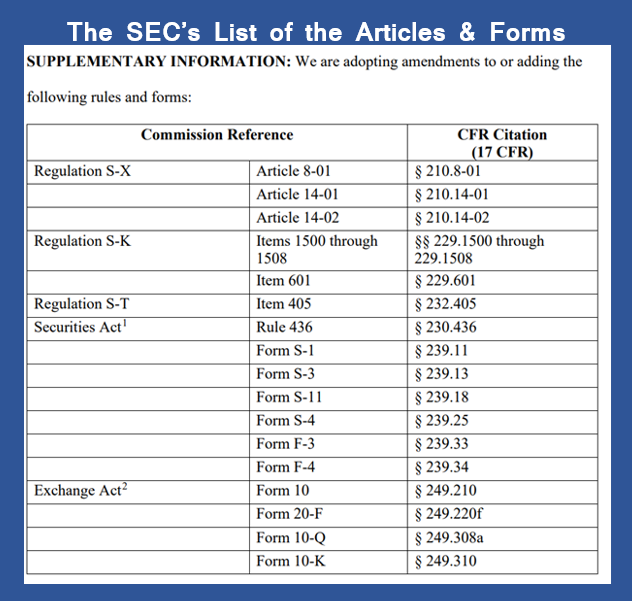

Last week, in a 3-2 decision, the Commission decided to finalize its rules on Climate Related Disclosures that it proposed almost two years ago after an explosion in corporate reporting, investor feedback, and mandates from the White House. The decision finalizes several amendments to a variety of the Commission’s rules and forms, including the Securities and Exchanges Acts and Regulations S-X, S-K, and S-T. These additions will require registrants to feature material climate related information in their disclosures and reporting before new securities are issued and/or M&A is announced as well as the requirement to include updates in quarterly and annual filings. In addition to climate disclosures, the new rules also outline both qualitative and quantitative descriptors for filings and statements.

Some of What the Finalized Rules Entail

The final rules are over 886 pages long, and it will take time for the legions of lawyers, accountants, and consultants to comb through and determine what the final impact will be, but here is a non-exhaustive list of what the final rules will look to require:

- Any climate-related risk identified by a registrant that’s had (or is reasonably likely to have) a material impact on a registrant’s business or strategy.

- Actual and potential material impacts of any identified climate-related risks on the registrant’s strategy, business model, and outlook.

- Disclosures if part of a registrant’s strategy activities will mitigate or adapt to a material climate-related risk.

- Disclosures on transition plans, internal carbon pricing, renewable energy credits, and climate scenario analysis (if applicable).

- Oversight by the board of directors regarding climate-related risks and any role by management in assessing and managing climate risks.

- Processes the registrant has for identifying, assessing, and managing material climate-related risks and if the registrant is in fact managing those risks.

- Disclosure if a registrant has set any targets or goals, disclosures on those goals, and any material impacts on the business.

- For non-exempt LAFs and AFs, disclosures regarding Scope 1 emissions and/or if its Scope 2 emissions metrics are material including:

- The capitalized costs, expenditures, charges, and losses incurred because of severe weather events and other natural conditions subject to applicable 1% and de minimis disclosure thresholds.

- Rules regarding who should file, the timing, and the rules for presentation and formatting.

Instant Reaction: It Could Have Been Worse

Ultimately one of the most contentious components of the proposed rules (the Scope 3 emissions requirements) was removed, and more time was added for filers to comply. The rules also allow some relative flexibility on the methodology used to calculate emissions (with a focus on materiality) and extend safe harbor from private liability for certain disclosures. Board members’ climate expertise will also not be required to be disclosed. In addition, final rules will not apply to asset-backed securities issuers, as was first proposed.

After reviewing, one gets the impression that the SEC seems less concerned about what an individual registrant’s response to managing or adapting to climate risk is, and more concerned if the issue is material to the business, and if so, if it is being reported in a standardized fashion. For instance, transition plans, which the SEC defines as “…a registrant’s strategy and implementation plan to reduce climate-related risks, which may include a plan to reduce its GHG emissions,” only require those who have them in place to disclose and report them (i.e., it does not apply to all registrants). It also applies the same materiality logic to climate scenario analysis and internal carbon pricing. If they are not being used, then there is no requirement to disclose them.

Emissions reporting was another key component of this and one where the SEC decided to take a more measured approach. It removed Scope 3 emissions reporting requirements from the final rule, along with allowing registrants to use existing emissions calculations like the Greenhouse Gas Protocol’s Corporate Accounting & Reporting Standard, EPA regulations, or ISO standards. The final rules also allow registrants to aggregate emissions into CO2e, instead of disaggregating into C02, CH4, N20, HFCs, etc., unless those emissions are material (for instance to a utility or an energy producer). This is part of the SEC’s push to avoid extraneous reporting on top of what will likely be a moderate lift for more established registrants and larger companies. However, this is a heavy lift for smaller registrants. The SEC’s utilization of the TCFD framework in developing the new rules should also make the process more familiar for registrants who already use it to disclose.

One area that will be of interest going forward is the 1% threshold. The SEC finalized that if capitalized costs and charges on the balance sheet (along with expenditures incurred and losses on the income statement as a result of a severe weather event or natural conditions) are greater than 1%, it would trigger a materiality/disclosure event and would need to be reported. The SEC in its comments recognizes that this is counter to the 5% rule of thumb for materiality that it uses (and some commentators recommended 10%). With this 1% threshold combined with other new requirements, we may end up seeing an initial massive disclosure dump.

With the rules only being released last week, it is still too early to tell what the full impact will be. Given that Scope 3 emissions were excluded, the likelihood of pushback or litigation filed against the SEC will remain limited. However, with the possibility of a new administration, there remains a chance that we’ll see some of these rules either be rolled back or not enforced. Still, states like California, New York, and others have enacted their own forms of climate related financial disclosures that, when combined with Europe’s complex laws, create a climate disclosure dragnet that will be tough to avoid.

Bottom Line

- The rules, while likely not to make either side of the aisle happy, are probably what disclosure in the U.S. needs (materiality qualifiers, standardization, common language, and digestible data).

- While the new climate reporting and disclosure rules will pose some challenges for larger and more sophisticated registrants, it will likely be an even larger lift for smaller and pre-IPO companies to comply with, and result in greater investment into corporate reporting and audit teams.

- With the combination of reporting requirements and the 1% threshold, markets could see a greater frequency of disclosures resulting in increased exposure to litigation risks and share price volatility.

- It’s likely that conversations on climate-related physical and transition risk will become more frequent prior to IPO or issuance of new shares/debt.

With recent cyber security and climate disclosures/reporting requirements coming into effect, there could be opportunities in data analysis where disclosure items must be structured (whether for new entrants or legacy companies), so there will be a litany of new data to comb through and monetize.

Further Resources

SEC’s Finalized Climate Rules: //www.sec.gov/files/rules/final/2024/33-11275.pdf

Bloomberg, “KPMG Study Reveals Surprising Plan for ESG Spending by Companies.”: https://www.bloomberg.com/news/articles/2024-02-16/big-companies-press-ahead-with-esg-despite-us-political-backlash