Academy Securities is a leader in educating, advising,

and marketing Rate Reduction Bonds.

Sector Overview

| $95B | 126 | 25+YR | AAA/Aaa |

| Issued to Date | Total Deals | Market History | Majority Rated |

| $95B | 126 | 25+YR | AAA/Aaa |

| Issued to Date | Total Deals | Market History | Majority Rated |

| Recovery Bonds | Utility ABS | Ratepayers | Stranded Cost ABS |

|

A Rate Reduction Bond (RRB) is an investment-grade security backed by legislated surcharges on customer utility bills—used by utilities to recover specific costs while offering bond investors a high-quality, reliable cash flow. The bonds are issued through a separate legal entity (SPE/SPV), which holds the right to collect the surcharges and insulates the bonds from the utility’s credit risks. RRBs allow utilities to recover extraordinary costs — such as storm and wildfire recovery, infrastructure upgrades, or energy transition projects — while spreading the cost over time and avoiding steep upfront rate hikes for customers. |

|

KEY FEATURES |

Irrevocable State-Level LegislationAn irrevocable financing order means that once a state utility commission authorizes the securitization charges, that order cannot be repealed or altered until the bonds are fully repaid. This provides legal certainty that the cashflows supporting the bonds will remain intact regardless of political or regulatory changes. In practice, it ensures bondholders are insulated from legislative risk over the life of the bonds. |

|

Non-Bypassable SurchagesNon-bypassable charges are fees that all customers in the utility’s service territory must pay, even if they switch electricity providers or generate their own power. The only way to avoid the fee is to disconnect from the grid entirely. This broad, captive customer base makes cashflows highly predictable and stable, supporting the AAA ratings of rate reduction bonds. |

|

True-Up MechanismThe true-up mechanism allows utilities to adjust the customer surcharge periodically to correct for over- or under-collections. This adjustment ensures that bondholders receive timely payments regardless of fluctuations in electricity usage, customer migration, or unexpected events. It functions as an “unlimited credit enhancement,” since charges can always be reset as needed to meet the debt service requirements. |

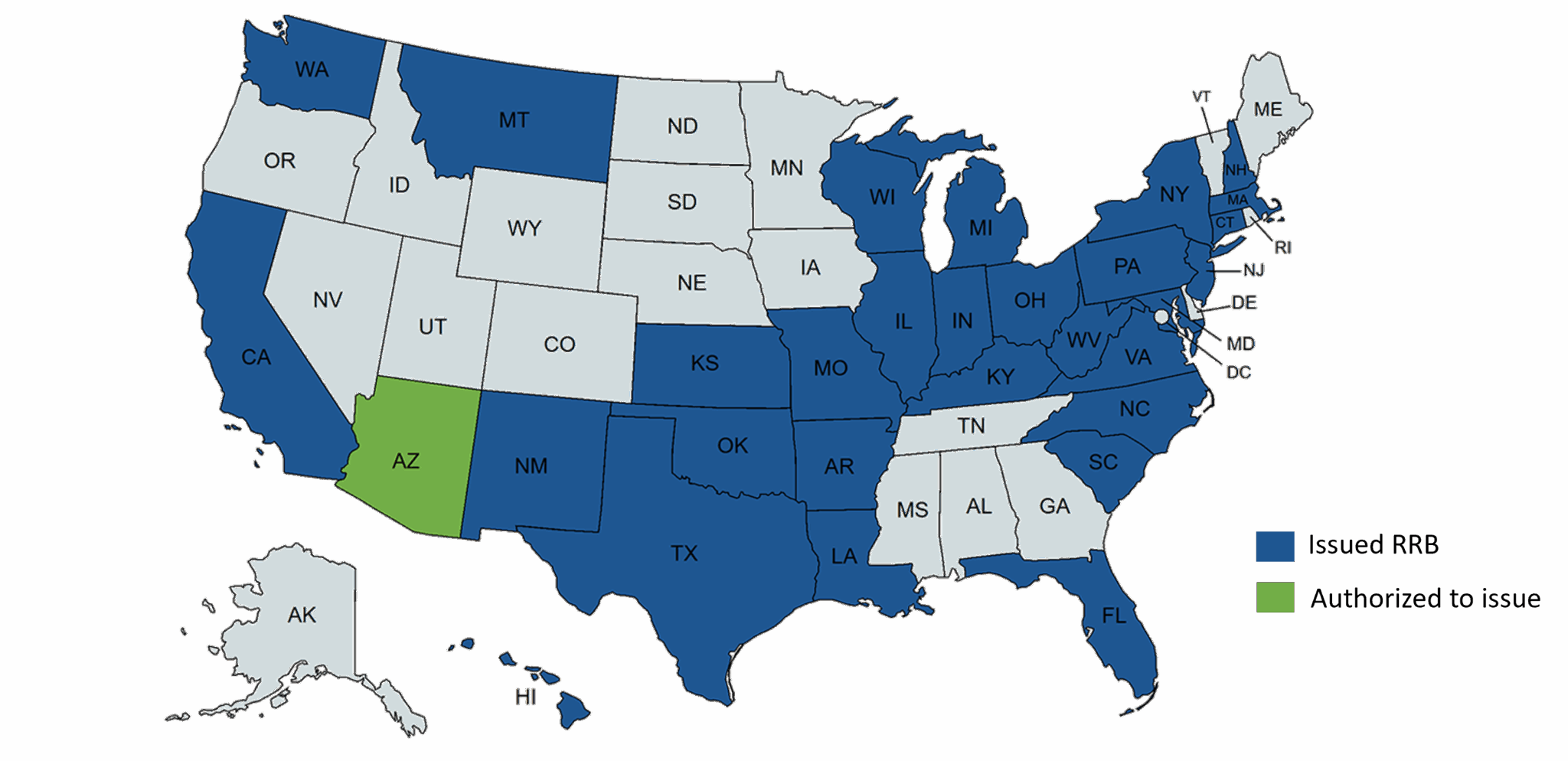

| Total Issuance $95,486,000,000 |

Total Deals 126 |

States with Issuance 29 |

| Average Deal Size $757,830,000 |

Largest Deal Size $4,000,000,000 |

Mr. Schaeffer joined Academy Securities in February 2021 with two decades of experience across trading, portfolio management, and financial advisory. He began his career at Deutsche Bank in New York in the Financial Institutions Group before advancing to senior trader on the ABS desk, where he helped achieve a Top 3 Wall Street ranking. In 2008, he became Senior Portfolio Manager and Managing Director at MKP Capital, building ABS and CLO investment strategies. He later served as Head of ABS Trading at Mizuho Securities USA, partnering with originations to elevate the bank into the Top 10 underwriters. From 2016 to 2021, he worked in financial advisory, founding a women-owned firm focused on ESG-oriented portfolios and investment education. Mr. Schaeffer holds FINRA Series 7 and 63 licenses.

Brooke Adams is a Director at Academy Securities, where she is a member of the securitized products capital markets, sales, and trading team. She brings over 15 years of experience across structured credit, fixed income, and global trading, with expertise in ABS, CLO, and RMBS, along with broader multi-asset strategies. Before joining Academy, she was a Senior Trader at Legal & General Investment Management America, where she executed across equities, fixed income, derivatives, and FX for global client portfolios. Earlier in her career, she held portfolio management and trading roles at PT Asset Management, focusing on CLOs and structured credit, and began her career at J.P. Morgan as an Investment Analyst. Brooke graduated from The Ohio State University, earning dual majors in Accounting and Finance and holds FINRA Series 7 and 63 licenses.

Academy’s Securitized Products Research and Strategy is led by Stav Gaon, Ph.D. The research and data analytics department aims to provide unique insights across securitized products and serve as a trusted advisor to Academy’s institutional clients. Academy’s data-driven securitized research publications are widely considered by the market as thought provoking, routinely highlighting “under the radar” value and opportunities. The department specializes in bottom-up deep fundamental analysis, collateral-specific underwriting, and structural, legal, and valuation nuances of structured finance investing.

Dr. Gaon draws on 20+ years of experience in securitization research. He joined Academy in early 2022 after a 16-year career at Citigroup where he worked as Co-Head of Global Securitized Products’ CMBS and CRE Strategy. Throughout his career he cultivated deep relationships with institutional investors and market participants across the industry. Dr. Gaon and his team were ranked #1 or Top-3 “CMBS research team” in 2017-2021 in the Institutional Investor All-America Fixed-Income Research Survey. Dr. Gaon holds a Ph.D. in Finance and Economics from Columbia Business School where his academic research focused on securitization and structured finance. Dr. Gaon also holds a BA in Economics and Business from the Hebrew University and an LL.B. from the Faculty of Law. He is a veteran of the Israel Defense Forces (IDF), where he served as a combat medic.

Academy Securities explains how rate reduction bonds work, why issuers use them, and what investors should know.