Is ProSec™ the New ESG?

Interest in Production for Security (or ProSec™) is finally getting the traction it deserves! Not just from the government, but investors, financial institutions, and corporations are also starting to respond to this trend.

ESG was a massive factor behind changes in investment, at the corporate, government, and individual levels.

It shaped policy. It brought much needed attention to issues that had not been addressed fully by government or industry.

Much of what ESG focused on – sustainable energy, water management, etc., fits perfectly into the ProSec™ theme. The emphasis may change as the current end goal is security of what we need, but much of the framework will be kept. So maybe ProSec™ isn’t the new ESG, but a natural extension/evolution of ESG?

Just look at the number of ESG ETFs that were launched across the globe. ESG-focused bond funds. Financial Institutions that would commit capital aggressively to some areas while reducing exposure to others.

We did always argue, in the T-Report, that many of the ESG metrics were:

- Backward looking. It takes time to adjust your global footprint. Some parts of ESG were easier to address than others, but many of the “scores” seemed to not incorporate enough information about where companies were headed, and overemphasized past data.

- Too exclusive/ignored “best in class.” On the investing side, in particular, certain industries stood out as “stars” in their ESG compliance. Others were inherently “bad” in ESG terms. Why wouldn’t we want the “best in class”? Why not the top handful of companies in each and every industry rather than skewing it sharply to industries that were “naturally” ESG compliant?

That led to an often repeated (at least in the T-Report) phrase, The Energy Companies of the Future, Are the Energy Companies of Today. That worked out well as a “slogan” and investment thesis. It is even more true today than it was then.

One negative, from my perspective, is that ESG made it appealing for companies to outsource things for additional reasons. If you could outsource things for a reduced carbon footprint, you were potentially incentivized to do that. That incentive, piled onto so many other reasons (cost being paramount), led to potentially even more outsourcing than we already had.

Sustainability

How “sustainable” is your business (or country) if you outsource things that are critical to your business/people, and you don’t have any control over the things you desperately need?

In some ways, this is clearer at a government/national level than at the corporate level. Partly because governments and corporations exist for different reasons (the welfare of the people versus the welfare of their stakeholders). Partly because the biggest U.S. companies are truly global, so while the U.S. may represent a large portion of their business, it is not the entirety of their business. Not by a long shot.

This country is finally getting around to being “sustainable” within the real definition of sustainable.

I go back to Maslow’s Hierarchy of Needs. People focus on:

- Physiological Needs. Basic requirements for human survival, such as food, water, and shelter. For our purposes, it comes down to the components of things like shelter (a lot of commodities, etc.) and will add electricity as well.

- Safety Needs. Protection from physical and emotional harm, including security and stability. Peace through Strength.

- Love and Belonging

- Esteem

- Self-Actualization. The realization of personal potential, self-fulfillment, and seeking personal growth.

I think we could argue that much of our policy in the West has been aimed at the Self-Actualization stage.

According to Maslow, it is difficult (impossible) to achieve stage 5 if you don’t have the stages below you complete.

Maybe that is why there is so much discord? Sure, social media is to blame for a lot of it, but maybe some people are working to achieve levels 3, 4, and even 5 while many are struggling to achieve 1 and 2?

But we digress.

The point at hand is that to be truly sustainable you need to provide (or have almost certain access to) the building blocks of life.

It seems incredibly clear from trade negotiations that as a nation, we have subjected our basic needs to other countries, primarily China.

That has to change, and the change is starting.

Governance

How can you have “good” governance if you govern yourself to dependency on a competitor?

The Beneficiaries

The government has been taking stakes in companies. Ultimately, that means that we the citizens (and taxpayers) have been taking stakes in companies. We will benefit if those holdings do well.

When the government takes a stake it brings a few things to the table that don’t necessarily happen when a financial market participant takes a stake:

- The U.S. government is a MASSIVE consumer. Will the administration direct consumption towards companies that it has a stake in? Seems like a playbook they would follow.

- The Federal Government has immense influence on regulations. Yes, the states and local municipalities have regulatory power, but how they utilize that may change if the federal government brings its full power to bear, in terms of getting regulatory changes! Just this morning, it was announced that the U.S. would pursue building nuclear facilities on their bases (the Fed has the regulatory power).

- Lower Cost of Capital. It is already happening, and it is logical that companies (with the government as a key stakeholder) may get cheaper access to credit than they would otherwise. Lenders always think about who is “backing” a company and that should help cost of capital across equity and debt instruments.

- Other “levers.” This gets a bit tricky. Other levers could be anything ranging from subtle hints to things bordering on coercion, to get the companies more business. As I said, this is tricky, but it certainly can happen.

The President likes to win, why would he not want companies (his admin invested in) to do well?

Ultimately, the country wins if we have a safer base of production and refining of things critical to modern day life:

- Semiconductors, AI.

- Pharma and Biotech.

- Electricity and Energy of all types to produce electricity.

- Nuclear is my favorite area. General (ret.) Waddell was on a call yesterday highlighting that the Department of Energy has 70 nuclear projects on its list. But only 1, yes, only 1, has regulatory approval to begin the building phase. Look for that to change rapidly. Many of the stocks linked to nuclear have had strong runs, but that may only be the beginning.

- Solar. I know it is hated by the admin, but I think the admin has demonstrated their willingness to pivot and I believe many people consulting with the government will hammer home the need for solar, to fill the gap between now and when nuclear will come online. It might take longer to play out, but since we haven’t had large moves yet, the risk of a correction is lower too.

- In between, the entire energy sector should do well, those are just my two favorite areas.

- Processed/Refined commodities critical to any of the above (also including military equipment).

- While not a direct beneficiary, indirect beneficiaries will include large engineering firms as well as logistics/heavy equipment, etc.

There is no shortage of investment opportunities.

- Accelerated Depreciation in the recent Tax Law helps a lot too!

The Trades

There are multiple ways to participate at the moment.

- A portfolio of “lottery” tickets. Scour the universe of stocks with smallish market caps ($10 billion and under). Look for those associated with any of the above areas. There seems to be no shortage of stocks that fit into that bucket. Maybe do some diligence on the names (weirdly, what the company is named may be a factor – we have AI looking into that), and what they own in terms of rights or IP. Who is the management? Then finally, look for price action and volume. This strategy is not my “finest moment,” and any true fundamental investor will shake their head in disgust, but that doesn’t mean we can’t create a portfolio (one that we trade, with a focus on volume) that works well.

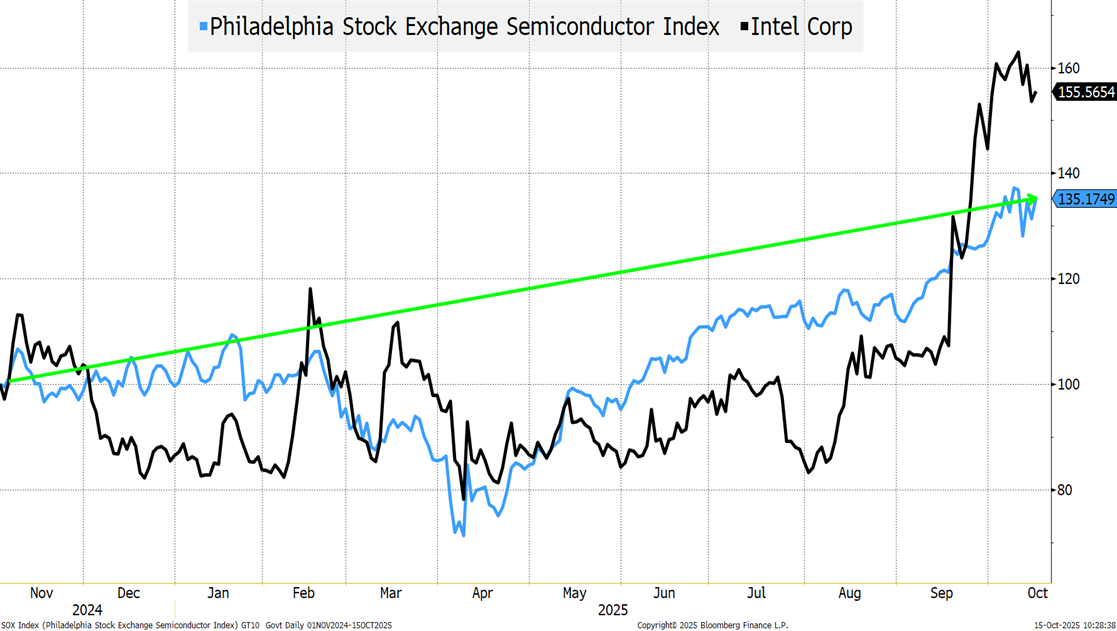

- National Champions. I would argue that the Intel investment is more of a “national champion” type of investment than other investments that we have seen so far (which have been far smaller). While “National Champions” as I use it, will do very well from an investment standpoint, it is quite possible for the entire sector to do well. Maybe the “National Champion” gets some of the benefits listed above, but the entire sector could do well, because the government’s actions demonstrate a commitment to the sector/industry.

Do not doubt, for a moment, that the admin wants to win the race for AI superiority.

So, look for bigger companies, even industry leaders, in fields that we think the government will focus on. You can only do so much with small companies. What companies are there in pharma, biotech, traditional energy, commodities, etc., that might become a “national champion”? I’m not 100% sure if U.S. Steel fell into this category, but maybe it did, indicating that INTC may not be a “one off” – thus validating the search for more national champions.

The opportunities range from what still hasn’t run enough, to what the admin will focus on next. I would list nuclear as the former and solar as the latter.

I will even toss out Bitcoin miners, who have had a decent run, but not only is this admin focused on stablecoins and crypto, but many people also seem to be able to pivot to data center technologies.

Again, if I’m correct and ProSec™ is the new ESG, we have a long way to run as traditional asset managers and corporations follow the path being carved out by the government.

What I’d avoid (and why I expect a launch of new ETFs trying to capture the zeitgeist):

- Foreign owned, foreign focused companies. The admin seems to be softening its stance, in this regard, with Canada and potentially NATO. It is strengthening its resolve to push on China. That is one of the issues with some of the ETFs I’ve looked at – too much foreign (especially China) investment.

- Too much focus on the commodities themselves. Processing and Refining gets the edge. On commodities of all types, the companies pulling it out of the ground (or sea) will do well, but it is the processing and refining where China dominates. That is where I see the most upside. China does not control the rare earths and critical minerals themselves the way they control the processed and refined versions.

The Private Wealth Fund

Remember all the chatter early in the admin’s lifetime about a Sovereign Wealth Fund?

About revaluing gold to today’s prices as one possible way of creating a private wealth fund?

The crypto community was extremely focused on it.

I always felt that a private wealth fund focused on crypto would face resistance. But a private wealth fund focused on ProSec™?

The President and this admin had this vision early on. It has faded into the background, but that doesn’t mean it isn’t something we could see. In fact, I expect to hear chatter on this again in the coming weeks.

We only have so much money “lying around” to make investments, so some sort of money set aside for these investments seems like a necessary condition for it to grow.

Think about all of the things that happen when the government takes a stake and it is difficult to argue that the admin won’t try to accomplish this on an even bigger scale. (I keep thinking deregulation is helped by investment stakes).

Bottom Line

I see nothing to stop the ProSec™ train from gathering momentum and becoming the next ESG – in that governments and corporations will think about security/sustainability through a new lens.

Lower rates (which I haven’t mentioned but still think are coming) and accelerated depreciation are two major tailwinds.

I suppose we could back down from all of this with a big deal with China, but as we argue in They’re Baaack… that seems unlikely.

We, collectively, have reached the awareness stage of the risk of being so subject to China that these investments will continue even with a good China trade deal.

And let’s be honest, I kind of like the lottery ticket portfolio as crazy as it seems. 😊

While today this is a U.S. investment theme (and clearly it was a Chinese one over the past decade) the concept of Production for Security will expand globally and there will be opportunities in Europe too. One “forcing” issue is that every country wants to do well in the AI and Data Center space and it is increasingly difficult to see how you do well in that space if you can’t produce enough electrons to keep the chips humming. That will likely be the catalyst in other countries, but I fully expect ProSec™ to go international! (over time).