Around the World with Academy Securities

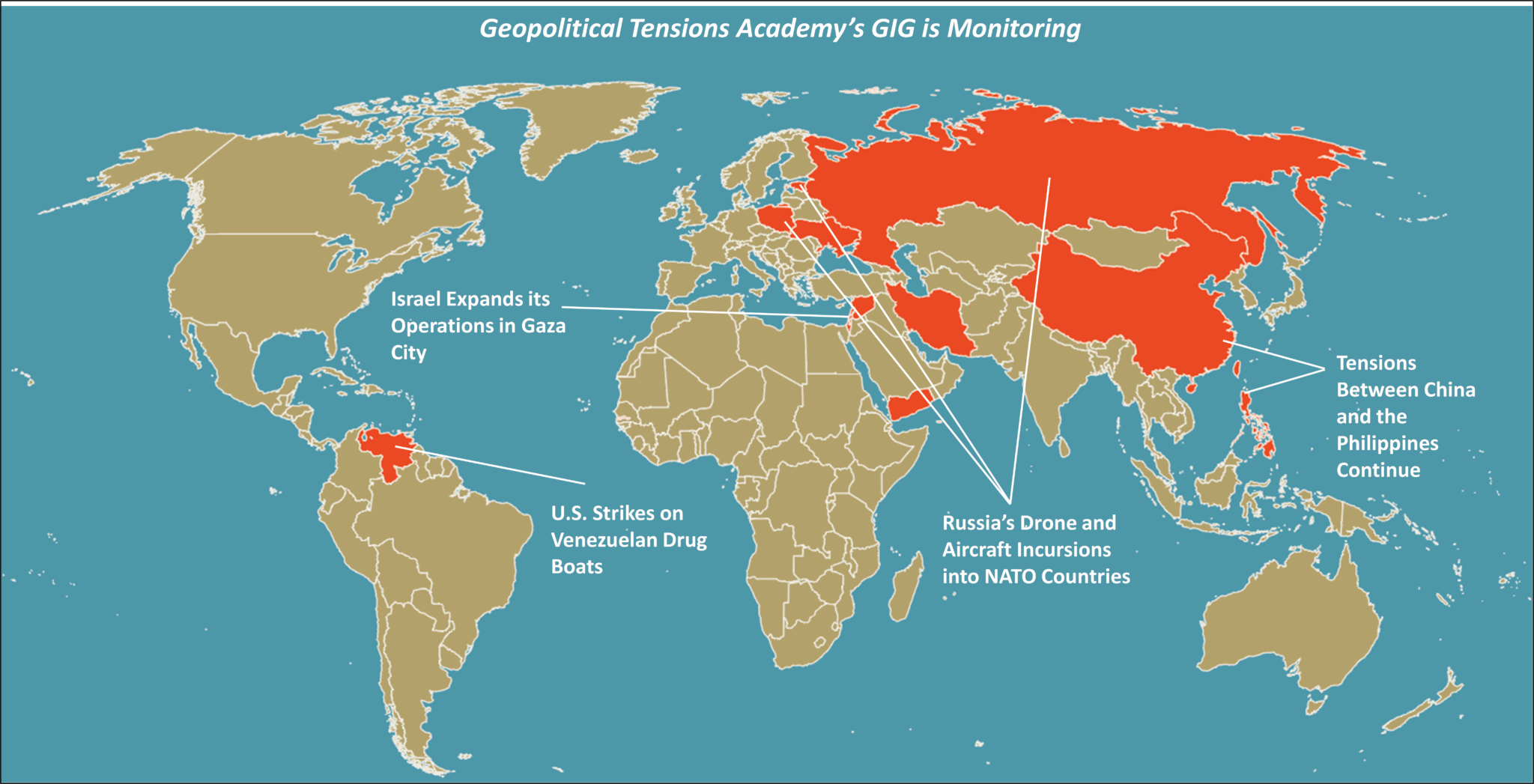

In this month’s edition of Around the World with Academy Securities, our Geopolitical Intelligence Group (GIG) focuses on the following geopolitical tensions that we are monitoring:

- Russia’s Drone and Aircraft Incursions into NATO Countries

- Israel Expands its Operations in Gaza City

- Tensions Between China and the Philippines Continue

- U.S. Strikes on Venezuelan Drug Boats

We kick off this month’s ATW with an update on the Russian drone and aircraft incursions into Poland and Estonia in the last two weeks. These were likely probing incidents designed to test NATO’s readiness and resolve. Next we address the latest updates regarding the Israeli operation to occupy Gaza City in an effort to defeat Hamas and end the war. The IDF’s air strike into Doha targeting Hamas leadership was a clear signal that in Netanyahu’s mind, the time for negotiations with Hamas is over. Next we address the tensions in the South China Sea between China and the Philippines. Following yet another incident between the two nations, it is clear that China is stepping up their operations in the region, especially after their Victory Day Parade earlier this month. We also address the recent strikes against drug boats from Venezuela in international waters as U.S. forces in the region continue to target these vessels in an effort to stop the flow of drugs from Venezuela. Finally, on the cyber front, we wanted to highlight a point from General Mary O’Brien from our GIG who said, “The Cybersecurity Information Sharing Act, which was a cornerstone of U.S. cybersecurity policy passed in 2015, expires on September 30th without Congressional reauthorization. The legislation’s liability protections permitted banks and investment firms to share threat intelligence with federal agencies without regulatory backlash. This represents a critical vulnerability for the financial services industry amid escalating cyber threats projected to cost the global economy $10.5 trillion annually.” We will continue to monitor the cyber landscape especially in light of the recent attacks in Europe.

Please reach out to your Academy coverage officer with any questions and we would be happy to engage.

Front and Center: Russia’s Drone and Aircraft Incursions into NATO Countries

As reported in our SITREP this month, tensions between NATO and Russia remain high following the Russian drone incursion into Polish airspace on September 9th and Russian fighter jets entering Estonian airspace 10 days later. These incidents make it clear that Putin is testing NATO’s resolve and reaction times, and unless something materially changes, he will likely continue to do so. As the war in Ukraine rages on, the latest initiative on the table is for NATO countries (such as Turkey, Hungary, and Slovakia) to stop buying Russian energy. If they do, President Trump has said he will move forward with other EU nations and begin to implement harsher economic sanctions on Russia. However, it is highly unlikely that any of these countries stop buying energy from Russia, which means that tougher sanctions on Russia are not imminent. Putin will continue the fight until he achieves as much territory as possible and outside of a complete collapse of the Ukrainian army in the near-term (which we believe is highly unlikely) the war will continue into the fall and winter months.

As reported in our SITREP this month, tensions between NATO and Russia remain high following the Russian drone incursion into Polish airspace on September 9th and Russian fighter jets entering Estonian airspace 10 days later. These incidents make it clear that Putin is testing NATO’s resolve and reaction times, and unless something materially changes, he will likely continue to do so. As the war in Ukraine rages on, the latest initiative on the table is for NATO countries (such as Turkey, Hungary, and Slovakia) to stop buying Russian energy. If they do, President Trump has said he will move forward with other EU nations and begin to implement harsher economic sanctions on Russia. However, it is highly unlikely that any of these countries stop buying energy from Russia, which means that tougher sanctions on Russia are not imminent. Putin will continue the fight until he achieves as much territory as possible and outside of a complete collapse of the Ukrainian army in the near-term (which we believe is highly unlikely) the war will continue into the fall and winter months.

“President Trump is hesitant to impose sanctions on Russia because he does not want to risk a peace deal with President Putin, he is skeptical of their effectiveness, and he wants the Europeans to step up and show they are serious. He feels the U.S. has carried the greater burden in the war and he is putting pressure on the NATO countries to take the lead in sanctions and weapons support to Ukraine. Trump wants to be the deal maker, and he feels that sanctions will hamper or end his ability to persuade Putin to end the war. He desires to use diplomatic soft power over sanctions. Separating Russia and China as leaders of the growing partnership to counter the U.S. is another key strategic objective. He feels sanctions could push the two closer together. Trump has stated that he will not lead the sanctions effort if NATO does not step up and demonstrate they are serious about not buying Russian oil and gas. When it comes to sanctions, NATO is a coalition of the willing and countries like Hungary and Slovakia are less willing to jeopardize their own economy and energy needs. With sanctions at risk, it leaves increased arms support for Ukraine as the core of NATO’s strategy to pressure Putin into negotiating a peace deal. The war will continue in its current stalemate through the winter with each side increasing the capabilities of the weapons being used.” – General Robert Walsh

“This phase of the Ukraine War began 3.5 years ago, and Russia has yet to fully mobilize and apply its manpower. Yet, it has now returned to the Zapad exercises with Belarus along the borders of NATO. Zapad and the Russian drone incursions are like the Chinese ‘salami slicing’ activities in the South China Sea: they make political statements, test allied resolve and response times, and create anxiety amongst allied populations. Western allies still have a few levers left against Russia. Slovakia and Hungary still depend on Russian oil delivered via legacy Soviet pipelines (passing through Ukraine). Ukraine damaged this pipeline a few weeks ago, creating issues with Slovakia and Hungary. The EU has proclaimed that it will phase out Russian fossil fuels by 2027, five years after the 2022 invasion. Slovakia and Hungary argue that they need viable alternative supply, which the EU has yet to provide. Energy poor, Turkey is the third-largest purchaser of Russian oil, after China and India. Turkey also receives Russian gas through the Blue Stream and Turk Stream pipelines, and would have to give up supply and transit earnings. Effective sanctions would have to hit India and China, which bring a host of attendant diplomatic problems. That leaves continued military and financial aid to Ukraine as the most likely levers. As neither Ukraine nor Russia is willing to concede key issues in negotiations, the fighting will drag on.” – General Rick Waddell

“The incursion by Russian jets over Estonian airspace was a further test of NATO systems and resolve. The response by Italian F-35s, supported by Swedish and Finnish assets, was credible, but we can see that this is part of a plan that will continue to probe for cracks in the Alliance. Planners will assume that it will escalate. One important aspect is the degree to which the U.S. will be seen to underwrite NATO’s military capability, particularly as plans for a post-ceasefire force are developed. At the moment, military technical and logistic support remains significant but hidden. In light of the recent state visit by President Trump to the U.K., the rhetoric was generally positive. It reaffirmed U.K.-U.S. ties, and sent a signal that support to Ukraine is still on the agenda. It added energy to the issue of cutting off Russian oil imports which has been taken up by the EU. But in the short-term, the main effort remains external support to Ukraine through arms supplies (air defense systems and predicable deliveries of ammunition), economic support (sustaining energy and heating infrastructure), and support to civil society through continued diplomatic solidarity.” – General Sir Nick Parker

“It seems like the Poland incursion has awakened NATO and perhaps backfired on Putin. The follow-on incursion into Estonia, reportedly the fifth this year, will likely only increase unity within NATO. While Putin will not likely give way publicly, it is likely that he will try another tactic rather than continue to test NATO as he sees his efforts having the consequence of unifying the Alliance. As much as it would be beneficial to convince Turkey, Slovakia, and Hungary to stop buying Russian oil, it is unlikely. Turkey has diversified their oil imports and was importing less than 20% of its requirement from Russia as early as March 2025. Turkey will be hard-pressed to reduce the imports further. Any additional sanctions that would impact the economy, and perhaps also impact internal support for Putin would seem to be the best course moving forward.” – General Lewis Craparotta

“I would assess NATO, while a slow and deliberative body, is coming to the realization that Putin will continue to probe across a much broader NATO front. Putin’s current view is that NATO will not do anything substantive to respond to the growing number of incursions. Probing the border allows Putin to gauge not only NATO’s response but it also supports an internal narrative of strategic intimidation and that NATO’s deterrence is questionable and NATO’s redlines are not well defined. It is unlikely in the near-term that the various EU and NATO nations will cease buying Russian oil. Still, strain on Putin’s defense economy continues to grow. Meanwhile, Russian Minister of Finance, Anton Sulianov, continues to demonstrate a high degree of competence helping Putin manage pressure on Russia’s economy (there is no near-term risk of implosion). The Russian economy continues to show positive growth for 2025 and 2026 albeit the estimates are only for 1-2%. The war against Ukraine will continue as Putin continues to see victory by staying the course.” – General Robert Ashley

“As for options to pressure Putin, there are still sanctions options for the west but not without some reciprocal undesired impact. Therefore, we will likely see a continued information pressure campaign against Putin threatening or even implementing economic sanctions against Russia, while at the same time supporting Ukraine’s continued need for weapons. Taking pressure off one approach only puts greater pressure on the other, and would ultimately benefit Putin more than Ukraine. The question that still remains is how much pressure Putin is feeling from inside Russia. It appears on the surface that he still enjoys widespread support from within. Therefore, he has no reason to change paths until Russians are tired of the loss of life or feel the real economic impact of a protracted war. Of course, this requires greater pressure on China, India, and others as well.” – General Steve Basham

“Putin is continuing to test NATO and European resolve, but the message he is receiving thus far is one of indecisiveness. The incursion of three Russian jets into Estonian airspace on 19 September is once again leading to Article Four consultations, as happened on the heels of the Russian drones being shot down over Polish territory the previous week. A Russian drone also violated Romanian airspace on 13 September following that NATO meeting, suggesting that Moscow is not altering its behavior in response to Alliance discussions. Something is going to have to dramatically change either militarily or economically in NATO’s and/or the EU’s response before President Putin will alter his calculations.” – Linda Weissgold, Former CIA Deputy Director for Analysis

“Efforts to pressure Russia into some compromise in the Ukraine War short of its stated war aims continue to flounder. Sanctions on energy are not gaining traction. China and India, Russia’s principal energy consumers, have refused to cease buying from Russia. The U.S. has indicated that its imposition of secondary sanctions on Russian energy buyers is contingent on European states’ willingness to do the same. Europe, for its own economic reasons, has declined to do so. Regarding the drone incidents, while it is broadly accepted that the drones in Poland were, indeed, Russian, there is little clear evidence in the public domain as to how or why they got there. While it is certainly possible that this was some intentional act on Russia’s part, it is unclear to me why Russia would take an action with substantial geopolitical downsides while discussions on the U.S. role in Ukraine and Europe are underway.” – Neil Wiley, Former Principal Executive, Office of the Director of National Intelligence

Israel Expands its Operations in Gaza City

In our last ATW we reported on the Israeli decision to launch a full scale occupation of Gaza City in an effort to completely destroy the remaining Hamas forces in Gaza. This decision was initially made after the ceasefire talks stalled once again, but it really became clear that there was no turning back after the Israeli strike on Hamas leadership in Doha, Qatar this month (see SITREP). It has become clear that Netanyahu is done negotiating and sees a complete occupations of Gaza City as the only way to defeat Hamas and end the war. This operation in Gaza City will be a protracted one and will likely come at a high cost to Israel. However, as we approach the 2-year point since the war began, it is clear that Hamas will not negotiate in good faith and the IDF has decided to continue fighting until Hamas capitulates and returns the remaining hostages, which is not anticipated to happen any time soon.

In our last ATW we reported on the Israeli decision to launch a full scale occupation of Gaza City in an effort to completely destroy the remaining Hamas forces in Gaza. This decision was initially made after the ceasefire talks stalled once again, but it really became clear that there was no turning back after the Israeli strike on Hamas leadership in Doha, Qatar this month (see SITREP). It has become clear that Netanyahu is done negotiating and sees a complete occupations of Gaza City as the only way to defeat Hamas and end the war. This operation in Gaza City will be a protracted one and will likely come at a high cost to Israel. However, as we approach the 2-year point since the war began, it is clear that Hamas will not negotiate in good faith and the IDF has decided to continue fighting until Hamas capitulates and returns the remaining hostages, which is not anticipated to happen any time soon.

“Israel is at the point where there is no other way to accomplish their military objectives without going into Gaza City and clearing areas where Hamas continues to exist. Their goal is to pressure Hamas, until they agree to release the hostages and make a peace deal. If that happens, Israel’s next step is to ensure Hamas has no further role in the governance of Gaza. The challenge for Israel is how much international criticism they can absorb as the humanitarian situation worsens and the U.S. pushes Israel to alter its tactics. Israel’s air attack on Hamas leadership in Doha, Qatar was the first air strike by Israel on a Gulf State. This action brought significant political risks with the Gulf States and the U.S., potentially harming the Abraham Accords and endangering the hostages. President Trump openly expressed significant displeasure with Prime Minister Netanyahu and dispatched Secretary of State Rubio to Qatar to persuade Qatar to resume its mediation efforts in the Gaza war. Prime Minister Benjamin Netanyahu’s said post-strike that he would not rule out additional strikes against Hamas leadership ‘wherever they are,’ further inflaming the situation. It prompted unified messaging from the Gulf States against Israel and opened discussions for a joint defense mechanism. They also raised concerns about Israel’s increasingly aggressive military posture. The attack highlighted the U.S.’s inability to deter aggression against its ally and left Israel with little gain, as the targeted Hamas leaders remained unharmed while significant political fallout ensued.” – General Robert Walsh

“The unusually quiet posture of the Gulf States prior to the Doha strike likely signaled tacit (but unattributed) support for Israel’s action against Hamas/Hezbollah and Iran’s proxies in general. Post-Doha, concerns are likely higher and predictably we’re seeing a more demonstrative and vocal response. No doubt Netanyahu feels U.S. support for the Gaza offensive as evidenced by the UN Security Council resolution failure this week. In keeping with strong ties to Israel, that vote marked the 49th time since 1970 that the U.S. has vetoed a Security Council vote against Israel. The IDF will press in Gaza City and Hamas will retain the hostages for the time being.” – General John Evans

“In the coming months, the IDF will work to clear and secure key Gaza neighborhoods, destroy Hamas’s combat power and tunnel networks, and support potential hostage-recovery operations. Urban clearing is both difficult and resource-intensive, necessitating the call-up and sustained deployment of large numbers of reservists, creating an economic headwind as mobilization pulls workers from Israel’s civilian economy. Netanyahu’s declared goal of ‘destroying and disarming Hamas’ will be hard to define and harder to achieve. Degrading advanced weapons systems is feasible; eliminating every small arm or explosive is unrealistic given the availability of materials and the group’s ability to regenerate fighters from the local population. Unlike defeating a conventional army, dismantling an insurgent network can be an exceptionally protracted process. Strategic success will require either enduring Israeli security control or a viable civil administration. Neither outcome will be secured quickly. A repeat Israeli strike in Qatar is unlikely, at least in the near-term. The September 9th airstrike was intended to demonstrate Israeli reach and resolve. It also served to avenge the recent deaths of Israeli civilians at the hands of terrorists. Having achieved all these objectives, Israel has no immediate need to pursue Hamas in Qatar, although they will undoubtedly target Hamas leaders when the opportunity presents, regardless of their location. Though vocally condemning the strike, the Gulf States will prioritize regional stability and economic ties with Israel over escalation. Their disappointment with Washington’s response, however, could prompt a reassessment of U.S. influence and security guarantees.” – General Karen Gibson

“Following the Doha strike, the Saudis signed a mutual defense pact with Pakistan, where an attack on one is an attack on both. It is not clear what substance there is to this pact, but it presumably would operate against Israel, Iran, or India. Those studying alliance theory might suggest that this is a ‘checkerboard alliance,’ where countries sensing a threat seek to balance that threat by allying with other countries on the periphery of the common threat – in this case, perhaps, a future nuclear-armed Iran, which a nuclear-armed Pakistan balances. Regarding Iran, the UN Security Council voted last week on whether to stop the ‘snapback’ sanctions permitted under the 2015 UNSCRs, given Iranian enrichment of uranium. China, Russia, Algeria, and Pakistan (interesting, given the above) voted against the snapback. The 2015 UNSCR did not allow vetoes by the Permanent Members. The E3 nations have been slow to act, but now the full pre-2015 sanctions will return by 30 September. Iran’s latest moves with the IAEA are likely last ditch desperation measures. If the full sanctions do return, the practical effect will be determined by China, which imports some 90% of the 2 million barrels per day that Iran has been selling since 2021. If China continues the importation, the sanctions will hurt other aspects of the Iranian economy, but not the export cash flow that the regime depends on.” – General Rick Waddell

“I think that Israel has committed to the complete defeat of Hamas in Gaza and, in consequence, will expand their military operations. While the fate of the remaining hostages continues to be a factor in Israeli decision-making, the government of Israel will not allow that to deflect it from the ultimate goal of defeating Hamas. As part of that effort, Israel will continue to engage Hamas leadership and military entities wherever they appear. The recognition of a Palestinian State by the UK, Canada, and Australia is largely diplomatic ‘performance art,’ and will have no practical impact unless western governments significantly withdraw diplomatic and military support from Israel, which I consider to be unlikely. The geopolitical situation regarding Iran remains tense. While Iran earlier indicated that it would continue cooperation with the IAEA, recent Iranian statements have been less committal. Snapback sanctions on Iran will be automatically reimposed at the end of September absent a new Security Council resolution, which I consider very unlikely. If snapback sanctions are imposed, Iran will likely withdraw from any IAEA cooperation which, in turn, will increase the prospect of additional military strikes on remaining Iranian nuclear infrastructure.” – Neil Wiley, Former Principal Executive, Office of the Director of National Intelligence

Tensions Between China and the Philippines Continue

As we reported in the ATW last month, tensions continue between China and the Philippines. Following the incident in August when two Chinese ships collided while pursuing a Philippine patrol ship in the South China Sea, last week, there was a collision between a Chinese Coast Guard ship and a Philippine fishing vessel, resulting in an injury to a Philippine crew member. While all of this falls below the threshold of the Philippines invoking the Mutual Defense Treaty it has with the U.S., it is clear that China continues to exert its influence in the region. This is especially timely following the Victory Day Parade which saw Xi meet with other autocratic leaders during a parade displaying China’s newest weaponry (see SITREP). However, with trade negotiations ongoing, the U.S. will be focused on coming to a deal with China before the November deadline.

As we reported in the ATW last month, tensions continue between China and the Philippines. Following the incident in August when two Chinese ships collided while pursuing a Philippine patrol ship in the South China Sea, last week, there was a collision between a Chinese Coast Guard ship and a Philippine fishing vessel, resulting in an injury to a Philippine crew member. While all of this falls below the threshold of the Philippines invoking the Mutual Defense Treaty it has with the U.S., it is clear that China continues to exert its influence in the region. This is especially timely following the Victory Day Parade which saw Xi meet with other autocratic leaders during a parade displaying China’s newest weaponry (see SITREP). However, with trade negotiations ongoing, the U.S. will be focused on coming to a deal with China before the November deadline.

“President Trump said trade negotiations progress was made on his call last Friday with China’s President Xi Jinping. He is expected to meet with Xi next month at the APEC summit prior to the 10 November trade deadline. The trade negotiations are a priority for President Trump, Treasury Secretary Scott Bessent, and his negotiating team as they try to balance defense obligations to the Philippines with a desire for a stable trade relationship with China. The U.S thought they had the upper hand in the tariff war until Beijing reciprocated by holding hostage rare earth and magnet sales to the U.S. Trump will not risk advancing the bilateral trade deal by upsetting China with confrontational military actions supporting the Philippines in the South China Sea. The U.S. is cautious not to escalate the tension or appear to be provocative. We can expect China to continue or even increase its ‘gray zone’ tactics against the Philippines, short of triggering a U.S. response, knowing the U.S.’s desire for a trade deal.” – General Robert Walsh

“At the Shanghai Cooperative Organization (SCO), Xi stood alongside two dictators. The SCO was a serious challenge and a warning to regional and international governments that are interested in protecting their sovereignty against resource exploitation, destruction of national markets, and expensive infrastructure that largely benefits China. There are good reasons why China’s neighbors remain wary of its dominance. Ironically, there are few stages that Putin can stand on without susceptibility to an ICC arrest warrant. KJU had not seen this level of attention since the ‘Rocket Man’ designation. If you look closely, the SCO revealed the weakness of China’s approach, and the opportunity for the United States and historically like-minded democracies. U.S. curation of global democracies (like India, Japan, ROK, Western Europe, South America) would be ready partners. The Philippines is one of the most important members of this team.” – General Michael Groen

“China continues to send strong messages to the U.S. not to contain or deter it: to include hosting Putin, Modi, and Kim Jong Un; displaying its nuclear triad in the recent military parade; sailing its newest carrier through the Taiwan Strait; and confronting Philippine activity in the South China Sea. Xi’s confidence that he can shape the outcome of events seems to be growing, given recent actions and rhetoric that China is a stabilizing global force. This administration will likely continue to focus on securing favorable trade negotiations and not aggressively responding to any of these events unless the U.S. is directly threatened. The U.S. will continue to pressure allies in the region to spend more on their own defense relative to China, an approach aligned with engagement and expectations for NATO partners in Europe relative to Russia.” – Admiral Kelly Aeschbach

“The U.S. will try to manage the relationship with China solely because of the impacts to the global economy. As mentioned earlier, all autocratic leaders are coming together to find ways to weaken U.S. influence. Putin with his NATO incursions, Xi with the Philippines, and Iran with their proxies are all examples of this. Sun Tzu wisely said, ‘the enemy of my enemy is my friend,’ and these autocratic leaders seem a lot closer than they used to be.” – General Brian Cavanaugh

“The recent U.S. decision to pause more than $400 million worth of military aid to Taiwan and the reported cancellation of Taiwanese President Lai’s stopover in the U.S. in July are likely to fuel Beijing’s perception that U.S. support for Taiwan and our allies in the region is inextricably linked to economic negotiations. Even if a trade deal is reached in the coming months, Beijing will continue to try to use this leverage to temper U.S. policy and to sow doubts within the region about our reliability and our priorities. At the same time, Beijing’s aggressive regional behavior, including recent run-ins with Philippine vessels, risks creating situations that could easily backfire and undermine Beijing’s efforts to project military readiness and power. The region will be closely watching the U.S. reaction to any such event for indicators of U.S. resolve.” – Linda Weissgold, Former CIA Deputy Director for Analysis

U.S. Strikes on Venezuelan Drug Boats

This month, the U.S. military launched three strikes against suspected Venezuelan drug boats in international waters (see SITREP). All three were lethal strikes utilizing U.S. forces that have been building up in the region since August. The question now is how far will these strikes go in reducing the flow of narcotics into the U.S. from Venezuela. If the flow of drugs from Venezuela does not slow, the concern is that additional actions will be taken against cartel targets on land, which will further escalate the situation.

This month, the U.S. military launched three strikes against suspected Venezuelan drug boats in international waters (see SITREP). All three were lethal strikes utilizing U.S. forces that have been building up in the region since August. The question now is how far will these strikes go in reducing the flow of narcotics into the U.S. from Venezuela. If the flow of drugs from Venezuela does not slow, the concern is that additional actions will be taken against cartel targets on land, which will further escalate the situation.

“The U.S. raised the stakes in the war on drug cartels operating from Venezuela with the third air strike on a vessel that was allegedly carrying drugs intended for the U.S. We can expect a low-intensity scenario with neither Washington nor Caracas wanting a wider conflict. The U.S. is maintaining a hardline approach towards Venezuela to pressure President Maduro into concessions on drug trafficking, immigration, and to stop his threats to Guyana’s offshore oil fields. The U.S. military operations are also aimed at fueling dissent within Venezuela to destabilize Maduro’s grip on power. Maduro is using the situation to increase nationalism, but he has little interest in taking on the U.S. military even if he gains Russia’s and China’s backing. While miscalculations can occur, there seems to be little chance for a military confrontation. We can expect President Trump to keep a military presence in the Caribbean to fight drug trafficking and demonstrate his resolve to focus the U.S. military more on Homeland Defense and less on overseas operations.” – General Robert Walsh

“Is it unlikely that the Trump administration will do anything in Venezuela proper to directly seek regime change but will rather put pressure on the regime to weaken Maduro. The Trump administration has kept a strong and consistent narrative relative to reducing the threat of drugs coming into the U.S. from drug trafficking organizations from Mexico and South America. Given our intelligence and military capabilities, this is not a difficult target to engage and there is no real military threat to the U.S. in the region. The challenge for the U.S. is what degree of transparency will the Trump administration exercise in sharing intelligence that supports determining if an imminent threat warranted or warrants lethal action and how this aligns with international norms of sovereignty and legal standards. We will continue to see the debate along party lines on the role of Congressional oversight and Executive power in exercising military strikes. In the meantime, the singular strikes against maritime targets need to be underpinned by a broad campaign across the U.S. national instruments of power and articulated to the U.S. people and our regional partners to bring clarity to what may appear to be disparate actions.” – General Robert Ashley

“Sustained military presence in SOUTHCOM is likely the new normal. This administration will continue to attack narco-terrorist drug boats and may conduct strikes against cartel interests in Venezuela proper. The administration wants regime change, and is signaling to anti-Maduro voters and military members that the U.S. will provide support if the Venezuelans are moved to make a change. Maduro is doubling down in his response to U.S. actions and further suppressing opposition internally. The risk of miscalculation is high, but I think the U.S. will continue to try to avoid direct conflict with the Venezuelan military.” – Admiral Kelly Aeschbach

“I do not see a high risk of the U.S. striking in Venezuela, nor a high risk of a U.S. destroyer shooting down a Venezuelan aircraft due to likely tight weapons control measures. However, there is always the risk of miscalculation on one or both parties. We will see continued posturing by the U.S. to send messages of discontent to the Maduro administration regarding the continued allowance of narco-trafficking. Internal to Venezuela, Maduro will be under pressure to respond to the U.S. actions or suffer being seen as weak by his supporters. However, at this time I would expect posturing only.” – General Steve Basham

“Expect to see continued condition-setting and the building of regional support to enable advisors to provide a range of executable options to the President if asked for options regarding potential strikes/operations in Venezuela. We are looking for a miscalculation by Venezuelan forces or the government injuring or killing U.S. citizens in Venezuela to provide the primary foundation for our intervention: to protect U.S. citizens/forces. Maduro will be given options to leave Venezuela (seek asylum) or suffer the consequences when we take action against terrorist organizations in Venezuela (Cartel de Los Soles & Tren de Aragua). Besides protecting U.S. citizens/forces, the justification will include stopping the flow of illegal drugs and illegal immigrants into the U.S. and capturing Maduro. The end state will be to re-establish the elected democratic government of Edmundo Gonzalez/Maria Machado. I expect something significant will happen in Venezuela before the end of the year once conditions have been set.” – General KK Chinn