The American Brand

We will explore this in more detail in this weekend’s note, but I did want to explain why I remain bearish on U.S. risk even after this week has seen stock prices drop further and credit spreads rise.

Last weekend we raised many issues in You Ain’t Seen Nothing Yet. The main thrust of the piece was the Market Risk of Deglobalization. We highlighted the risk that the focus on trade flows is causing capital flows to reverse.

American Exceptionalism created conditions where global capital flooded into the U.S. That helped asset prices of all varieties (public and private, stocks, and real estate). There is strong evidence that capital is starting to flow out of the U.S (U.S. stocks are down, global stocks are outperforming to the downside, if not outright moving to the upside). In the past month, QQQ (Nasdaq 100) is -12.6% while FXI (a Chinese Stock ETF) is +7%. Almost a 20% differential in one month is nothing to sneeze at, but I continue to think We Ain’t Seen Nothing Yet.

Increasingly, I’m worried about the American Brand.

To a large degree, those capital flows came to the U.S. because of what it represented. What I cannot help but wonder is how much purchasing (across the globe) of American brands comes from the American Brand?

With somewhere between 30% and 40% of revenues for companies in the S&P 500 coming from outside the U.S. (see the link to last weekend’s report above), are some of those sales at risk?

While I think the market is only starting to price in capital outflows, I do not believe we have started to price in the risk of less selling of American Brands globally. I could be wrong, but we will go into more detail in this weekend’s T-Report to explain the rationale.

We’ve had bear markets in the past. Most seem to have been given a simple name to explain the root problem. S&L, LTCM, Tech Bubble (though I think fraud and Enron and WorldCom played a major role), the GFC, and the European Debt Crisis. If markets continue to fall and we reach bear market territory (which I expect), there will be a temptation to blame this on tariffs, but I think it all comes down to the American Brand.

One positive we highlighted was that credit was behaving. Spreads have shown some cracks. Credit hasn’t broken and is rebounding this morning, along with equity futures. Having pointed that out, the risk of further credit weakening (bringing out the equity bears in full force) remains high.

I see a lot of chatter and evidence that this market is oversold. That everyone is so bearish. I see some of that as well. But I also see person after person “buying the dip.” This market might have the worst positioning possible – a bunch of bears who are all long risk.

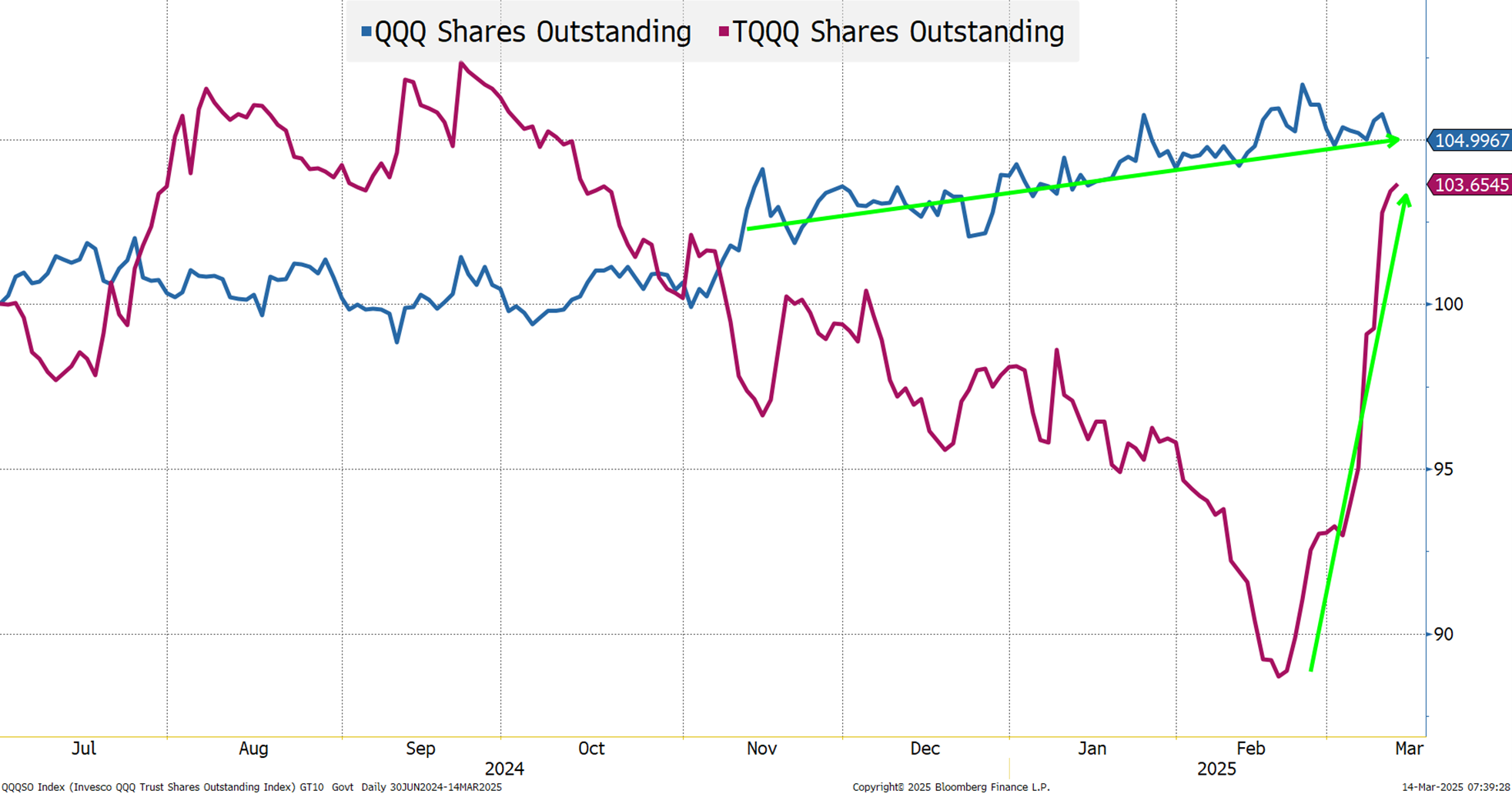

The shares outstanding on QQQ have barely budged and are still higher than they were ahead of the election. This $300 billion ETF doesn’t look like it has seen any capitulation whatsoever. TQQQ, a 3x leveraged QQQ ETF, did see selling, but for the past few weeks, inflows have surged. It is back to levels higher than after the election (when we saw some profit taking). Sure, you can “scoff” at TQQQ (many do), but it is almost $20 billion (representing $60 billion in leverage), so scoff at it at your own peril. This simple chart smells like the opposite of capitulation and that despite the recent sell-off, we could see more. I know there are many signals pointing to the opposite, but I cannot get this out of my head.

Bottom Line

I will be fading this rally in stocks and credit.

I expect credit to get a lot more attention from equity bears, and not in a good way.

While Treasuries can rally on bad news, particularly at the front end as the Fed comes into play, the long end I think will underperform. 10s hit 4.16% on March 3rd and haven’t gotten that low since then. Even on Monday’s risk-off day, they only closed at 4.22%, and are now back to 4.3%. If the long end of the yield curve doesn’t rally, it doesn’t help risk that much. I expect much of this is surrounding the deficit and foreign flows out of the U.S.

On the bright side, “We’re An American Brand” is one heck of a tune!

Good luck, I will be watching today to see if this bounce has legs (so far, none really have), but unless something changes very rapidly on the global stage, I think the weakness we’ve seen is only the appetizer and we will explain the American Brand thesis more this weekend. Basically the American Brand had a lot of intangible benefits that we may all have underestimated as that brand seems to be evolving.