Non-Standard Deviations

We all live in a world where we are used to “standard” deviations.

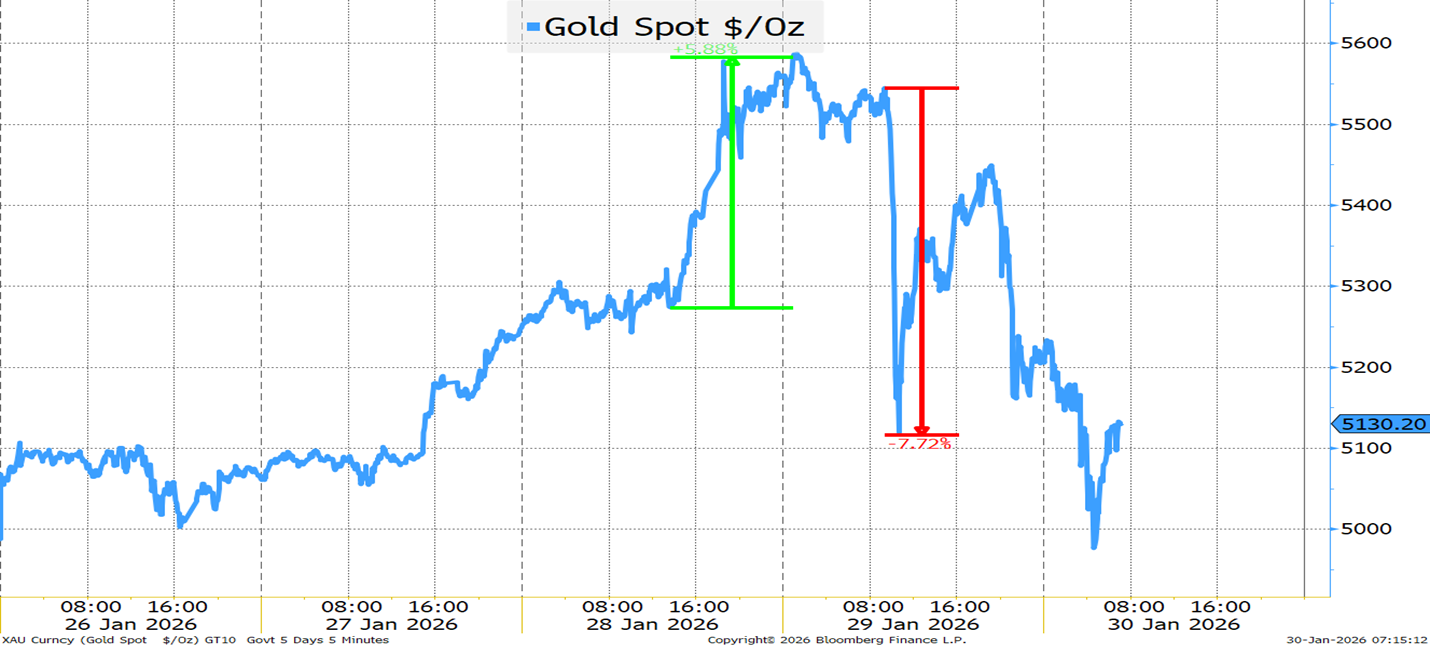

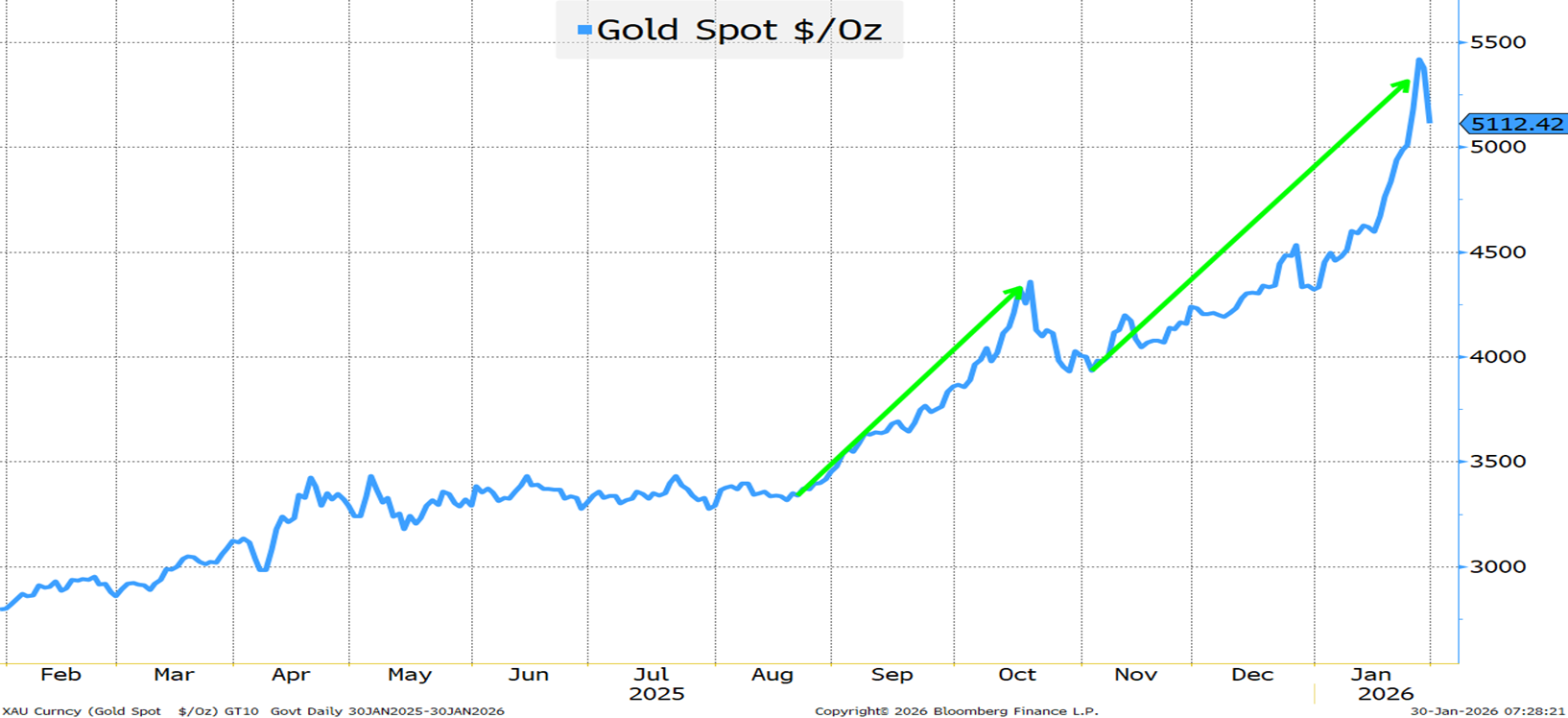

There was nothing “standard” about gold’s move yesterday.

I was getting ready for a meeting and my stream was flooded with victory tweets on gold! Gold above $5,500 having only recently crossed $5,000.

What was going on?

- Apparently betting sites had started to sell Reider to buy Warsh (who has just been announced on Truth Social to be the President’s choice for Fed Chair). Historically he has been on the hawkish side and not a fan of crypto. That explains, potentially, part of yesterday’s moves.

- It may explain why tech traded decently overnight, only to get hit hard as the cash market opened. Since META was up strongly and had announced AI spending numbers that were quite large, it seems difficult to blame the tech sell-off on concerns about AI spend, though I think there are still risks around the AI spend (and the ability to produce enough electricity to run the AI/Data Centers).

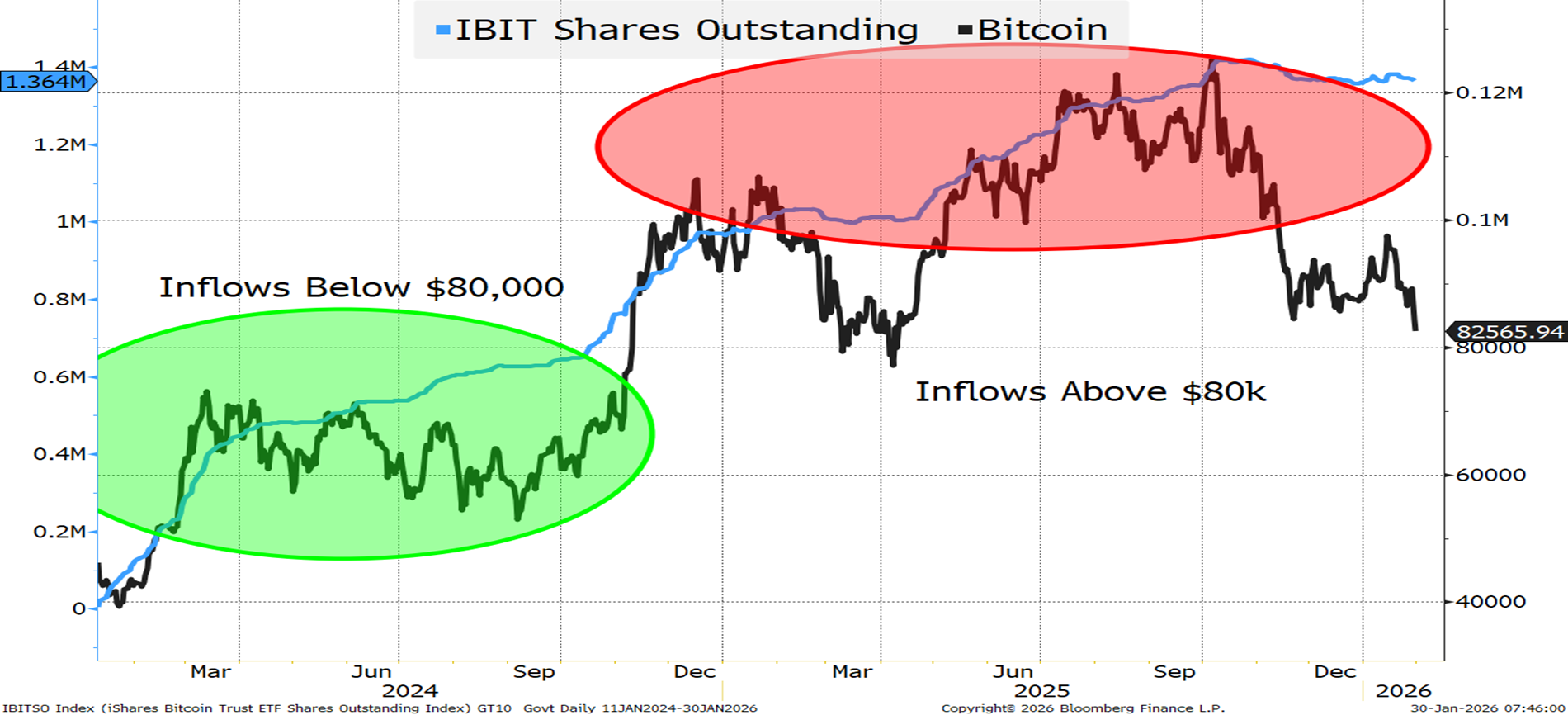

- Bitcoin was down all day. Though the inability to get the Clarity Act passed certainly played a role in Bitcoin’s weakness. Bitcoin was down while every “physical” commodity was higher, and Bitcoin did not participate in the bounce that stocks and “physical” commodities experienced as the day went on.

I find it difficult to believe that Warsh won’t “evolve” to positions more in line with what the President wants out of the Fed Chair.

One issue that could be “tricky” is that Warsh has been quite outspoken about inflation. He has been anti-QE (which we think was used for way too long and at way too high of a level post-GFC, and we still haven’t “normalized” from that “experiment”).

Maybe Warsh currently agrees with us that official inflation (CPI, PCE) is overstated and other metrics like Zillow and Truflation (see last Sunday’s report) are more reflective of a reality where inflation has already declined in the real world and just hasn’t appeared in the “data” (again, I think we should revamp how we collect and process data – it seems like many of the methodologies are at best outdated and at worst, antiquated). But we digress.

If Warsh thinks inflation is an issue, I will have to rethink my 75 bps of cuts by the September Meeting.

If I Had a Dollar for Every Time “Debasement” Was Said I’d be…

The mention of “Debasement” seemed to create higher gold prices.

Notice how we have specially stuck to “mentions” of debasement, not actual debasement.

At one time, if you mentioned “debasement” you were at least partially obligated to explain debasement and maybe even show some evidence of debasement.

At some point, we seemed to jump past that, to the ability to wave the magic debasement wand, and justify certain trades.

Debasement this. Debasement that. Debasement here. Debasement there. Debasement everywhere.

Is there really that much debasement?

I think the narrative was aided by low liquidity during the holidays. Then as some traders tried to counter the moves higher, the cries of “debasement” grew louder (literally, we could not go 15 minutes in the financial media without hearing the word bandied about like it was a foregone conclusion). That spurred stop losses. It fueled even more speculation.

GLD, an ETF, saw daily trading volumes spike in the past few days. What was curious was that while there was immense trading volume in an asset that had been rising, the inflows to the ETF were negligible. That seemed strange. Many (including myself) would have expected the price rise to be accompanied by inflows into one of the easier ways to access exposure to gold (yes, I understand the issues of “paper” gold versus “physical” gold, but even accounting for that, it seemed odd).

Now China is curbing trading (and while not as obvious as gold, I’m told by some precious metals traders that the Chinese hours had become so unpredictable that they had to not only scale back position size, but also think much more seriously than ever about overnight positions).

To me, all of this points to more downside for gold. (Probably the other precious metals too, and maybe even commodities, though I’m more sanguine about commodities).

Bitcoin will be tested in the coming days.

- I have not done the work, but the Bitcoin ETFs have been accumulated at prices above today’s level (seeing people say average price is around $87k). So, the “new” adoption is probably underwater. The longer you held off to buy Bitcoin (presumably because you were skeptical), the more likely you are to be underwater.

So far we have not seen outflows out of big tech (QQQ continues to see inflows), but outflows from ETFs like that would now also potentially weigh on crypto as it would include selling of MSTR. MSTR is only 0.2% of QQQ so it would take some serious outflows to really move the needle, but it does solidify the increased connectivity between Defi and Tradfi (yeah, I’m trying to sound cool with those terms 😊).

Bottom Line

Expect Warsh to say some things that reposition himself to be in line with the admin’s agenda for the Fed (he wouldn’t have been nominated without going through extensive conversations with the President and Bessent). I continue to argue that cooperation and coordination is good and does not negate independence.

On the flipside, the “debasement” trade has been overdone and I think recent price action sets a retrenchment on that – especially on gold.

On Bitcoin, the next few days will be critical. Could it bounce and break through $90k or even $100k? Yes, but the risk right now seems to be to the downside. If we’ve stalled on progress with the U.S. government, and if debasement is overdone, then we could see lower prices. The recent performance, where “digital gold” failed to live up to its promises (unlike physical gold), will make adoption more difficult. MSTR’s average Bitcoin purchase price (reported around $76,000) could act as a magnet, spurring even more concerns.

Ultimately, I am watching stocks closely to see if yesterday’s sell-off was an aberration, or the start of a more meaningful pullback. Nothing much has changed in the narrative, but the narrative often adapts to price action, and given positioning (mostly bulls), we are susceptible to a “garden variety” pullback in risk assets.

Non-standard deviation moves (or, if you prefer, moves that are high multiples of the standard deviation) seem unlikely to quickly revert to “normality” or the previous trends.