Time to Add Duration?

The bond market has once again “stolen” the show. Higher yields are the topic du jour and have been impacting equities, and presumably crypto (though the ”GENIUS Act” and a commitment by this administration to move forward on crypto is also a big driver there).

At the moment, this seems far more about narratives (or, more precisely, narratives lost), positioning, and some “funky” global dynamics, than anything truly fundamental.

Narratives Lost

The bond market was comfortable heading into this year based on:

- What seemed like a focus on deficit reduction. From the President to Bessent’s 3, 3, 3 mantra, there was a lot of optimism around the bond market.

- DOGE was welcomed by almost everyone, initially. There was anticipation that with some effort, focus, and high tech brought to bear, we would see significant savings, almost immediately on spending. Less “pure” waste was discovered, and while many object to some of what money was being spent on, it had gone through the proper appropriation channels, making it difficult, if not impossible for DOGE to do much about. Instead of potentially trillions, the number seems in the $100 billion to $150 billion range. Not bad, but not what was anticipated in the narrative.

- The Deficit. For all the hawkish talk, when it comes time to cut taxes and cut spending, it turns out to be difficult to get support to cut spending. We all kind of knew this in the back of our minds, but were hopeful. The reality is sinking in that the deficit is extremely difficult to contain, given the “business” of politics. The narrative was powerful, and now it seems unlikely to be addressed much (or at all) in the current round, and the hope for the future has been dampened (if not bludgeoned). The loss of the narrative has been more impactful than the actual increases in the deficit.

Between the Moody’s downgrade and watching the “sausage being made” in D.C. on the Big Beautiful Bill, this was a catalyst to push yields higher. This is more about narratives being lost, than the actual changes in the deficit.

Positioning

Positioning is always a bit of guesswork. There are a lot of indicators that often go into divining positioning. This time, it might be quite simple.

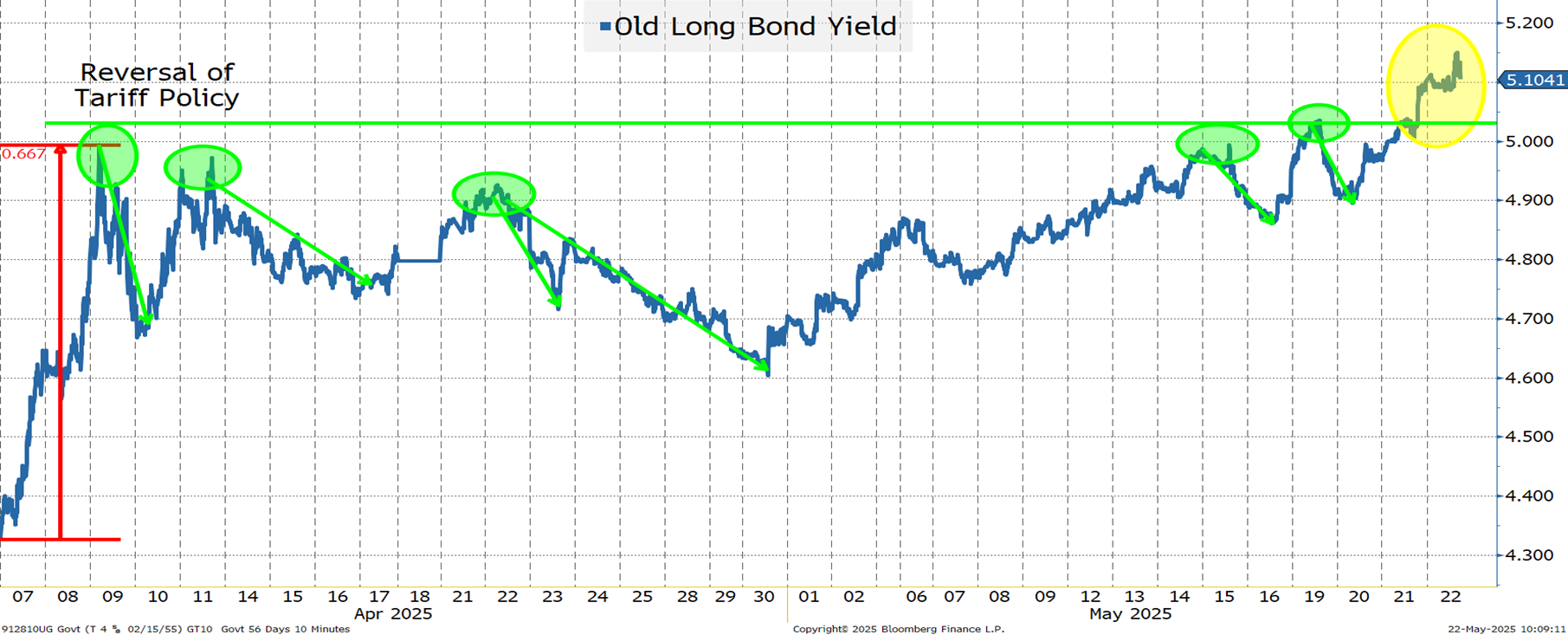

While there were a lot of issues facing the market as the Liberation Day Tariffs went into effect, the rapid risk in bond yields seemed to catch the most attention in D.C.

After the administration pulled back significantly on their tariffs, markets seemed to take comfort that around 5% on 30’s was a “line in the sand.”

Since then, every rise in yields has been bought.

There is highly likely to be some indigestion at these levels which might be something algos try and take advantage of, but trying to push yields higher to see if new capital flows in, or stops are triggered?

“Funky” Global Dynamics

While the last move to higher U.S. yields was accompanied by a weaker dollar (DXY dropped about 2%), yields across the globe went higher!

- Japanese bond yields have surged, with the 10 year yield jumping from 1.25% to 1.56% this month. That move didn’t prevent them from having a “failed” auction.

- Dutch pension rules have changed, limiting their purchasing of ultra long bonds, which weighed heavily on markets.

- While I highlighted Japan, most sovereign debt has been hit in the past week.

So while it is “easy” to point to the “lost narrative,” this goes beyond anything specific to the U.S.

It is “almost” like some major international asset manager, on record stating they are worried about global debt, is selling bonds, globally.

When we examine what foreign buyers (thinking far more about pension funds and insurance companies than central banks) may shy away from in the U.S.:

- Treasuries are the easiest to be underweight. With yields higher across the globe, it is easier to just buy your own domestic sovereign debt, than buying U.S. debt and hedging the FX risk.

- U.S. corporate credit is more difficult to avoid. The depth of the market ensures that anyone who wants a diversified portfolio, by sector, companies, ratings, and maturity, has to participate in the U.S. markets. Liquidity is far better in the U.S. for size than elsewhere. Necessity will ensure foreign investors spend their bond money on credit, where they can. We do think corporate clients will explore issuing debt in other currencies more than in the past, as it could lead to some incremental pricing benefits.

- U.S. equities are global more than U.S. so they cannot be avoided to the extent other markets can be. 40% of earnings of companies in the S&P 500 come from global sales (which may see a slowdown, but remain a crucial part of earnings potential). Just glancing at the biggest names in the S&P 500 and the Nasdaq 100 and it is difficult to label them as “U.S.” rather than “global.” So, investors will still be purchasing U.S. stock indices (though they will allocate domestically more than in the past, but there is a limit to their ability to do that in scale).

Of all the assets the U.S. sells to the world, treasuries are the least “differentiated” which may weigh on them.

The Fed

The market is back to pricing in 2 cuts by the end of this year. I think that is too low.

The scenario playing out, as I see it, is the following:

- Hints of rising inflation as some tariffs get passed along to the consumer. This slows the Fed and keeps them on hold at the next meeting.

- Realization hits, that 10% is “manageable” and will be split, in some form between exporter, importer and consumer (not great for margins). It will take time for prices to be raised to reflect tariffs as:

- They have to actually hit the importer meaningfully.

- It takes time to adjust prices higher, as many things were contracted prior to tariffs.

- The declining inflation we were seeing prior to tariffs was a function on many things – but the consumer, stretched very thin, is playing a role.

- “Buy now, pay later” is attracting questions about what it means for the health of the consumer who is relying on that form of credit.

- With student loan payments now hitting credit scores, we will see less spending as people have to make those payments.

- While the tax cuts can help, the “extension” of the sunsetting provisions doesn’t act as a tax cut, so it won’t be as inflationary as it might be otherwise.

- The uncertainty starts to hit the “hard” data, including jobs. We have argued the birth/death model seemed almost nonsensical last month. Travelling and talking to corporations across the country had done little to alleviate concerns that “caution” is the “correct” response to all the uncertainty.

- Finally, before all the tariffs hit, we were on pace for more “good” cuts. Cuts justified by real yields being too high. The concept that we needed a recession to spur rate cuts made little sense to me. We were on the correct trajectory and think we can get back on that pace.

My bet would be a cut at the July meeting and at least 3 cuts for the year (possibly more if tariffs and the response to uncertainty weigh on the economy even more than I think it will).

Tariff Revenue

Tariff revenue may not prove to be long-lasting. It is incredibly difficult to ascertain whether tariff revenue will remain a goal, or we will see “dealz” that drive tariffs lower in the coming months. There is no incentive to drive tariff revenue lower while the promise of it can help push the budget through, and there are indications that the administration is committed to tariffs and the revenue, but it could also be a ploy, at the moment, to get the budget through.

It helps and will start showing up in the data and may become part of the positive narrative for bonds in the coming weeks.

Corporate Bond Issuance

May, so far, has seen over $120 billion of IG issuance (Academy has been very involved in a healthy portion of those deals).

Typically, we would see issuance slow post Memorial Day. Given the volatility that spurred issuance, my outlook is for a dramatically smaller calendar in June, unless rates go a lot lower.

The IG supply slowdown should help treasury yields.

The Treasury Issuance Schedule

The Treasury department may also change their issuance guidance to focus on shorter maturity bonds given their view that higher yields are “temporary” – which would also help treasuries.

Bottom Line

The only thing stopping us from “pounding the table” to buy treasuries, is the pressure globally on yields, and the fact that 5% on 30’s was such a “buying trigger” for the past month, might leave many overly exposed in a world where the markets seem to be good at finding, and punishing those types of positions. Also, the extent basis trades were “reloaded” likely means new “stops” are lurking out there, higher than where they were in April, but possibly reachable?

Nibble on yields here, but I want to see stability globally before plowing into U.S. Treasuries (which is the opposite of how we’ve been trained to behave with the U.S. market generally leading the world, rather than the other way around).

Yesterday morning’s Bloomberg TV segment on bonds and Budget 2026 played out well on the bond side, though it was somewhat surprising how poorly stocks seemed to react.