Another Interesting “New” Chart – Electricity Inflation

A few months ago, we started to regularly check in on the Tariff Revenue chart. We look forward to getting the next “large” number in a little less than 2 weeks.

In the meantime, this chart has attracted our attention. Full credit to ZeroHedge for pounding the table on it, but it fits a few of our themes quite well:

- Energy = Electricity. We have started trying to disassociate energy with oil and make sure we highlight that energy, in this day and age, means electricity even more than oil and it is important for investors, corporations, and politicians to think that way.

- It makes some of the charts about nuclear projects in development really raise your eyebrow (China is pushing hard in this direction).

- It also fits in with our theme that the Middle East, and Saudi Arabia in particular, is pushing to become the data center capital of the world. Oil is far more expensive to move than “data” and with a wealth of potential solar energy, the region is positioned to meet the rising energy demands of AI and data centers. Also, buying a lot of high-powered chips from American chip companies is a quick way to reduce trade surpluses.

- Potential risks to the AI spend. We highlighted some issues and the focus on electricity demand in this weekend’s Tariffs, AI and ProSec™ (Yes, we are trying to get ProSec or Production for Security to stick).

- While this is not something we have shared, I can admit that I’m in a losing battle with my “smart” thermometer which seems to want to set the temperature to “melt” and manages to turn it higher than I want on a regular basis, and each software “update” seems to only empower the “smart” thermometer even more. I’m having Hal/Space Odessey moments with my thermometer. Maybe it is just me, but it is increasingly annoying, but I digress…

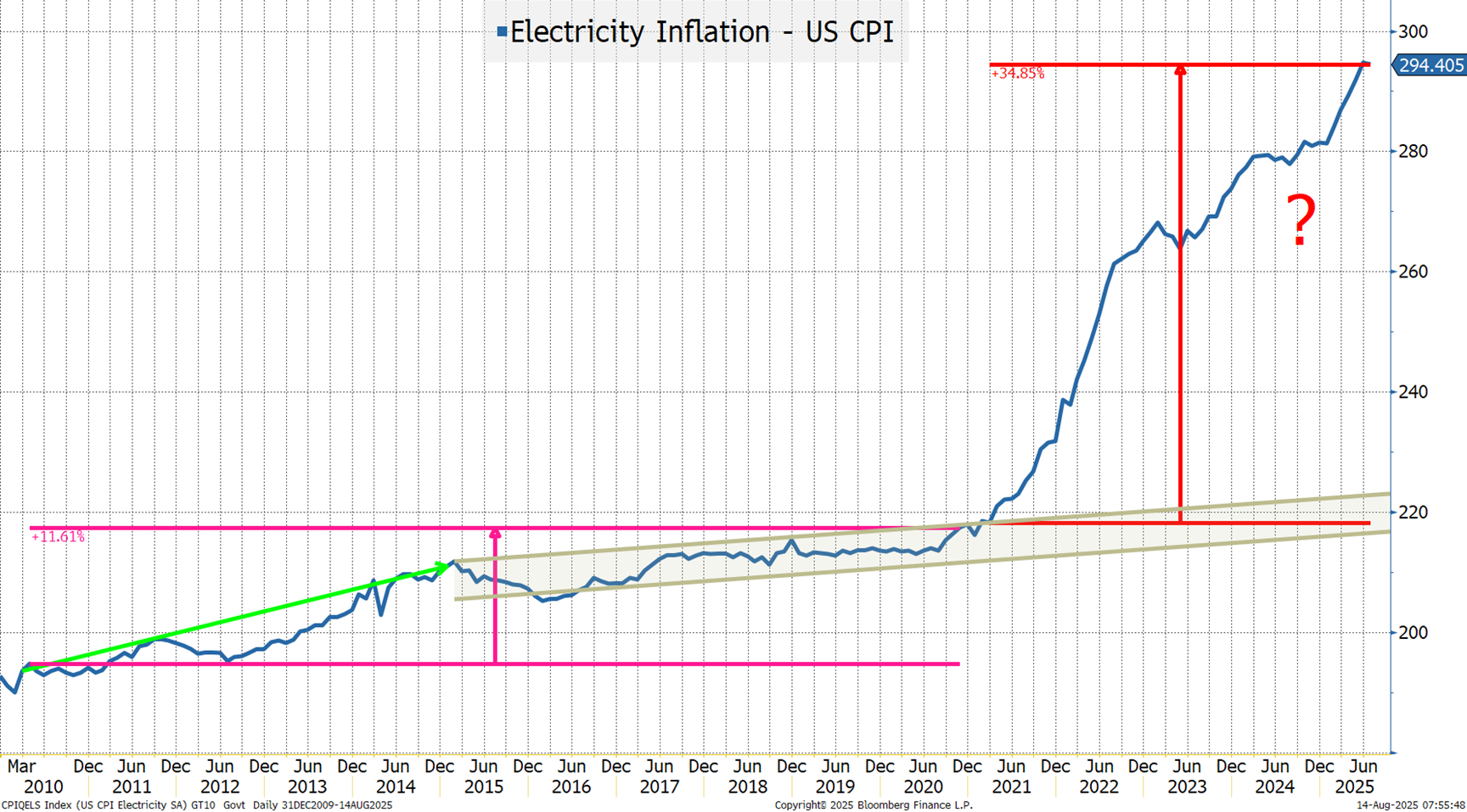

For a decade, from 2010 to 2020, electricity, as measured in CPI, rose less than 12%. Since then, it has risen almost 35%!

We are all well aware of changes in gasoline prices. We fill up the car periodically and most gas stations publish their prices, so we see them when we drive by.

We get hit with electricity bills once a month, so maybe it isn’t as noticeable, but I suspect in the coming months there will be a LOT more discussion by people about the rise in energy prices. Who cares what happens to gasoline prices if electricity is inflating by almost double digits annually?

I found this chart interesting, and this is just the start of what we are trying to explore on the electricity side of things.

Electricity generation is one of the biggest opportunities out there. As prices rise, and politicians focus, it could create even more opportunities. While it is probably a long way from slowing the AI spend, it will be important for that industry to stay focused here (and they already are in a big way) as keeping as much here as possible would be great (remember the Saudis, amongst others, are preparing to compete and that could present some security threats).

Anyways, not urgent or alarming, but I do think it is interesting. Btw, given my overall thoughts on CPI, I suspect that the CPI calculation is understating what most of us are experiencing in terms of inflation on our electric bill.