Getting the Fed to Get Ahead

Normally we title this report “Ahead of the Fed”, but this time, it really had to be “Getting the Fed to Get Ahead.”

First Things First – The Middle East

If you missed yesterday’s webinar, we highly recommend watching the replay. The generals bring a great combination of experience, not just in the region, but also from hands-on experience with President Trump.

Decent Job Data?

If you have been following the T-Reports, you know that we have been on the aggressive side on what the Fed should be doing this year. We are in the 3-4 cut camp (towards 4) and starting as early as July (or at least signaling that July is in play).

Strong Jobs Data:

- The Establishment Survey’s Headline Total for May of 139k.

- -95k revisions to prior two months.

- Ongoing low initial survey response rates. When companies cannot be bothered to respond to the survey, how accurate can it possibly be?

- Positive 199k jobs in the birth/death adjustment. It is not clear to me that the full adjustment impacts the number (might be adjustments-on-adjustments), but that is large relative to the size of the total print. Oh, yeah, the April number was 393k jobs from the birth/death adjustment, because nothing says “it’s a great time to start a business” like a global trade war.

Medium Jobs Data:

- Unemployment rate remains at 4.2%.

- Labor participation rate dropped to 62.4, the lowest since January 2023.

- JOLTS Openings 7.4 million. Not bad versus expectations, and the prior month, but hovering around “normal” levels and well off the 10 million or so jobs allegedly available last year. We use “allegedly” here as there are many reasons to believe that the data doesn’t capture the shift to online job advertising well – it overstates the number of real jobs available.

- Quits rate dropped (indicative of employees being nervous about job prospects), and Layoff levels soared from 1.6 million to 1.8 million.

- This data is from April, when things were “better” by all accounts, making us question where the May data will come in.

- Jobless claims above 240k.

- Probably a bit “generous” to include this in the “medium” category, but I didn’t want to seem to have too much of a one-sided view 😊. I’m “sure” continuing claims hovering near the highest levels since COVID isn’t a big deal either.

Weak Job Data

- ADP at 37k after only 60k the prior month.

- Part of me trusts the data coming from a company that does payrolls for a living.

- Household employment change of 695k job LOSSES.

- Okay, the Household Survey is even more random than the Establishment Survey, but that is pretty bleak (the 4-month total is also negative). Also, in May, the job losses occurred primarily in the full-time employment category, which is not good. It has bounced around a lot though.

- The Challenger Job Cuts number is so noisy, it is difficult to get a good read, but it is around 700k for the year in total, which almost matches the entirety of last year.

The current headlines, away from stories about $100 million signing bonuses for AI experts, don’t seem to indicate that hiring (or spending – away from AI/Data Centers) is increasing.

The good data has caveats, the medium data has bigger caveats, and the weak data is just plain weak.

If I was submitting dots, or SEP (Summary of Economic Projections), or arguing about the verbiage in the announcement, I’d be very cautious on the state of the labor market and would be pushing to get ahead of risk here.

Inflation Data

The inflation data has been mild. Yes, there are concerns about how inflation will play out given tariffs, but we have argued that at 10% “pause” rates (which presumably will be extended), it is manageable and a slow bleed.

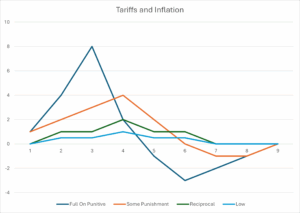

While this chart is simplistic, the “grey” line, or reciprocal is our best estimate of how it will play out. It will take time for tariff inflation to show up. Even then it will be moderate. It will dissipate rapidly as it is “one time” and as the economy slows from impacts relating to trade etc.

On the Big Beautiful Bill – Tax Extensions do NOT behave like Tax Cuts – from an economic stimulus/inflation standpoint.

A big chunk of the bill is extending provisions that would otherwise be sunsetting. Since no one seems to be behaving as though they will sunset, that portion of the bill merely enables the status quo to continue, rather than acting as stimulus.

Oil, as we have been told over and over by the Fed, literally ad nauseum, is “transitory.”

It is fair to have some concerns about inflation, but they too should have dropped from the height of Liberation Day tariff uncertainty.

Bottom Line

The Fed probably won’t follow our take, but the case seems compelling, and not putting July on the table may come back to haunt them, even as soon as July.

Separately, 10-year real yields above 2% (by almost whatever measure of real yields you prefer) is not stimulative.

Keep adding to duration.